The gold/silver ratio measures the relative value between gold and silver. Investors can utilize the gold/silver ratio to increase their ounces in a precious metals portfolio without additional investment.

What is the Gold/Silver Ratio?

The gold/silver ratio (or mint ratio) is the price of gold divided by the price of silver. It represents the number of silver ounces required to buy one ounce of gold.

If the ratio is 50, it takes 50 oz of silver to buy 1 oz of gold (in other words, gold is 50 times more valuable than silver).

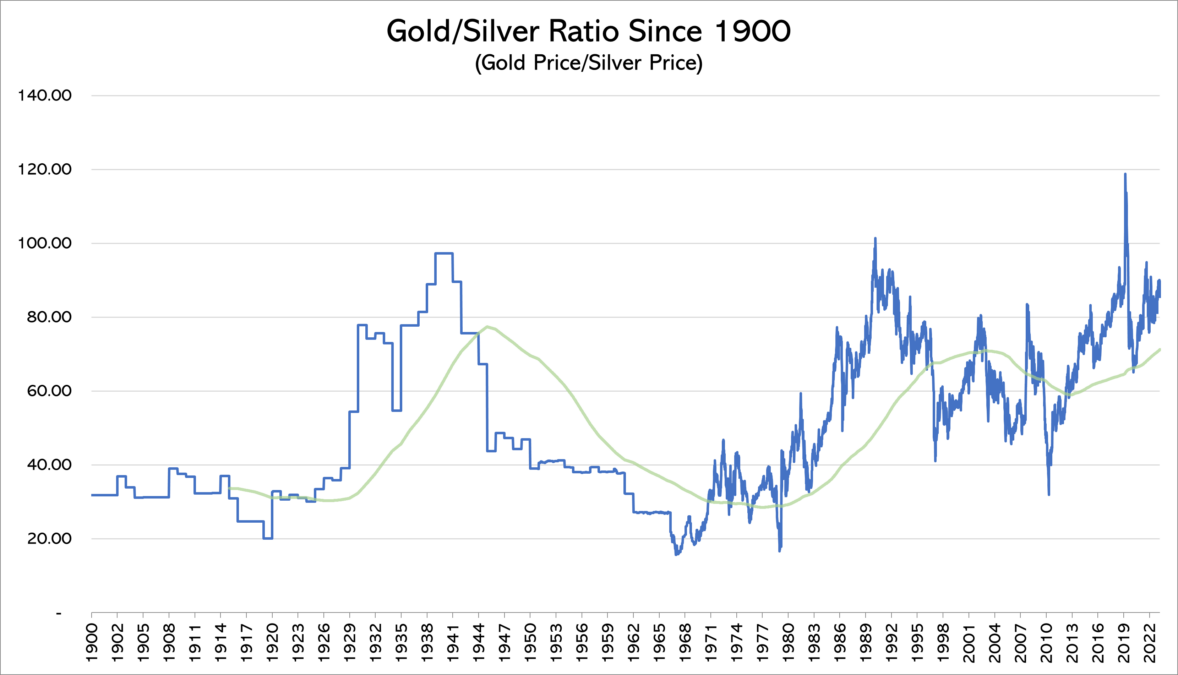

Below is a chart of the gold/silver ratio dating back to the year 1900.

When the gold/silver ratio is rising, gold is outperforming silver.

When it is falling, silver is outperforming gold.

What is the Average Gold/Silver Ratio?

The gold/silver ratio tends to oscillate between 20 and 100. The average ratio over the last 30 years is about 70. This means that, on average, gold is 70 times more valuable than silver.

Low values indicate that gold is undervalued, while the high values indicate that silver is undervalued.

