Feb 10, 2026

Gold and Silver Taxes Explained (IRS + State Rules)

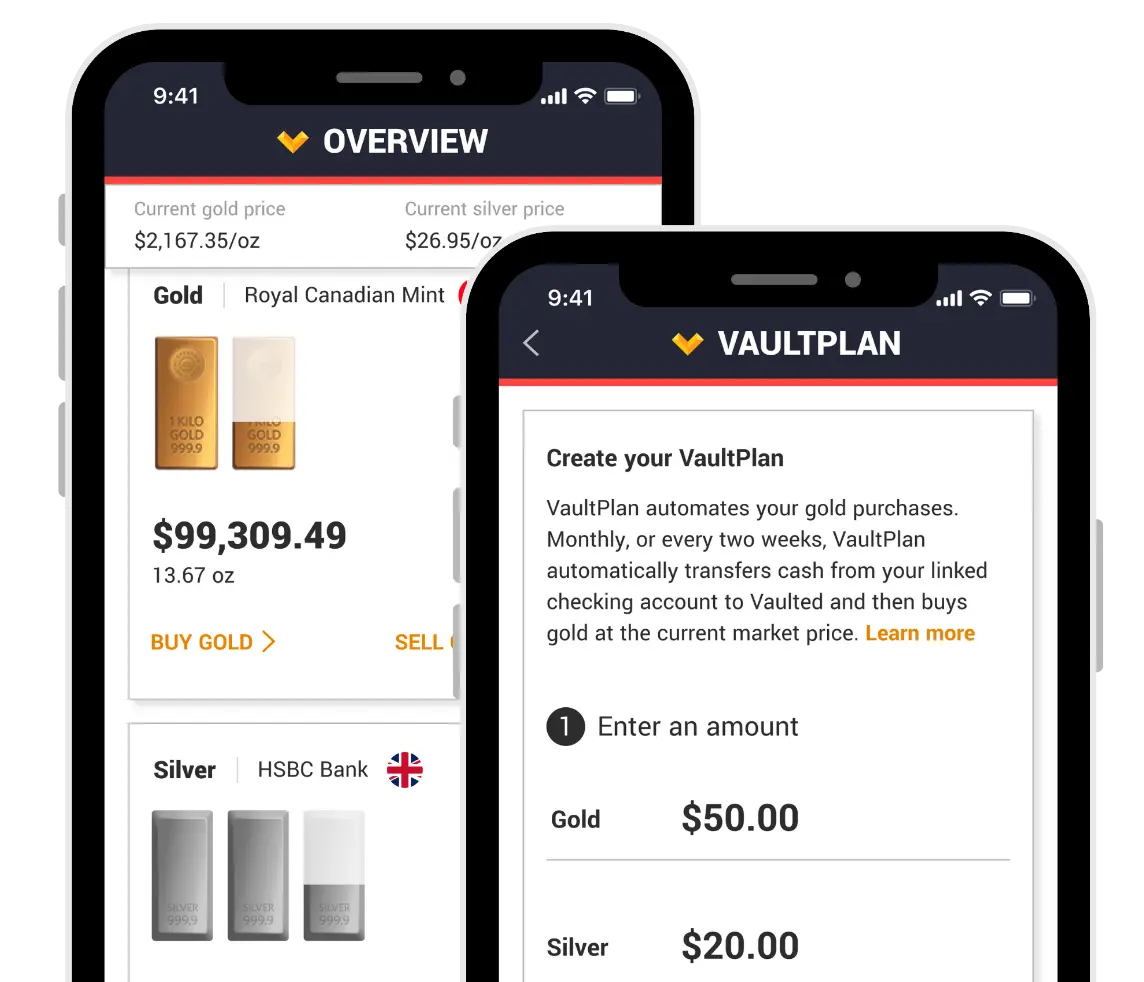

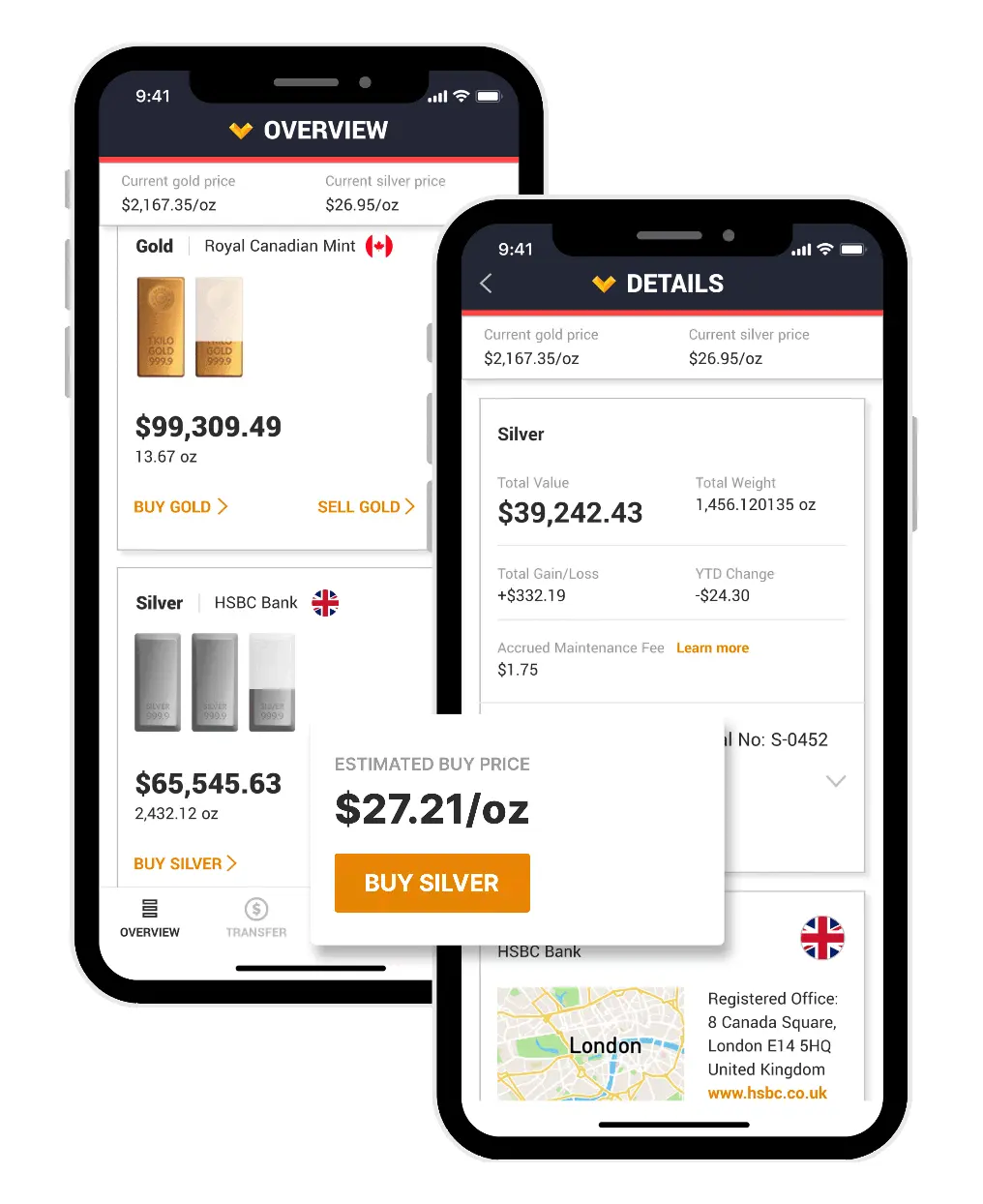

Buy physical gold with the tap of a finger

Vaulted makes it easy to buy, hold, and take delivery of physical gold and silver.

Purchase Pure Gold and Silver

stored in the world's most secure vaults

Join the Professional Market

with the lowest transaction fees anywhere

Take Delivery of Your Metals

in whatever form you prefer

Own Specific Serial-Numbered Bars

with no pooling or leasing

Maintain Full Control

over when you buy, sell, or take delivery

Contact Your Personal Advisor

for entry points and portfolio guidance

INDEPENDENTLY VERIFIED

STORAGE

This audit confirms that all Vaulted gold and silver is safely stored under your ownership and accurately accounted for in the vaults of the Royal Canadian Mint and HSBC Bank.

Set your portfolio on a solid foundation. When cycles turn, gold endures.

Vaulted is the preferred choice for individuals and institutions.

- Best cost structure in the industry. Tell me more

- Direct guidance from precious metals experts

- Industry-leading standards of security and privacy

Analyst Reviews

“You can create an account in seconds, link your bank account and transfer money directly, and purchase or sell gold with one click.”

Christy Rakoczy / Finance Writer

“With Vaulted, buying and selling gold is easier, safer, and more affordable than ever. They make gold buying less complicated than ordering a pizza."

Rachel Green / Investing and Personal Finance

“If you want to save in gold, protect your wealth, and diversify your portfolio, Vaulted offers a unique method of investing in ‘the yellow metal.”

Andrew Boyd / Managing Director

“Vaulted is an excellent choice for investors who want to own actual gold, but don’t want to worry about physically storing the gold.”

