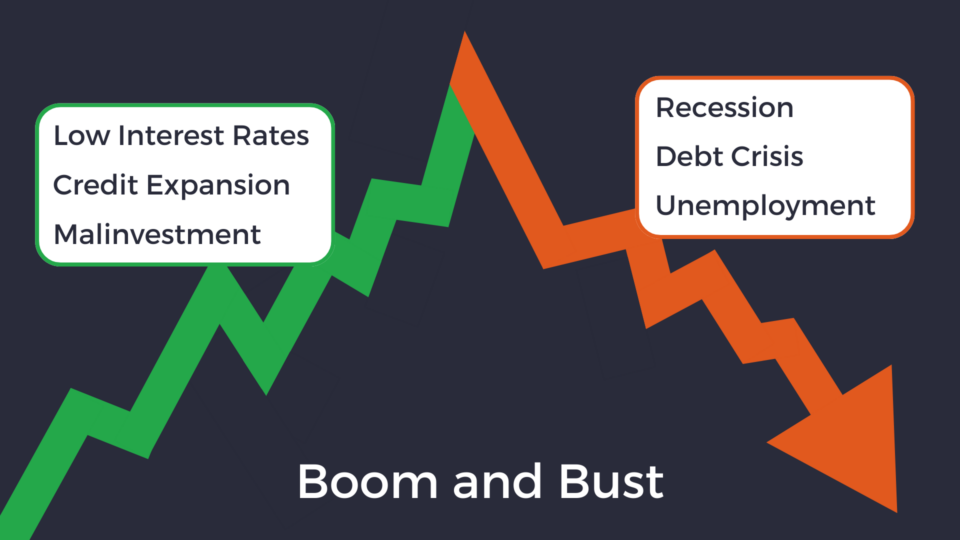

Economic crashes begin with artificially low interest rates and credit expansion which lead to a misallocation of resources, inevitably culminating in a recession.

What Causes the Economy to Crash?

Every economic crisis is unique, although they do follow an underlying logical structure. We must first understand how interest rates coordinate resource allocation decisions (production, investment, and consumption) between the present and future.

Then, we can grasp the dangers of interest rate manipulation. When a central bank artificially lowers interest rates, it distorts market signals and leads to an unsustainable boom followed by an inevitable market crash.

How Prices Work

In a market economy, prices tell economic participants how to properly allocate scarce resources.

For example, if the price of tables rises:

- Producers shift resources from goods with less demand (chairs, for example) toward building more tables.

- Investors are incentivized to allocate capital to table-making enterprises.

- Consumers tend to buy fewer tables.

Most economists agree that the government should not interfere with the prices of goods and services. Artificially manipulating prices upsets the highly complex, integrated communication process between market participants, creating harmful surpluses and shortages.

And yet, manipulating the most important price in the entire market economy remains a cornerstone of modern economics.

I am, of course, referring to interest rates: also known as the price of time.

Instead of telling us how to allocate resources between tables and chairs, interest rates tell us how to allocate resources between present and future.

Understanding Interest Rates

People with money have two choices: 1) spend, or 2) save.

A higher savings rate indicates a willingness to defer consumption. If a consumer believes some of his money can be better utilized in the future, he will save it.

That’s where the interest rate comes in. Interest rates originate from how different individuals value present consumption against future consumption.

Let’s say you value $100 today the same as $101 one year from now, and I value $100 today the same as $120 one year from now. We would both be happy if you loaned me $100 at a 10% interest rate.

The loan market plays a very important role in forming mutually beneficial arrangements between lenders (those who prefer to save) and borrowers (those who prefer to spend). The interest rate is the reward a saver earns for loaning out their money. From the borrower’s perspective, the interest rate is the cost to borrow money.

Banks serve as operators in the loan market. They are responsible for connecting savers who want to lend and debtors who want to borrow.

The Market Interest Rate

The more people save, the more money is available for loans. Increased savings causes an increase in the total supply of loanable funds.