How to Trade the Gold/Silver Ratio

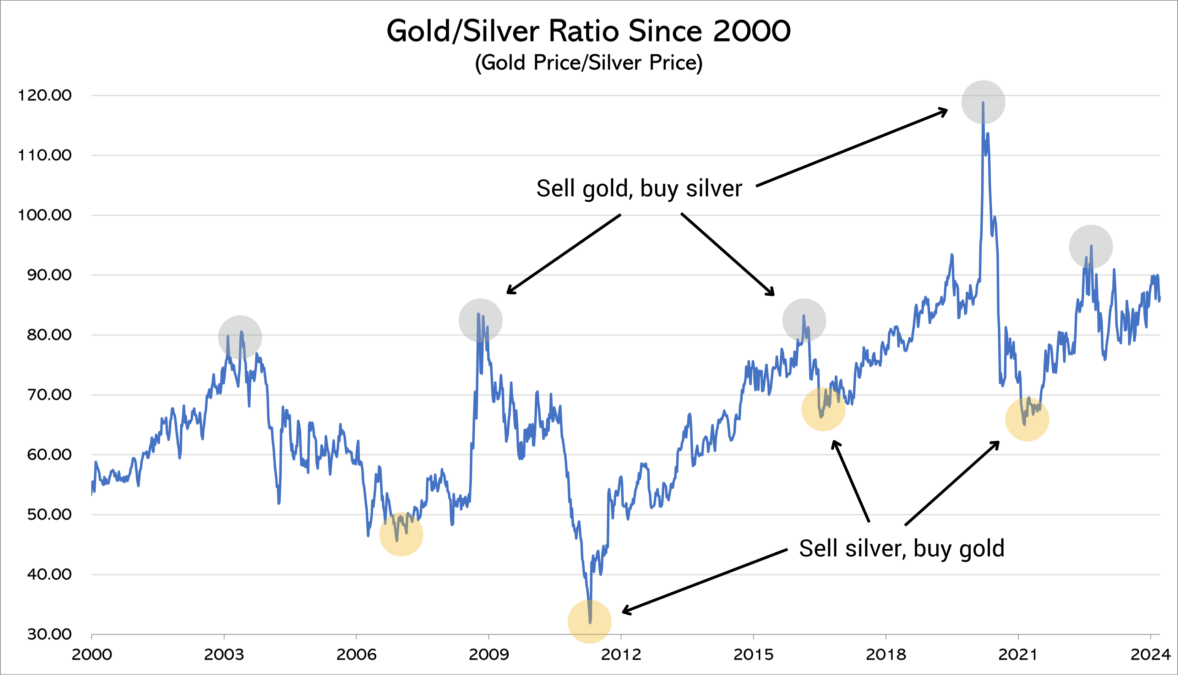

A “ratio trade” involves selling gold and buying silver (or vice versa) when the ratio is in an extreme position.

The gold/silver ratio provides trading opportunities that no other asset class provides. Stocks, bonds, real estate, cryptocurrencies, and other commodities do not have a proven pattern of long-term mean reversion, which means they are unsuitable for ratio trading.

The strategy goes something like this:

- Allocate heavily to gold when gold is undervalued relative to silver.

- Wait for the ratio to reach a potential peak (indicating silver is undervalued).

- Execute a ratio trade from gold to silver.

- Wait for the ratio to reach a potential trough (indicating gold is undervalued).

- Execute a ratio trade from silver to gold.

The Risks of Ratio Trading

A successful ratio trading strategy requires a careful analysis of various technical and fundamental indicators, including risk appetite, inflation forecasts, relative strength of the US dollar, momentum indicators, geopolitical stability, and speculative positioning in the futures market.

Ratio trading also requires a very long-term investment horizon. As you can see from the chart above, market cycles can last years or even decades.

If you intend to employ a ratio trading strategy in your precious metals portfolio, it is crucial to seek guidance from a professional. When you open a Vaulted account, you not only gain access to physical gold and silver at a fraction of the cost but also benefit from the expertise of a dedicated personal advisor.

Vaulted advisors have an average tenure of 15 years in the industry and are here to ensure you make informed decisions every step of the way.