Jim Wang / Founder of Best Wallet Hacks

By The Numbers

Access vaults that store

$85B+

of gold and silver

Connect to markets that trade

$2.4T+

every year

Vaulted’s modern, easy-to-use platform unlocks access to the world’s most secure vaults. Created by McAlvany Financial Group, America’s foremost precious metals firm trusted by 50,000 clients over 50 years, Vaulted gives you unparalleled access to purchase precious metals with confidence.

The Most Secure Vaults in the World Are Yours

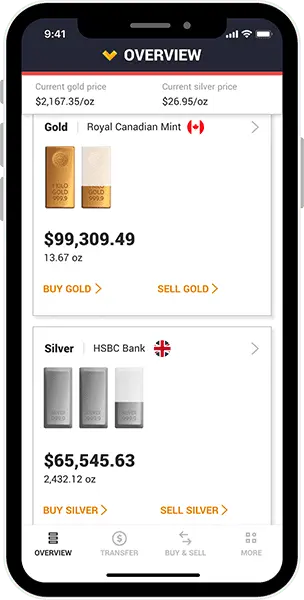

Vaulted gold remains securely locked at the Royal Canadian Mint, where it was manufactured and certified conflict-free, until you choose to sell or have it delivered to your doorstep.

Vaulted silver is allocated to pure 1,000 oz London Good Delivery Bars at HSBC Bank where they are physically segregated from all other inventory. Each bar has a unique serial number which is tracked and reported in the Vaulted app.

Access to gold and silver 24/7

Vaulted brings physical gold ownership into a simple digital experience, with secure storage and delivery available on request.

- Buy real, serial-numbered bars from your phone in 3 easy steps. Tell me more

- Work with an expert advisor to incorporate gold and silver into your long-term investment strategy.

- Enjoy industry-leading standards of security and privacy.

There's a better way to bank

Your cash loses purchasing power every day it sits in a bank. Gold, on the other hand, has retained its value for thousands of years.

When stocks dive and currencies fail, your gold remains safe. Put your savings to work. Vaulted provides a practical way to hold gold as part of a long-term savings strategy.

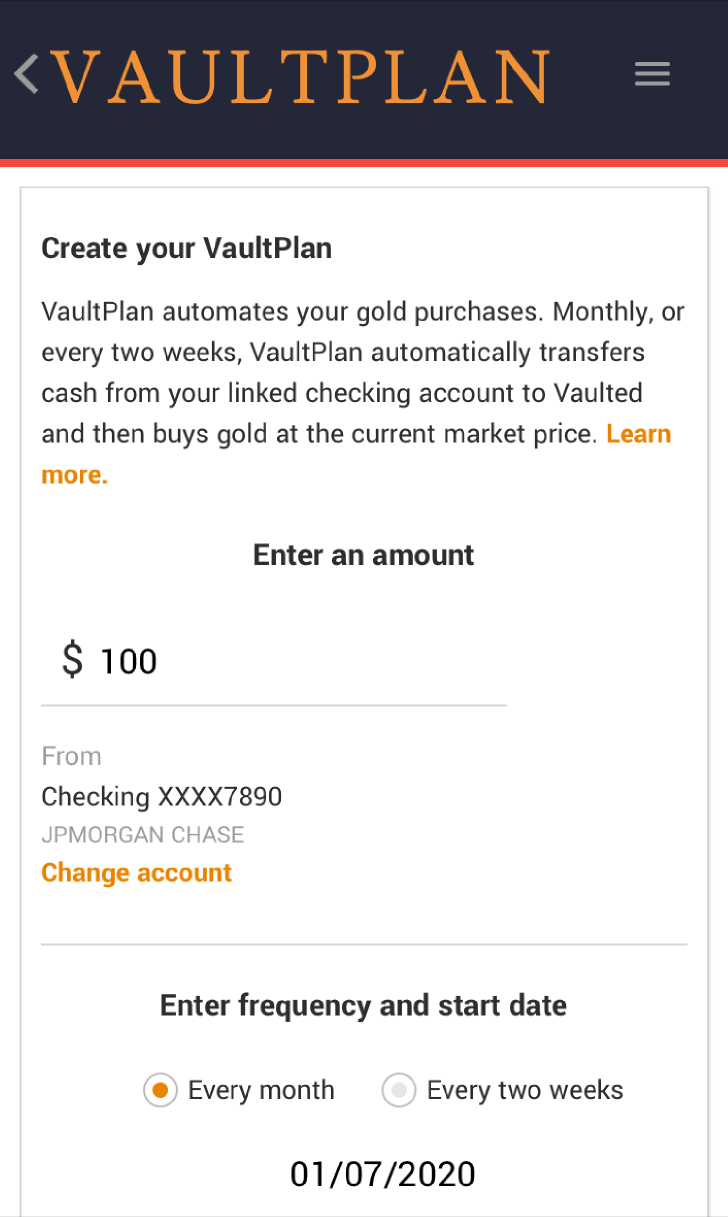

Effortlessly save with VaultPlan

VaultPlan puts you in control over your savings by automatically adding to your gold and silver investments every month. Saving becomes effortless! Once you set it up, VaultPlan does the rest.

