Gold Fees

When you purchase gold, we clearly display your buy and sell prices to avoid surprises.

We charge a 0.8% premium over the wholesale market gold price.

Your buy price = Wholesale price + Premium

The 0.4% annual maintenance fee is billed on a semi-annual basis (every January & July). We have no minimum maintenance fee.

Learn MoreSilver Fees

When you purchase silver, we clearly display your buy and sell prices to avoid surprises.

We charge a 2.0% premium over the wholesale market silver price.

Your buy price = Wholesale price + Premium

The 0.6% annual maintenance fee is billed on a semi-annual basis (every January & July). We have no minimum maintenance fee.

Learn MoreThe best cost structure in the industry. Period.

No really...we checked. Vaulted minimizes transaction costs by connecting investors to the most liquid metals markets in the world.

Stable Spreads

“Spread” refers to the difference between the buying price (bid) and the selling price (ask). Compared to the stock market, spreads on precious metals tend to be quite large, particularly during periods of high demand. Vaulted investors do not need to worry about these issues. We cut out 70% of the traditional gold and silver supply chain, minimizing costs and shielding you from the volatility that retail investors often encounter.

Low Premiums

In addition to wholesale spreads, retail investors often pay premiums and commissions (for example, a 1-oz silver coin might cost $30 even if the spot price is $25). Premiums can be anywhere from 5-15% on gold and 10-25% on silver. Vaulted guarantees a low, fixed premium over our wholesale aquisition cost, so your price is always transparent and predictable. Fewer people take a cut of your investment, so you get the best prices every time.

Tax Advantages

Taxes are another major cost of buying gold. Gold-backed ETFs and physical coins/bullion are taxed as collectibles in the United States, meaning they face a 28% long-term capital gains tax rate. Vaulted assets are subject to a different tax structure that may reduce your tax liability by 30-50%. Please connect with your Vaulted advisor for more details on the tax implications of your capital gains in Vaulted.

*All investors should consult a tax professional. This is not tax advice.

No Matter How Much You Invest, Rest Assured We Are Not Wasting Your Money On Senseless Fees.

Vaulted pricing is transparent, trustworthy, and affordable.

We are able to lower gold fees by using cutting-edge technology, eliminating unnecessary middlemen, keeping overhead costs low, and storing the gold bars directly at their manufacturer, the Royal Canadian Mint. We pass those efficiencies on to you.

Source of Gold

Vaulted employs the The Royal Canadian Mint's Responsible Precious Metals Program, which identifies and validates the chain of custody of incoming gold refining deposits.

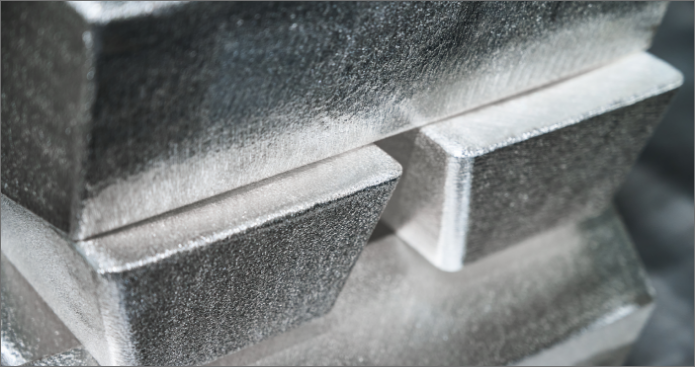

The Royal Canadian Mint's superior production standards and security protocols are implemented at every level of refinery and vaulting operations.

The refinery is a restricted environment controlled by security personnel and supported by state-of-the-art surveillance technology.

The gold you purchase is guaranteed to be conflict-free. Vaulted avoids all sources of gold that deny basic human rights, or which finance and contribute to abuses of human rights.

Source of Silver

Your silver is safeguarded in the renowned vaults of HSBC Bank, located in London, England. As a core member of the LPMCL precious metals market, HSBC is one of the industry’s trusted leaders, ensuring unrivaled liquidity and protection for your assets.

HSBC Bank’s vaulting services are second to none, trusted by prominent institutions like the world’s largest gold-backed ETF, SPDR Gold Trust (GLD), and even some Central Banks.

With a strong emphasis on confidentiality, every transaction is executed with the utmost discretion. Your assets remain securely stored within HSBC’s state-of-the-art vaults, equipped with cutting-edge surveillance systems.

HSBC adheres strictly to robust security protocols governing trading, clearing, settlement, and storage. When it comes to the safety of your silver, there is no better choice.

Storage

Vaulted is your direct link to the finest storage facilities in the world.

Your gold is stored at the Royal Canadian Mint in Ottawa, Canada. The Mint is located at 320 Sussex Drive, Ottawa, Ontario K1A 0G8. We chose the RCM as our storage counterparty because of its excellent reputation and stringent security protocols.

Your silver is stored in the vaults of HSBC Bank in London. HSBC’s registered office is located at 8 Canada Square, London E14 5HQ, United Kingdom. HSBC is an undisputed leader in the industry that stands at the core of the LPMCL precious metals market, the world's largest and most liquid silver market.

The world's most secure vaults are yours with the tap of a finger

Security

Our vaults provide fully segregated, highly secure storage with comprehensive protections against damage and loss.

The Royal Canadian Mint's vaults are supervised by security personnel and supported by state-of-the-art surveillance technology. All holdings are counted on a quarterly basis and audited annually by the Government of Canada’s Office of the Auditor General.

HSBC Bank offers the highest caliber vaulting services in the industry. The world’s largest gold-backed ETF stores its gold in HSBC’s London vaults, along with other large institutional investors and even some central banks.