Ratio Trading: Historical Performance

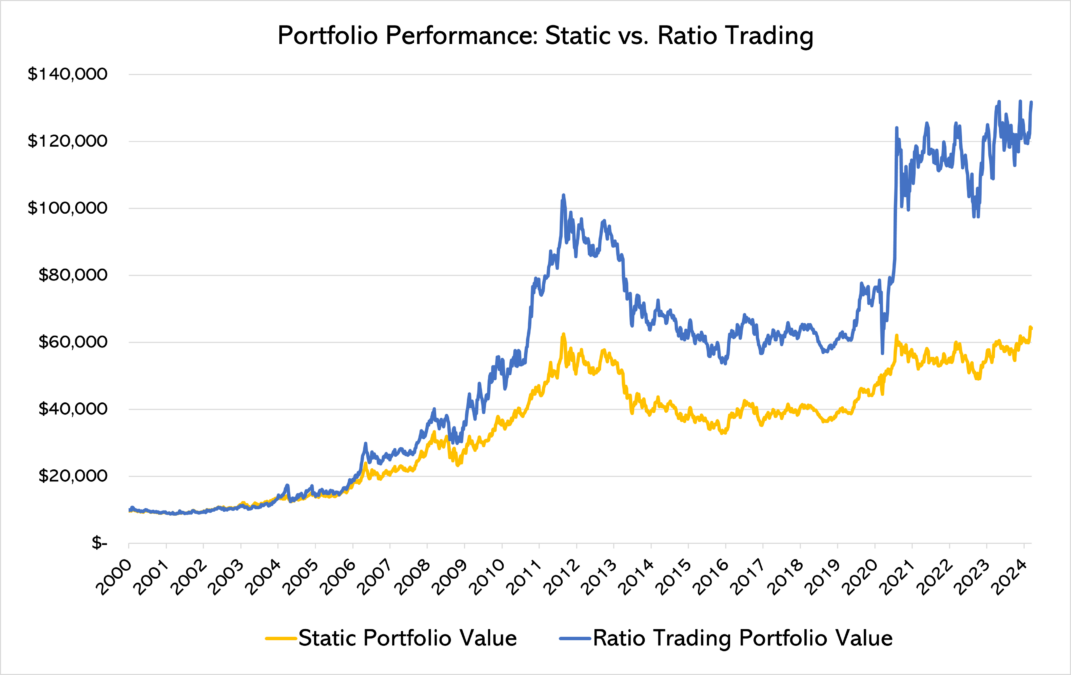

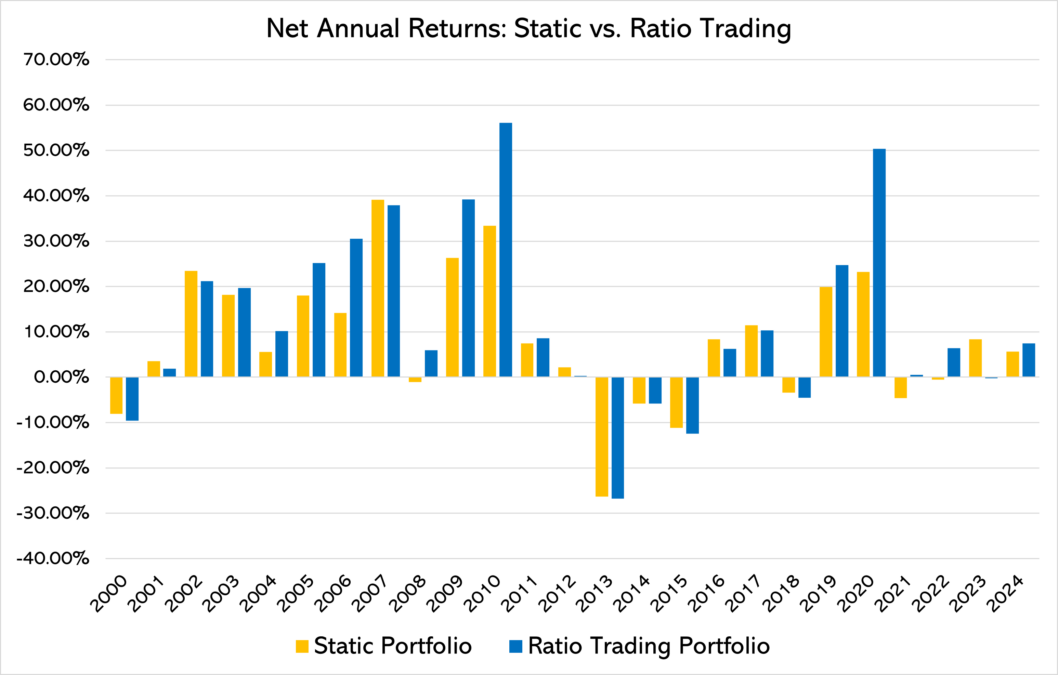

The chart below shows an example of a static gold and silver portfolio vs. a ratio trading portfolio:

Initial investment: $10,000

Time horizon: Beginning in 2000, ending in 2024

Starting allocation: 90% gold, 10% silver

Final Portfolio Value:

- Static: $64,151.22

- Ratio Trading: $131,196.55

CAGR:

- Static: 7.72%

- Ratio Trading: 10.85%

Total Return:

- Static: 541.5%

- Ratio Trading: 1,212.0%

Past performance does not guarantee future results. The performance of portfolios presented above should not be interpreted as indicative of future performance. Investors should be aware that all investments carry risk. The example portfolios provided are for illustrative purposes only and do not constitute investment advice, recommendation, or endorsement.

If you are interested in ratio trading, we highly recommend you open a free Vaulted account and set up a consultation with your personal advisor.

Double Your Ounces Without Investing Another Dollar

Many of our clients who have participated in this strategy over the last 50 years have more than doubled their ounces (in both bull and bear markets).

Set up a Vaulted account to learn more.