Gold Investing 101

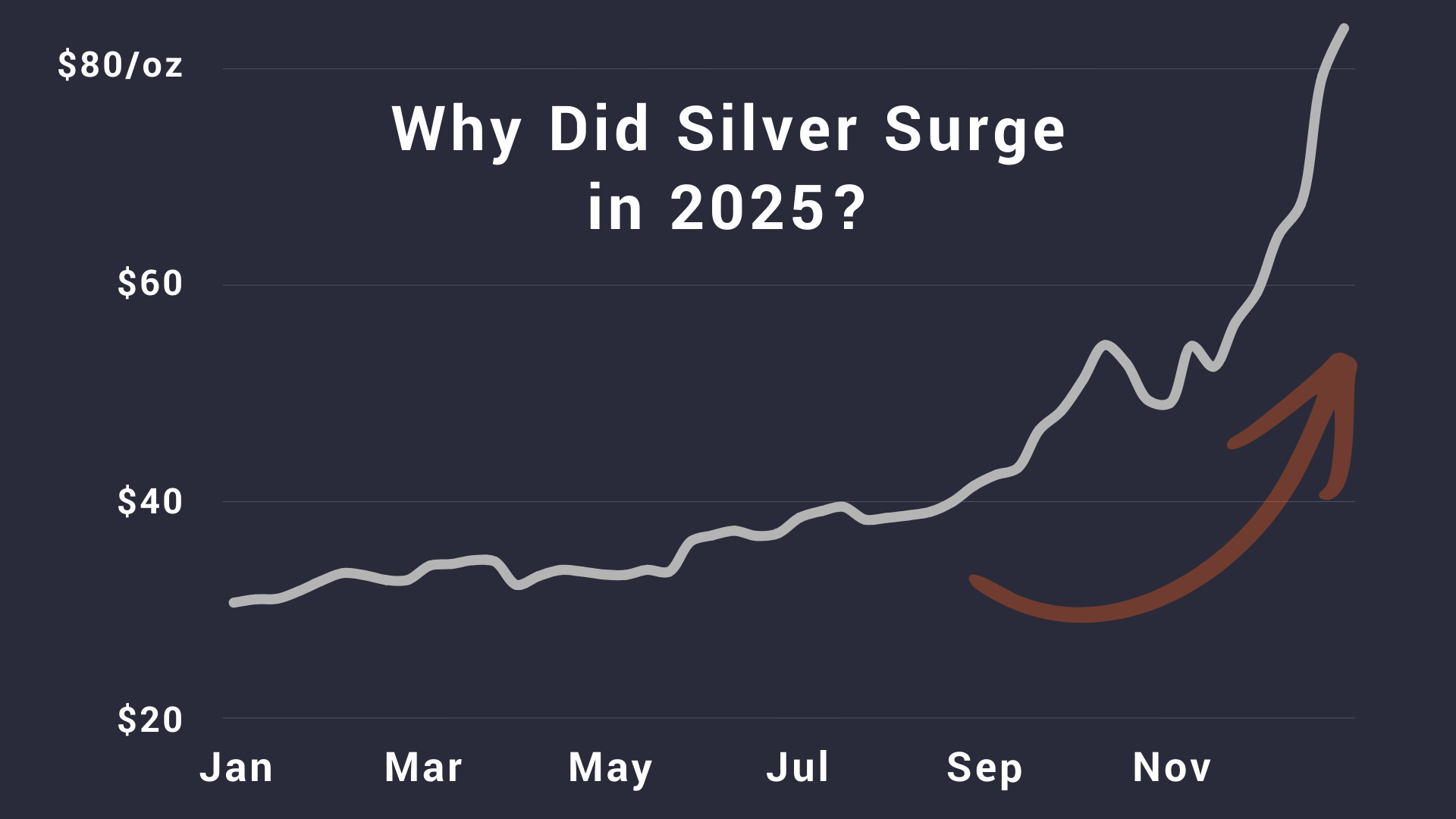

7 Reasons Behind the Silver Surge

In 2025, silver experienced a radical repricing—from a low of $28.3/oz to a high of $87.7/oz (a 210% move). In this article, we will explain the forces that caused the silver surge.

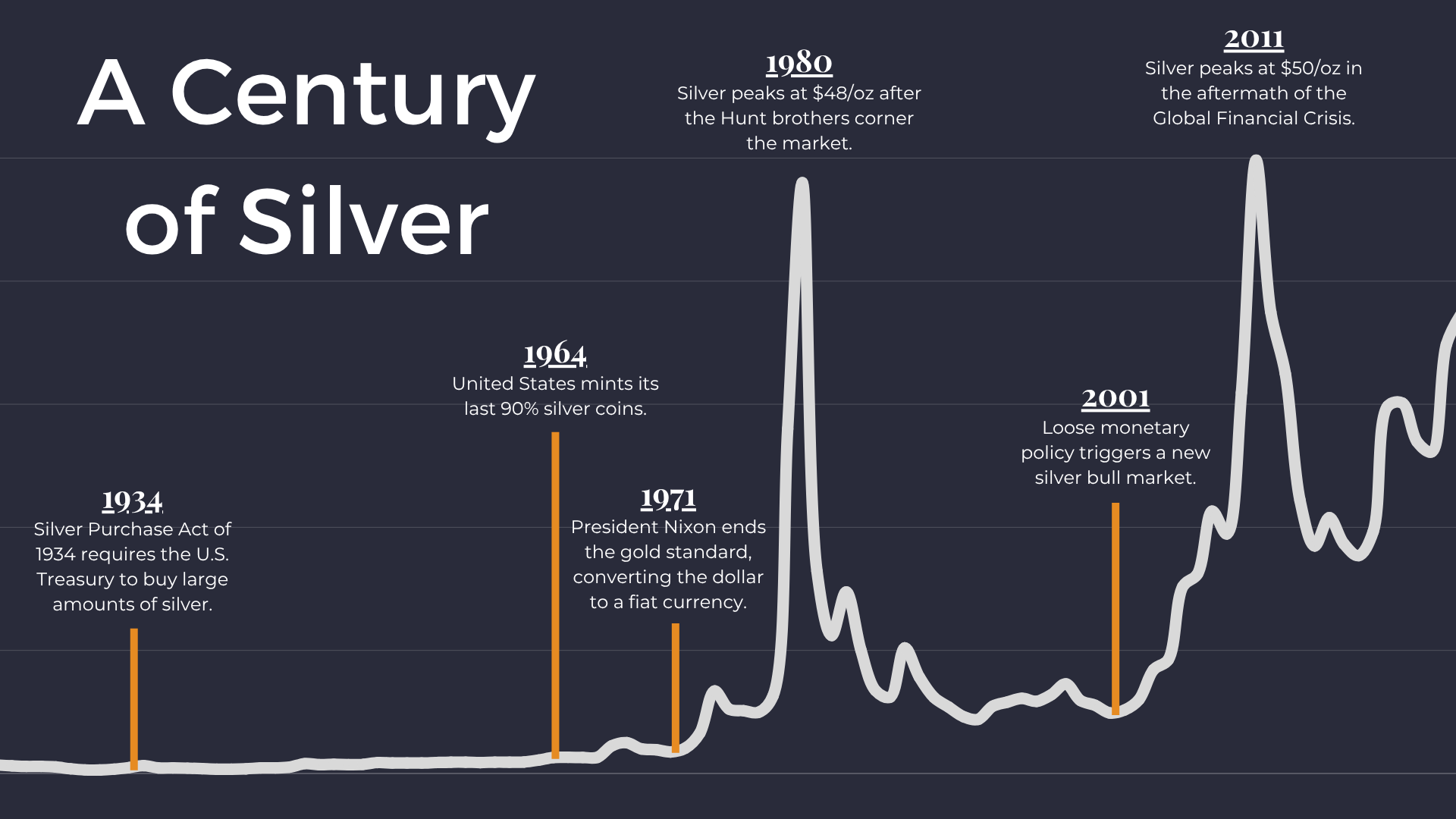

100 Years of Silver Price History

We’ll explore the silver price history from 1925 to today and zoom in on recent decades (30-year and 10-year price trends).