Setup Your VaultPlanFair pricing, clearly explained

Our pricing is transparent and affordable. Vaulted is able to minimize fees by using cutting-edge technology, eliminating unnecessary middlemen, and keeping overhead costs low. We pass those efficiencies on to you.

Our Technology

The Vaulted platform is designed and maintained by the same team that built core infrastructure for Microsoft, Google, and Ernst & Young. Our regulatory team managed due diligence at top banking institutions such as UBS, Rothschild, and Goldman Sachs.

Latest from the blog

View all posts

Jan 23, 2026

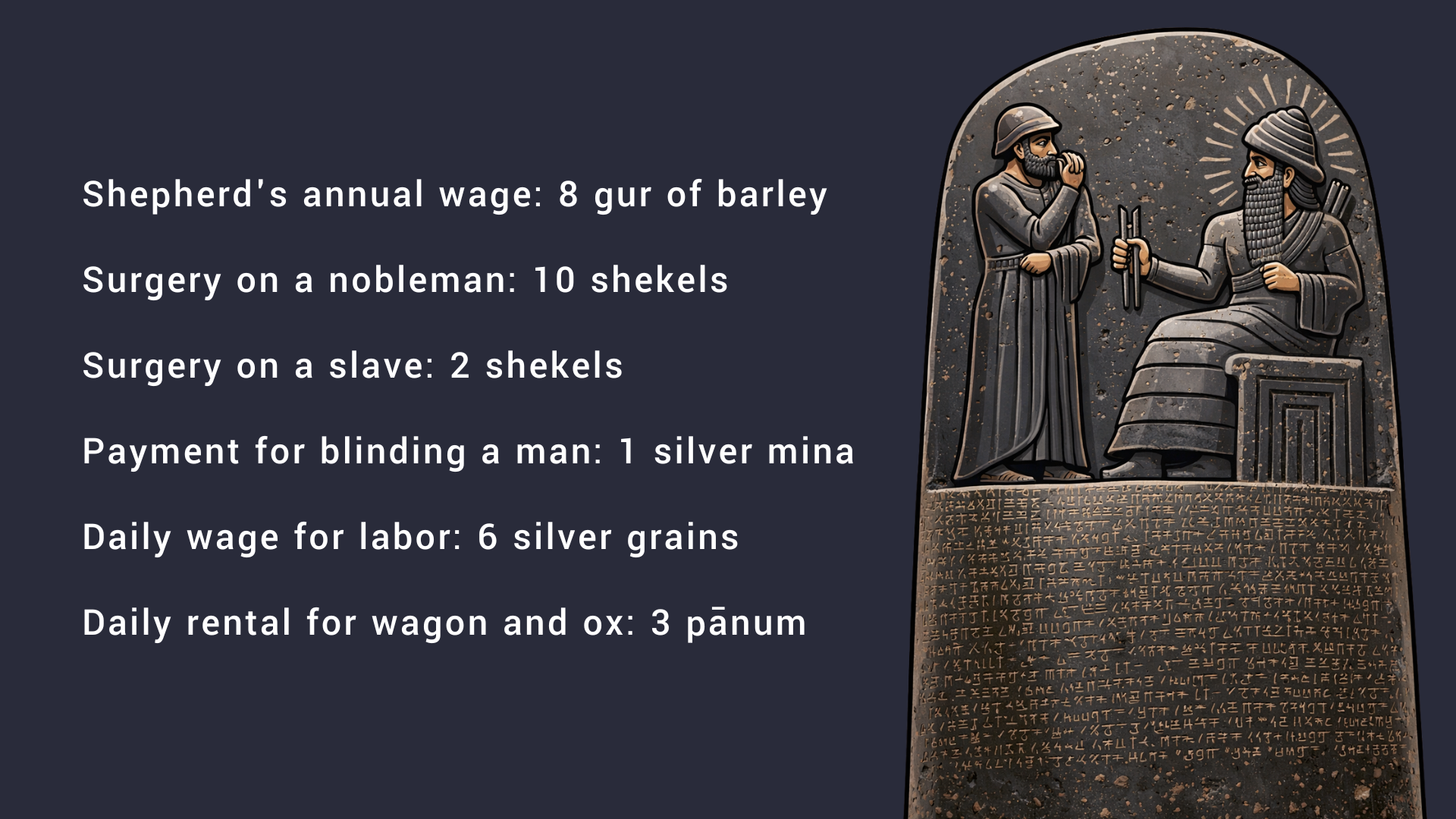

Comparing Ancient Babylonian Prices to Today

This article uses gold as a stable benchmark to translate wages and prices from Hammurabi’s Code into modern terms.