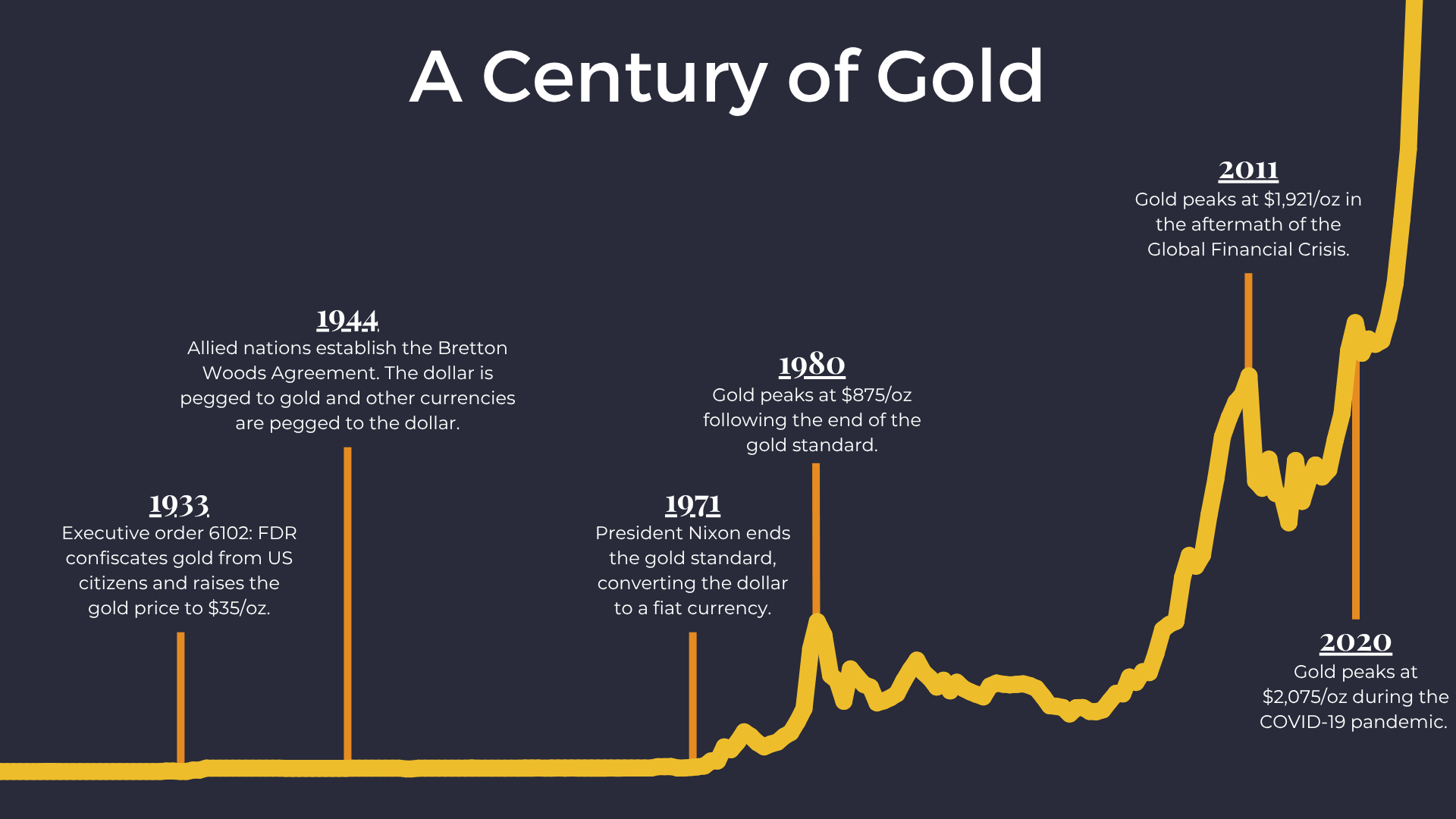

100 Years of Gold Price History

We’ll explore the gold price history from 1925 to today and zoom in on recent decades (30-year and 10-year price trends).

Interest Rates vs. Gold: 3 ways the Fed impacts gold

Gold and interest rates have an inverse relationship. When interest rates fall, the price of gold tends to rise, and vice versa.

Who Determines the Gold Spot Price?

The “gold spot price” refers to the price an investor will pay for the immediate delivery of one ounce of gold. But who decides it?

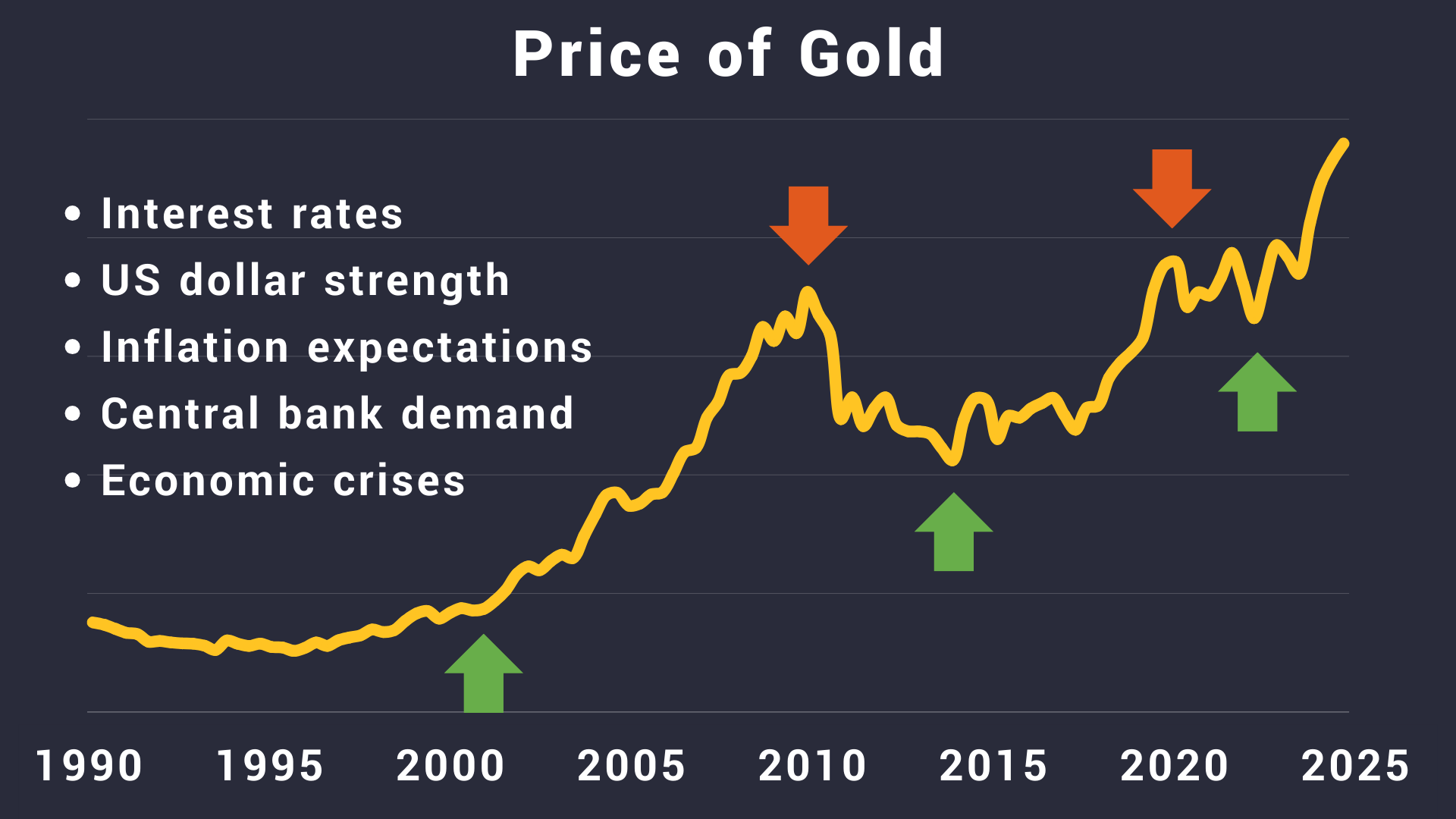

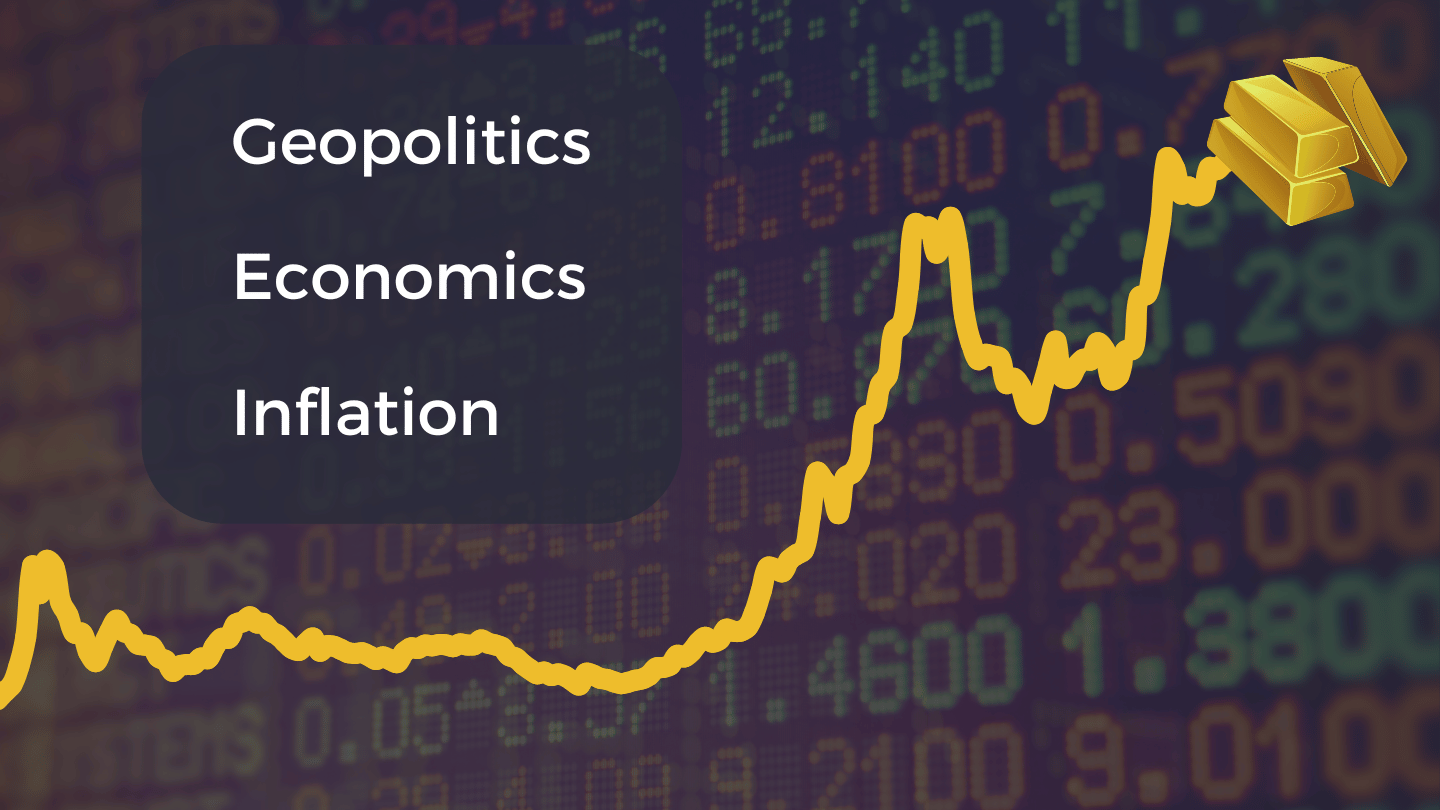

What Makes the Gold Price Rise and Fall?

The price of gold rises when some event encourages marginal buyers to buy, or discourages marginal sellers from selling. This article discusses the top 10 factors that drive gold prices.

10 Key Factors That Determine the Price of Silver

The price of silver is determined by supply and demand on major exchanges, as traders react to inflation expectations, interest rates, industrial demand, and geopolitical events.

The Top 5 Benefits of Investing in Gold

Gold is immune to inflation, valued across every culture, and independent of banks, governments, and corporations. Today, gold's greatest benefit for investors is its ability to improve risk-adjusted returns in a portfolio.