Jan 20, 2026

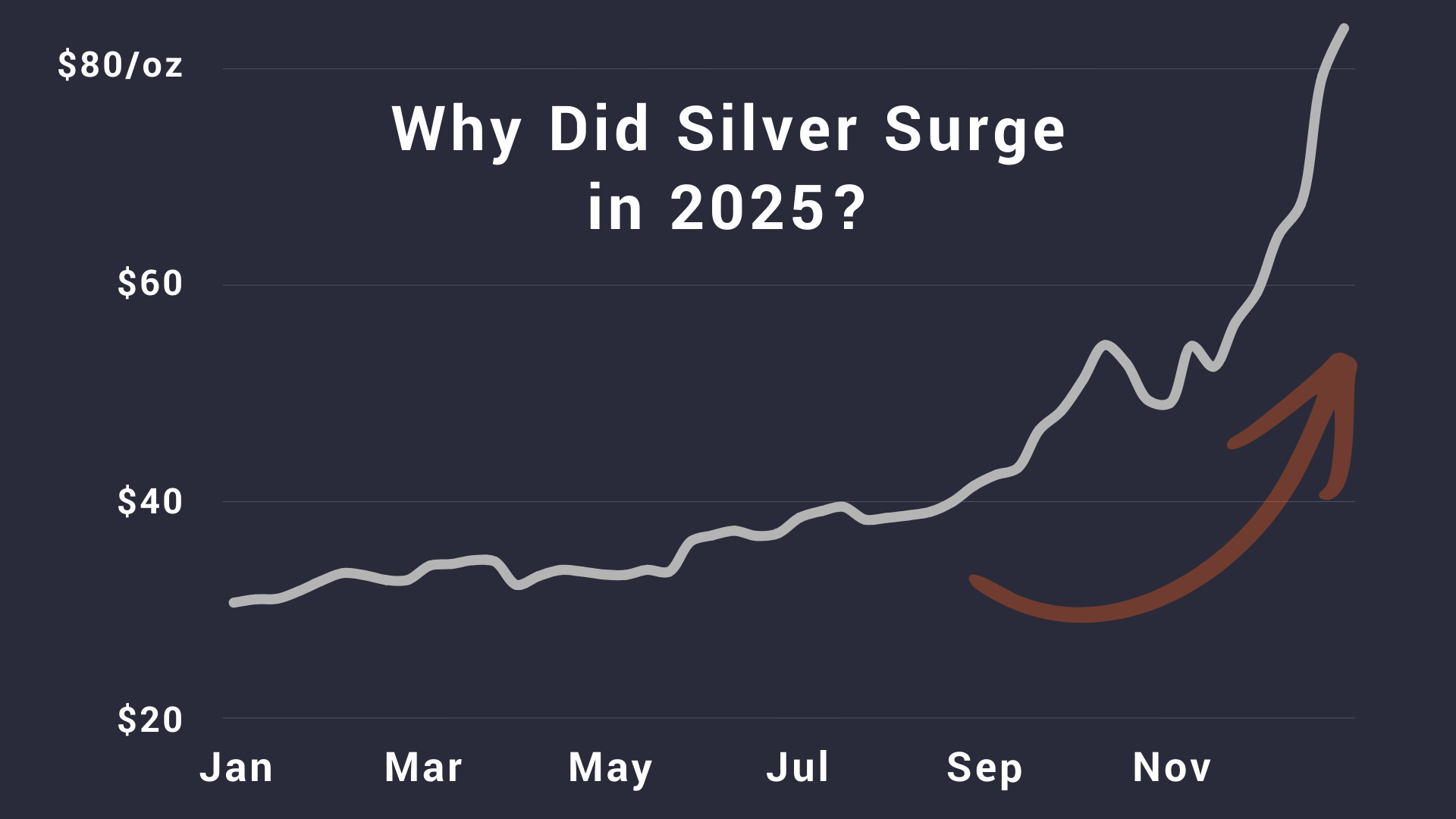

7 Reasons Behind the Silver Surge