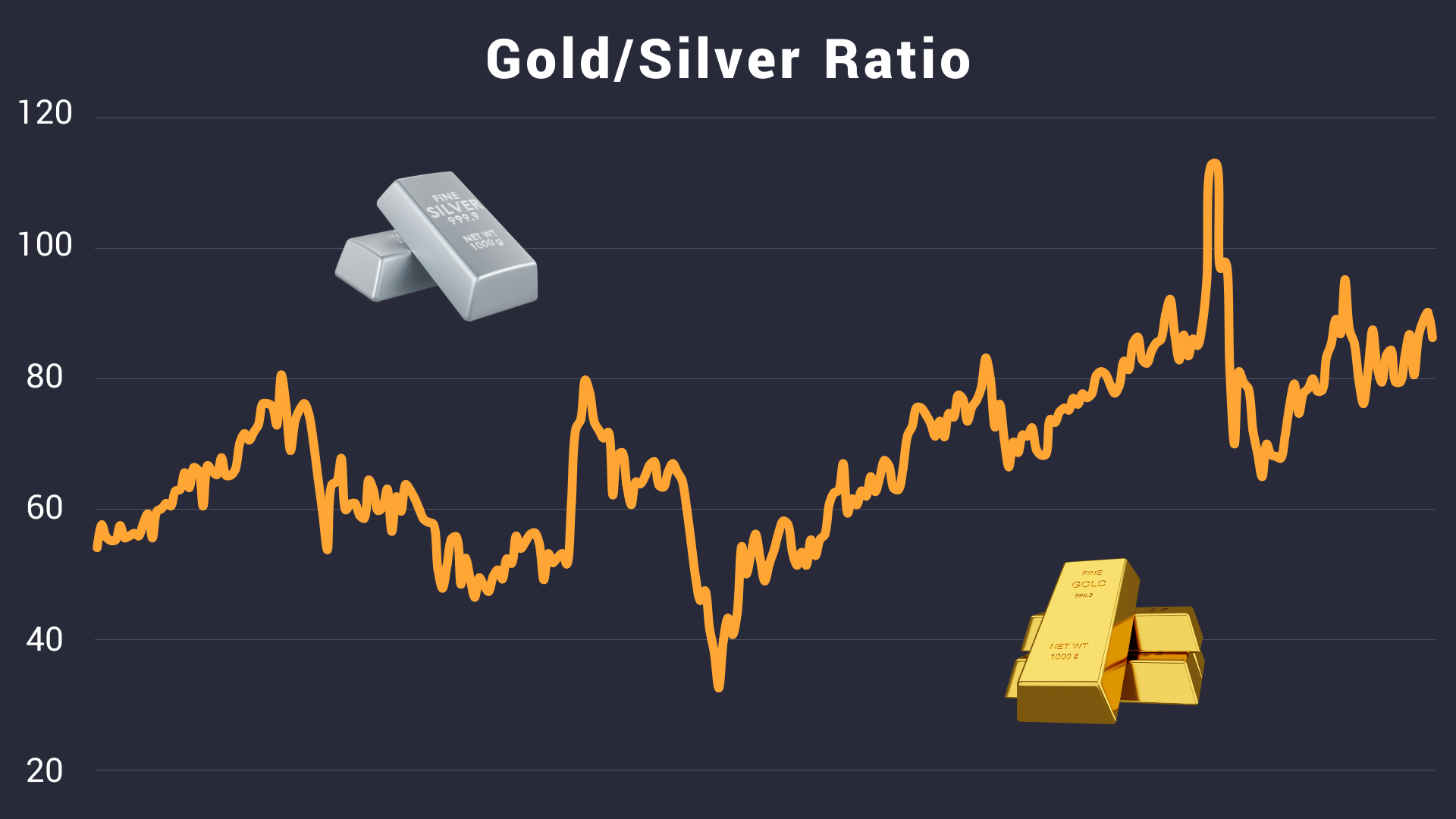

Trading the Gold/Silver Ratio

The gold/silver ratio = price of gold divided by the price of silver. Here is how to use the ratio to spot opportunities in the precious metals market.

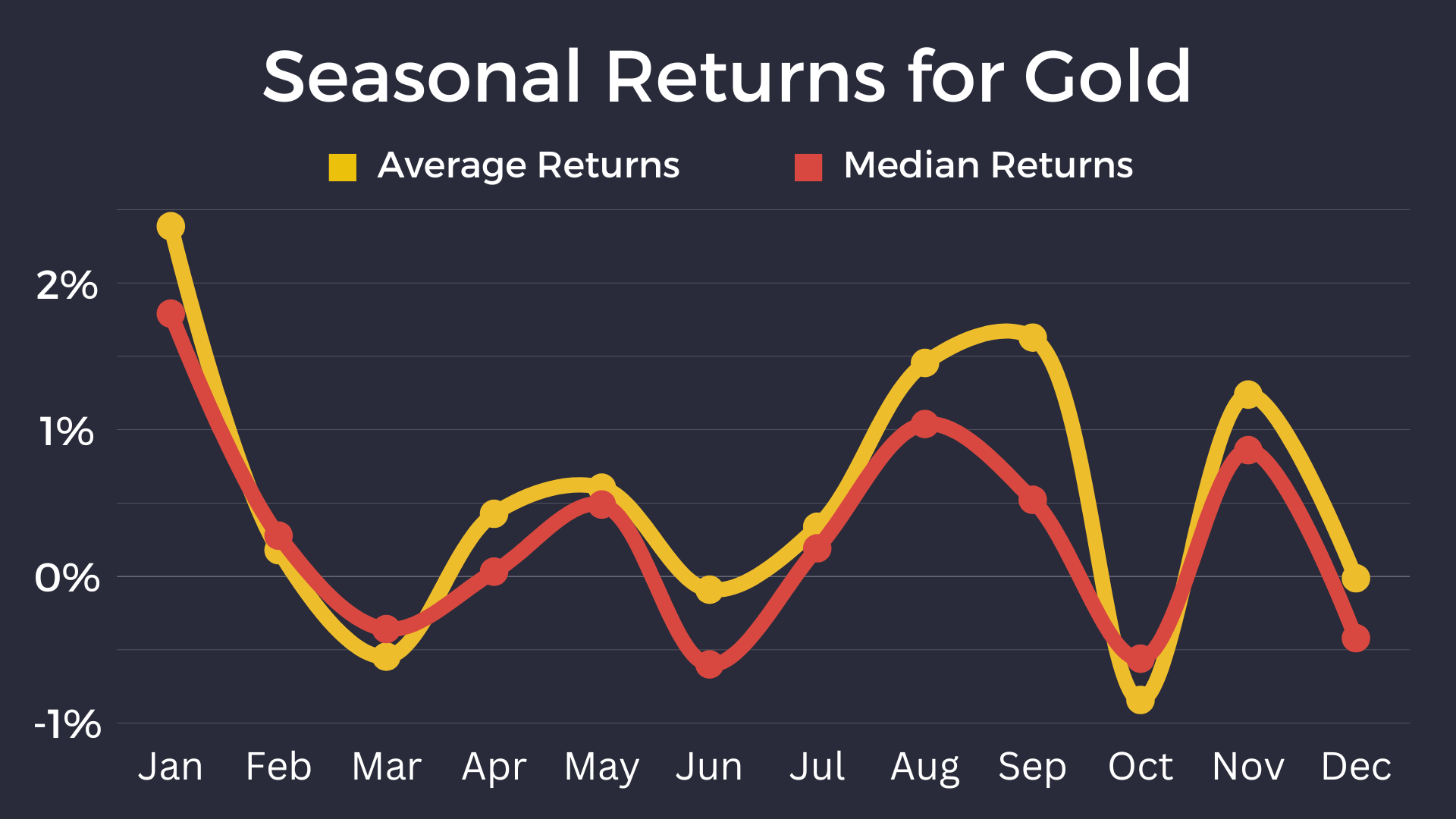

Seasonal Gold Demand: Trends and Performance

Indian wedding season, Christmas, Chinese Lunar New Year, and other seasonal patterns can significantly impact the price of gold.

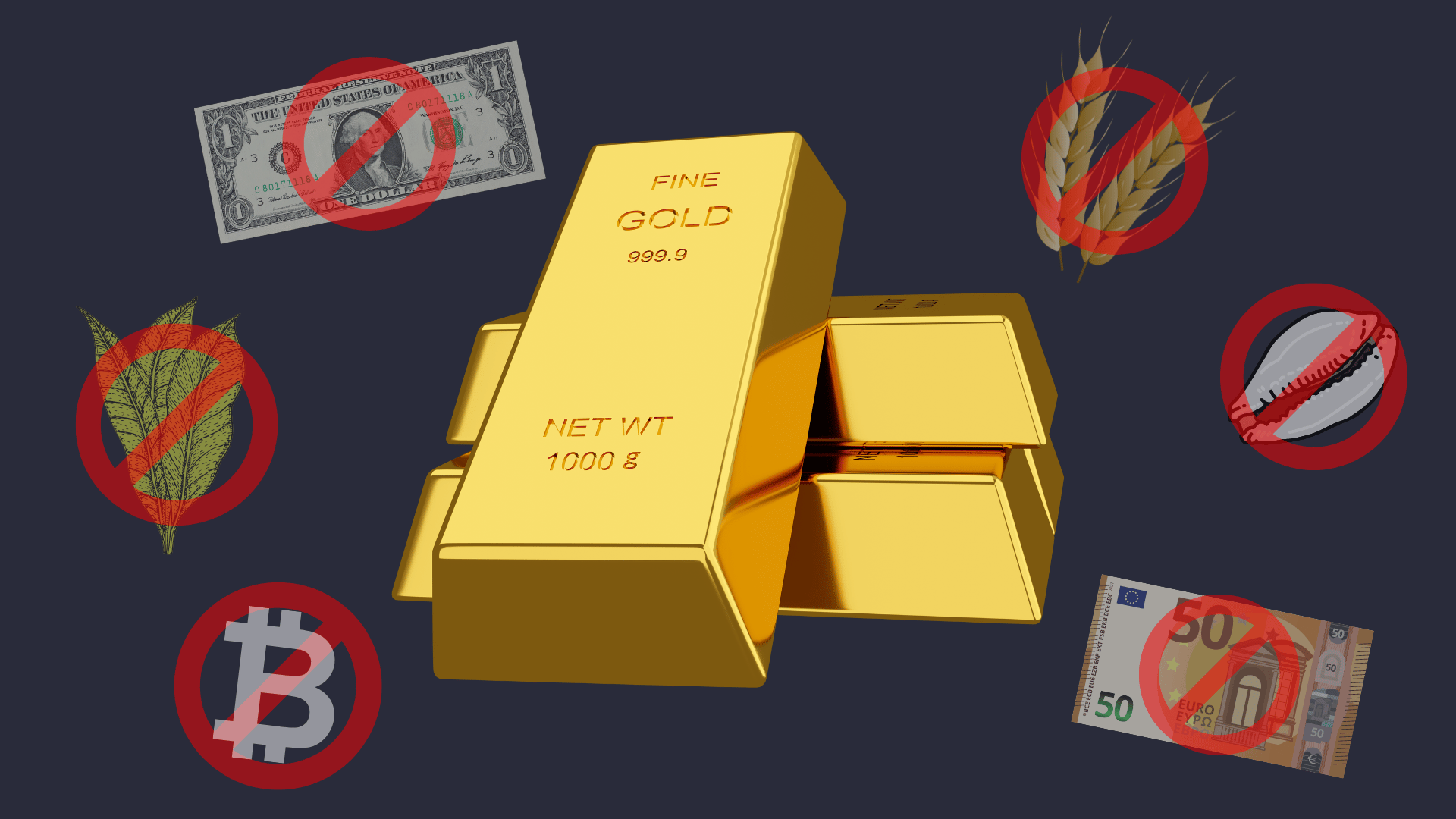

Why Do People Say "Gold is Money"?

History, economic theory, and empirical evidence: three arguments supporting gold as the purest form of money.

Silver Industrial Uses: How Silver Runs The World

Silver is often associated with “second place.” But don’t be fooled: silver is a remarkable metal that often plays a much greater role in our everyday lives than its glamorous yellow counterpart.

Why Should I Care About the Gold Price?

Because the entire global financial system was built on gold. Today, the gold price sends important signals about the economic health of the world’s most powerful nations.

Because the entire global financial system was built on gold. Today, the gold price sends important signals about the economic health of the world’s most powerful nations.

The Truth About Gold Price Manipulation

Gold bugs often debate the scope and impact of gold price manipulation. Some of these accusations are absolutely true, while others enter the realm of conspiracy.

Gold bugs often debate the scope and impact of gold price manipulation. Some of these accusations are absolutely true, while others enter the realm of conspiracy.

Gold vs. Bitcoin: Where Should You Put Your Money?

Everything you need to know about the two top choices for hedging against the U.S. dollar, and how to take advantage of the forces driving this battle.

Gold: The Miracle Metal

Gold’s ability to serve the role of currency, industrial material, and aesthetic symbol make it one of the most unique creations of the natural world.

How to Invest in Gold: 7 Methods You Should Know About

Gold is a symbol of wealth, prosperity, and security. Everyone has heard of it, but did you know there are dozens of ways to utilize gold for your portfolio?

The Gold Supply Chain: How Does it Work?

The gold supply chain has generated vast riches, strengthened the global economy, and shaped civilizations. Let’s take a look at how the supply chain functions today.

The 4 Factors to Evaluate a Gold Investment Strategy

Investing in gold, like many alternative investments, requires a layer of expertise beyond that of stocks and bonds. Breaking this layer is an essential step in maximizing portfolio returns, hedging against inflation, and obtaining the unique benefits of precious metals.

Can You Get Rich Investing in Gold?

Gold has a few key characteristics that make it an essential tool for achieving superior returns, building long-term wealth, and hedging against economic downturns.

Gold has a few key characteristics that make it an essential tool for achieving superior returns, building long-term wealth, and hedging against economic downturns.

The Economics of Gold

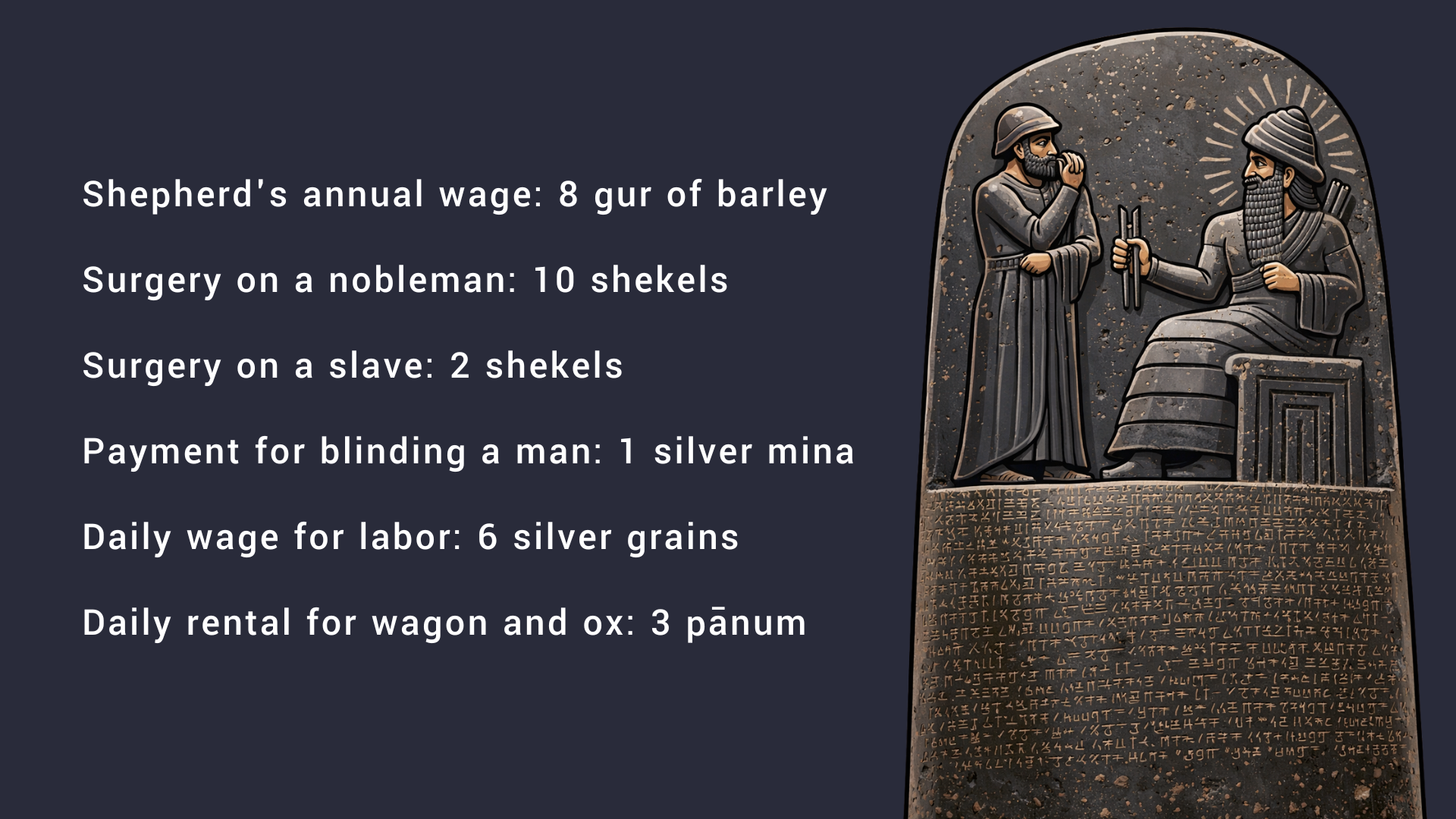

Comparing Ancient Babylonian Prices to Today

This article uses gold as a stable benchmark to translate wages and prices from Hammurabi’s Code into modern terms.

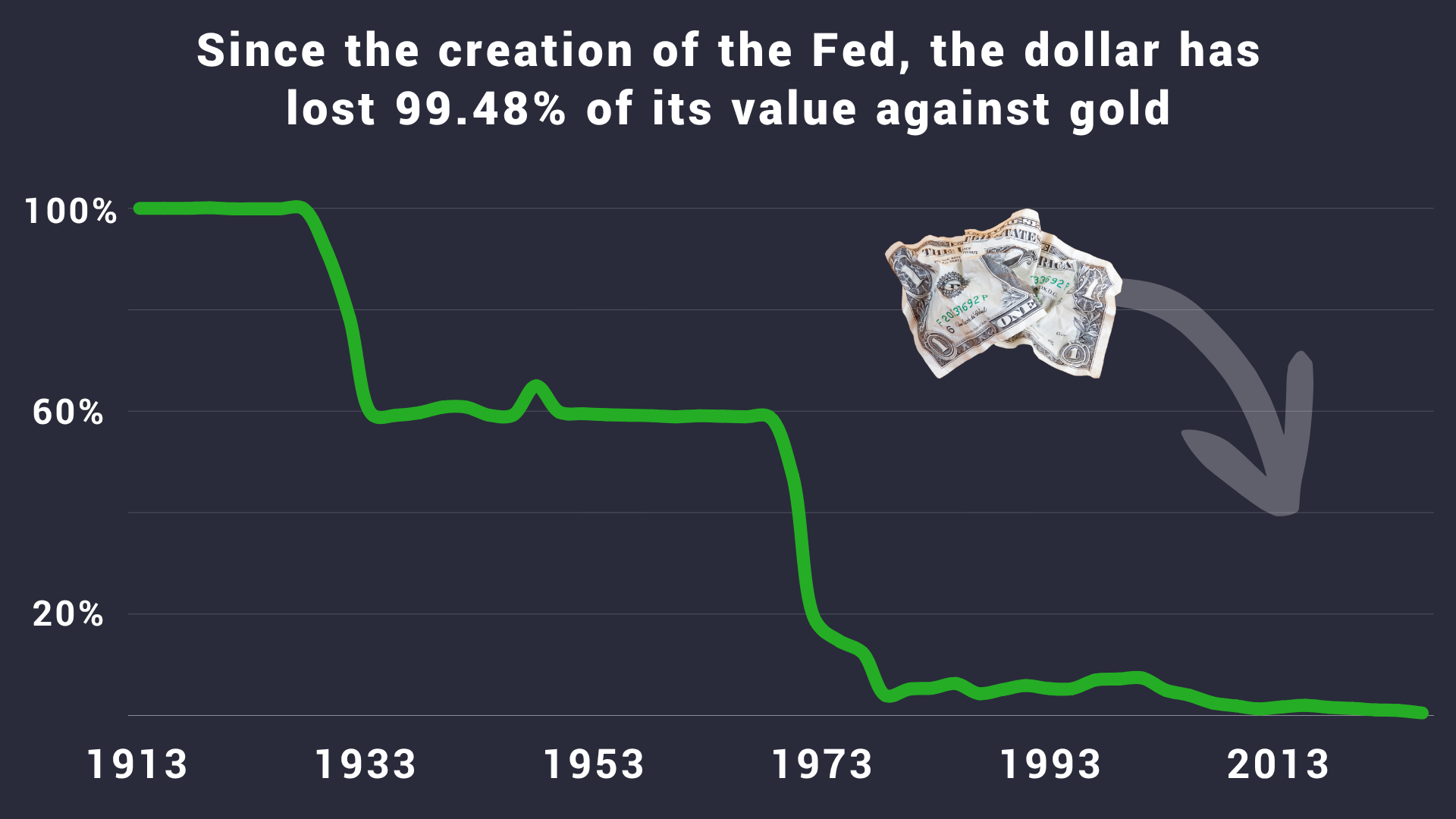

Gold and the Dollar: A Breakup Story

Gold and the US dollar were once inseparable partners. Now they are sworn rivals. Let's dig into the breakup that shaped the modern economic system.

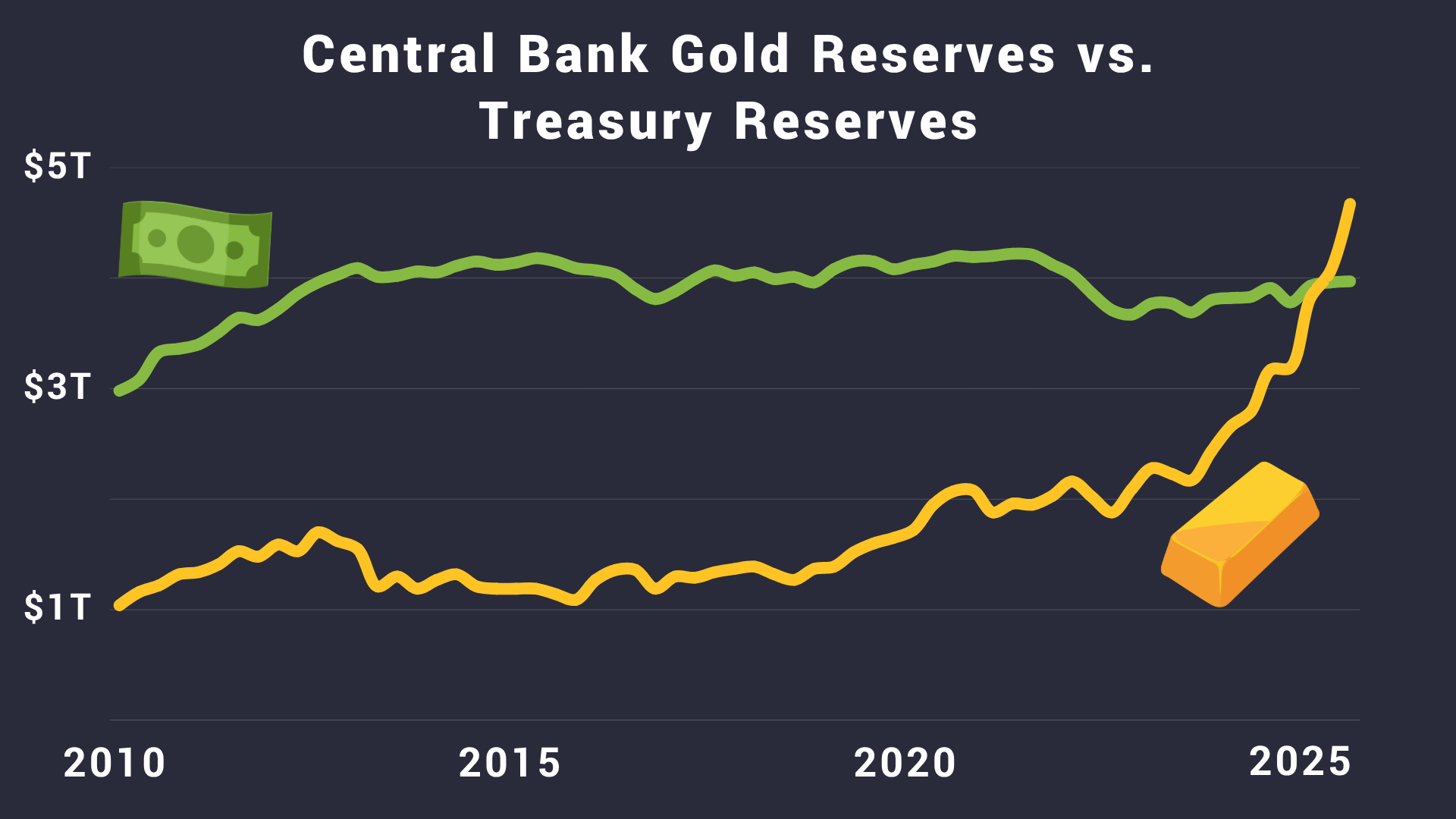

Gold Reserves vs. Treasuries: Did Gold Just Become the Global Reserve Currency?

The value of central bank gold reserves just surpassed the value of foreign U.S. Treasury holdings. When the biggest players in the world swap bonds for bullion, it’s worth paying attention.

Why is Silver Valuable?

Silver is one of the most attractive investment opportunities today. Despite its growing applications in technology, silver remains extremely undervalued.

What Does the Gold/Oil Ratio Tell Us?

Gold and oil are the two most important commodities in the world. Tracking the gold/oil ratio is like watching the tug-of-war between Wall Street and Main Street.

How Do Tariffs Impact Gold?

Trump’s tariffs have sent gold to an all-time high. Markets expect tariffs to cause some combination of higher inflation, a declining U.S. dollar, geopolitical tensions, and more foreign gold demand.

Would a BRICS Currency Challenge the U.S. Dollar?

Discussions of a new “BRICS currency” are gaining widespread attention. This article explores why an increasing number of foreign nations are attempting to “de-dollarize,” and why gold has emerged as a viable alternative to the USD as the global reserve currency.

What Causes the Economy to Crash?

Economic crashes begin with artificially low interest rates and credit expansion which lead to a misallocation of resources, inevitably culminating in a recession.

What Backs the United States Dollar?

Prior to 1971, the US dollar was backed by gold. Today, the dollar is backed by 2 things: the government’s ability to generate revenues (via debt or taxes), and its authority to compel economic participants to transact in dollars.

Why Do People Say "Gold is Money"?

History, economic theory, and empirical evidence: three arguments supporting gold as the purest form of money.

Semiconductors, Medicine, and Telescopes: Industrial Uses of Gold

We are all familiar with gold’s visual beauty, which made it the precious metal of kings and emperors for thousands of years. Today, this illustrious yellow metal is no longer reserved for royalty. You rely on gold every day, as does anyone who takes advantage of modern electronics, dentistry, medicine, and…space travel?

Why Does Fiat Currency Fail?

Fiat currencies rule the world, despite their shoddy track record over the last 100 years. What can we learn from fiat currency collapses in recent history?

History of the Gold Standard in America

To understand the history of US monetary system, we must grasp the role of its central protagonist: gold.

How Does Quantitative Easing Impact Gold?

The long-term risks of quantitative easing, including eroding the credibility of the US dollar, are closely linked to gold's performance.

The long-term risks of quantitative easing, including eroding the credibility of the US dollar, are closely linked to gold's performance.

History of Hard Money: Japan’s Lost Decade

In the 1990s, Japan’s economy crashed after a frenzy of debt, speculation, and easy money. Japan’s lost decade now stands as a dire warning to modern economists.

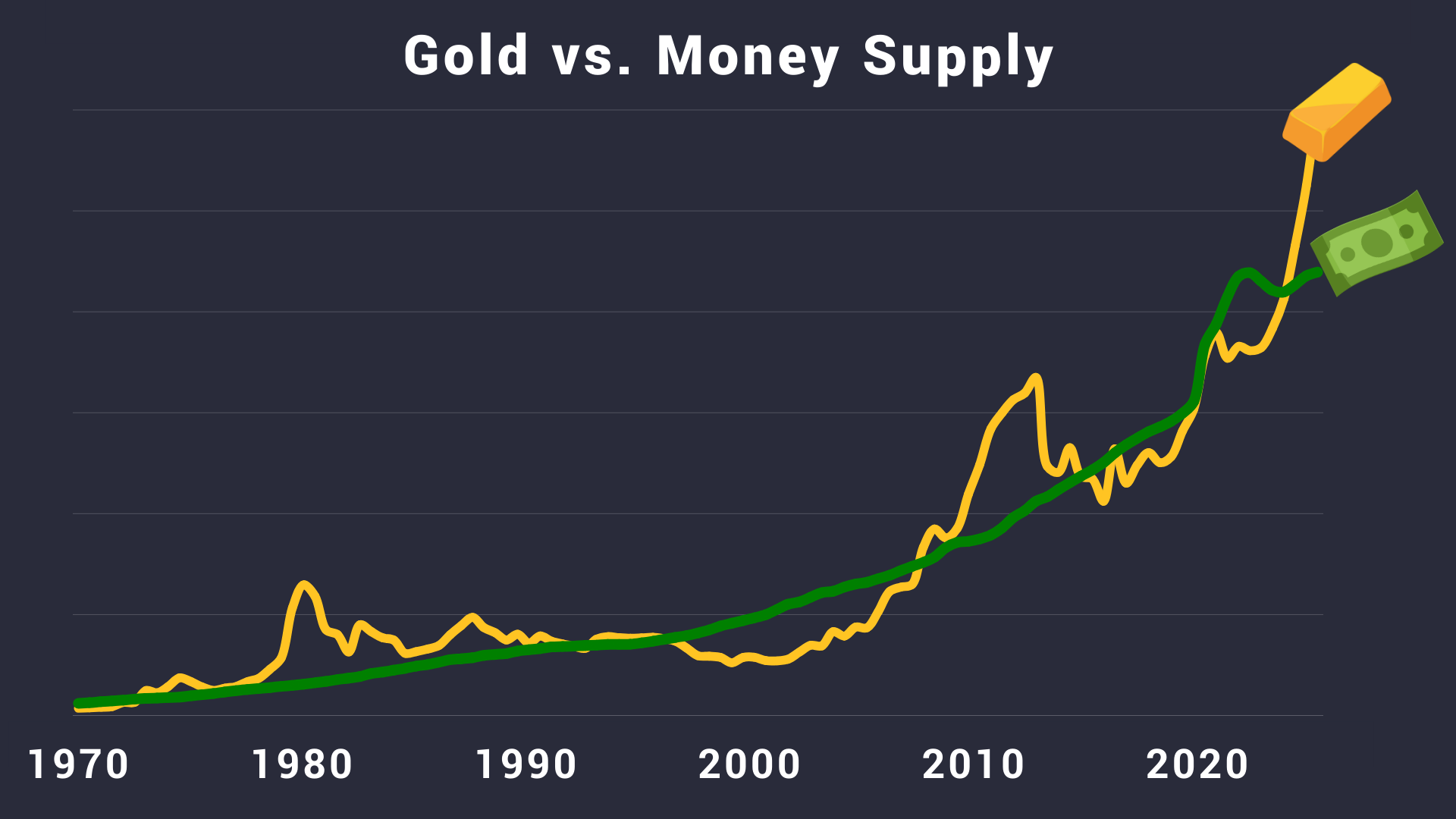

Gold vs. Money Supply

History is clear: when the money supply increases, the gold price follows. The more dollars are printed, the more can be stuffed into the earth’s limited supply of gold.

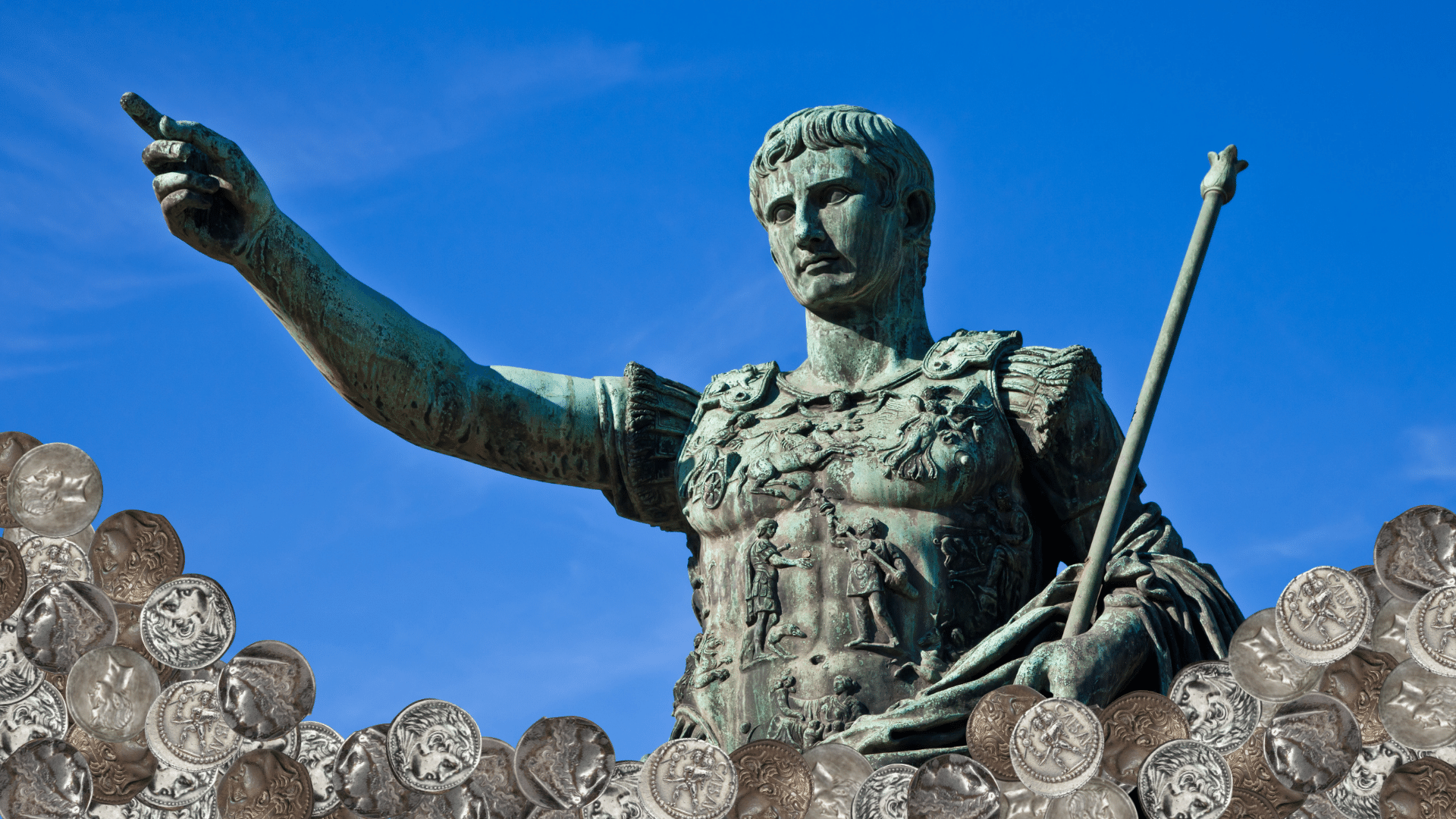

History of Hard Money: The Denarius and the Fall of Rome

When Matthew wrote his gospel in 85 AD, one pure silver Denarius covered the daily wages of a skilled Roman craftsman. Three hundred years later, the coin had been reduced to a worthless scrap of copper alongside a crumbled empire.

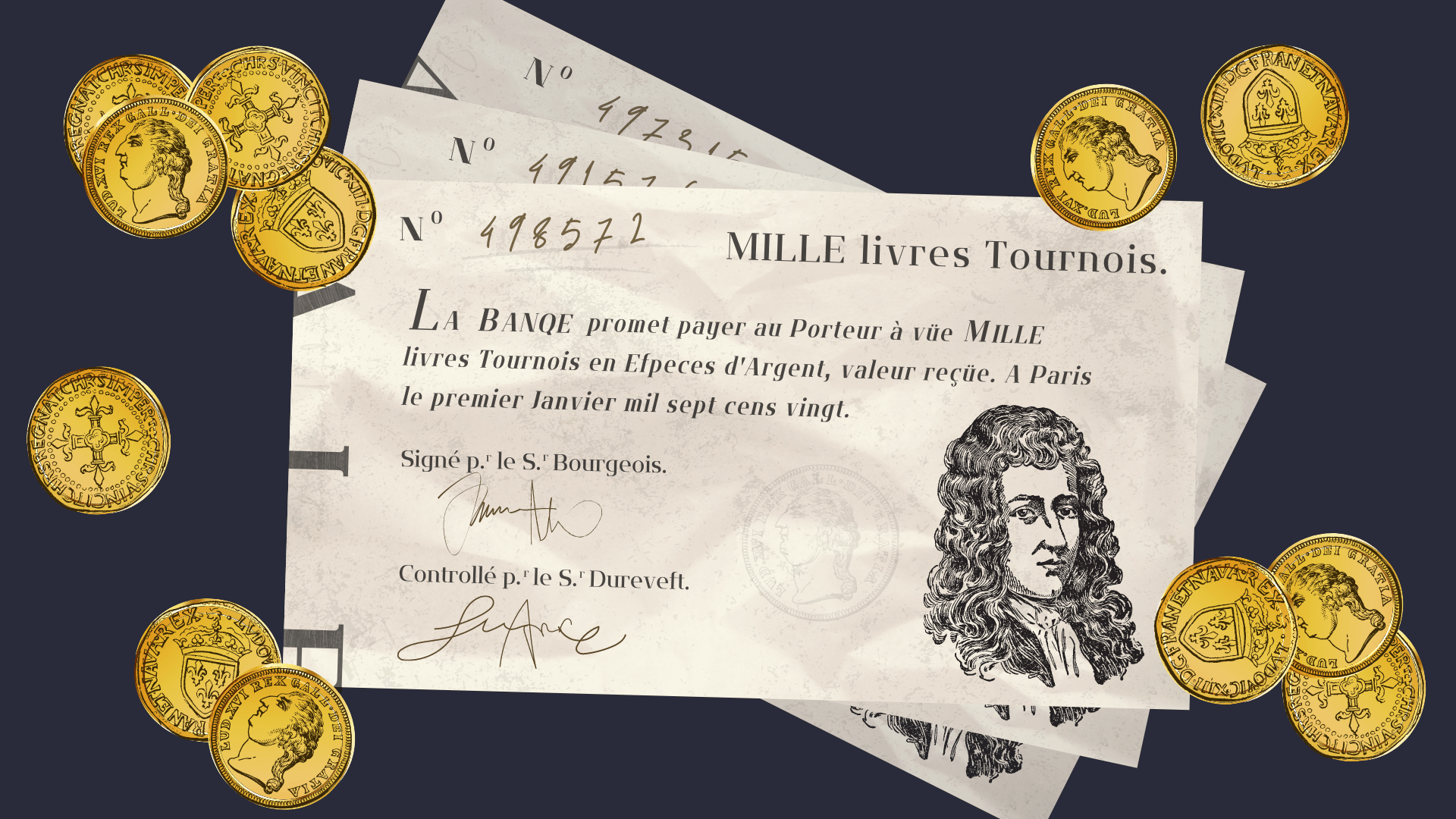

History of Hard Money: The Mississippi Bubble

If you happened to be walking around Paris from 1715 to 1722, you would have encountered one of the first experiments with paper money, centralized banking, and fractional reserves.

The Gold Supply Chain: How Does it Work?