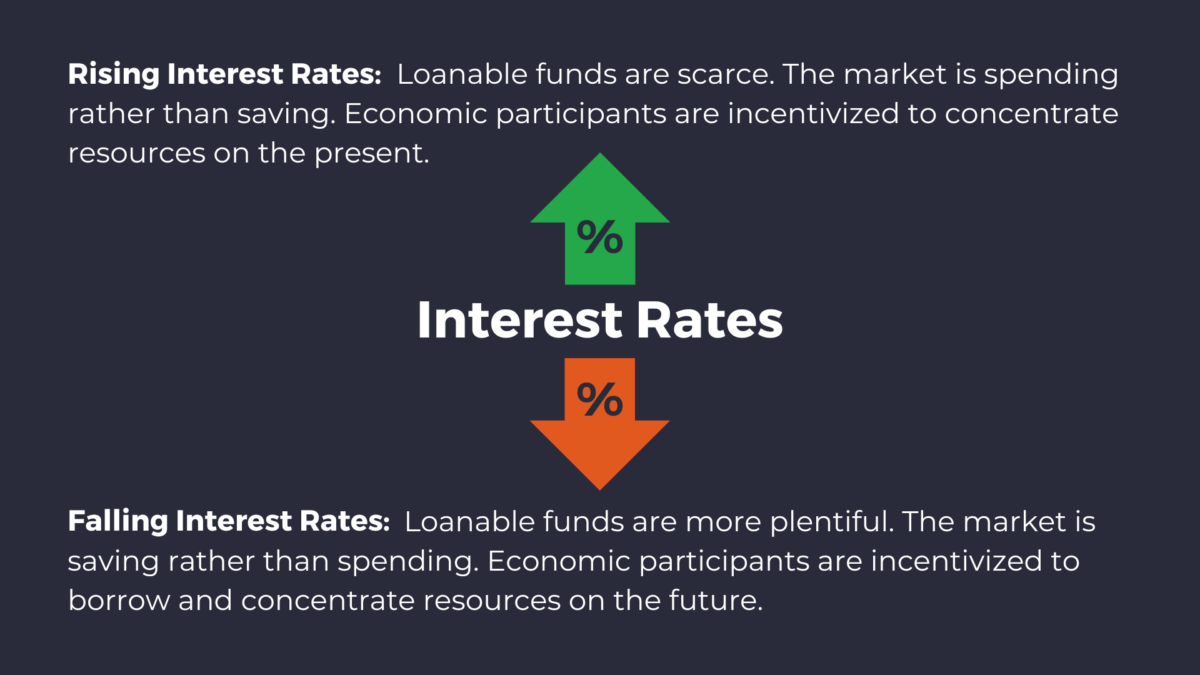

When loanable funds become more plentiful but the demand for loans stays the same, lending gets more competitive. Lenders must lower the rate of interest on their loan contracts to attract borrowers. Therefore, as people save more, interest rates fall.

When loanable funds become scarce, borrowing gets more competitive. Lenders can demand higher interest rates on their loans. Therefore, as people save less, interest rates rise.

This gives rise to the market interest rate.

(Of course, individual loans have different interest rates depending on the borrower’s default risk, the length of the loan, inflation expectations, etc. All interest rates in a pure market economy tend toward a market-clearing level after adjusting for these factors, where supply and demand are balanced.)

Resource Allocation in the Market Economy

Just like all prices, the market interest rate sends an incredibly important signal.

Interest rates help entrepreneurs and investors determine whether consumers are saving or spending: in other words, how they are allocating their purchases between the present and future.

Falling interest rates mean people are more interested in spending than saving. Rising interest rates mean people are more interested in saving than spending.

This signal helps entrepreneurs and investors allocate resources in a way that matches present and future consumption preferences.

If people are deferring consumption, that means they plan to spend money in the future. When businesses observe falling interest rates, they know they need to concentrate resources on future production to meet future demand. They will be able to borrow money at a cheaper rate, which will provide the funds required for new factories and new technology. Investors will also notice the falling interest rate and focus their capital on future-oriented businesses. They will earn a lower interest rate on bonds, and therefore deploy their capital toward equities (technology stocks, for example). Consumers will be encouraged to borrow and spend. Prices and asset valuations will rise.

When interest rates increase, businesses know the spending is happening now. They will be disincentivized from borrowing money, and therefore focus on current production. Investors will direct their capital toward bonds, which earn a higher rate of interest. Consumers will be discouraged from borrowing.

A simple interest rate adjustment from 3% to 3.5%, or vice versa, sends all these signals and more.

The Profit Motive

It is important to realize that economic participants do not need to consciously recognize the significance of the market interest rate for it to properly influence resource allocation decisions. The entrepreneur does not need to observe a falling interest rate and think, “oh look, this means consumers are deferring consumption — I had better invest in a new factory so I can meet all the future demand!”

When the interest rate is allowed to freely adjust on the market, it automatically encourages proper resource allocation. When the interest rate falls, the entrepreneur will invest in the new factory because it becomes profitable to do so. Entrepreneurs are constantly evaluating input costs and potential profits associated with new lines of production. Some business plans which were not economically feasible when the interest rate was 5% become feasible when the interest rate falls to 1%.

The profit motive encourages entrepreneurs to serve the most urgent needs of consumers. If consumers want factors of production to be concentrated toward the future rather than the present, the interest rate will automatically make it more profitable to do so (and vice versa).

Ah yes, the invisible hand at work.

Interest Rate Manipulation

If the interest rate does not reflect true consumption preferences, economic participants cannot properly allocate resources between the present and future.

If interest rates are artificially low, businesses, consumers, and governments will borrow too much money. Debt levels will increase to prepare for future spending, which never arrives. Scarce resources which should be concentrated on the present are concentrated on the future. Investors pour their capital into future-oriented businesses. Unnecessary factories are constructed; unnecessary technology is developed. Stock valuations soar on false promises of future demand. The economy grows extremely fast, but future demand does not justify this growth.

If interest rates are kept artificially high, resources which should be concentrated on the future are concentrated on the present. The economy is unprepared for future demand.

But how does this happen?

When allowed to adjust freely, interest rates will self-correct, just like all prices in a market economy. Only the government possesses the authority to interfere with this process. In fact, this is the primary responsibility of modern central banks.

When a central bank artificially adjusts interest rates, it pulls them away from their market-clearing level. Calculating the natural rate of interest is impossible without direct input from market participants.

The Boom and Bust Cycle, Explained

Central banks tend to keep interest rates artificially low. This encourages borrowing and stimulates economic growth. Stocks perform well. Consumers and businesses, flush with borrowed cash, go on a spending spree. In the minds of economic participants, future demand justifies the money supply growth and snowballing valuations.

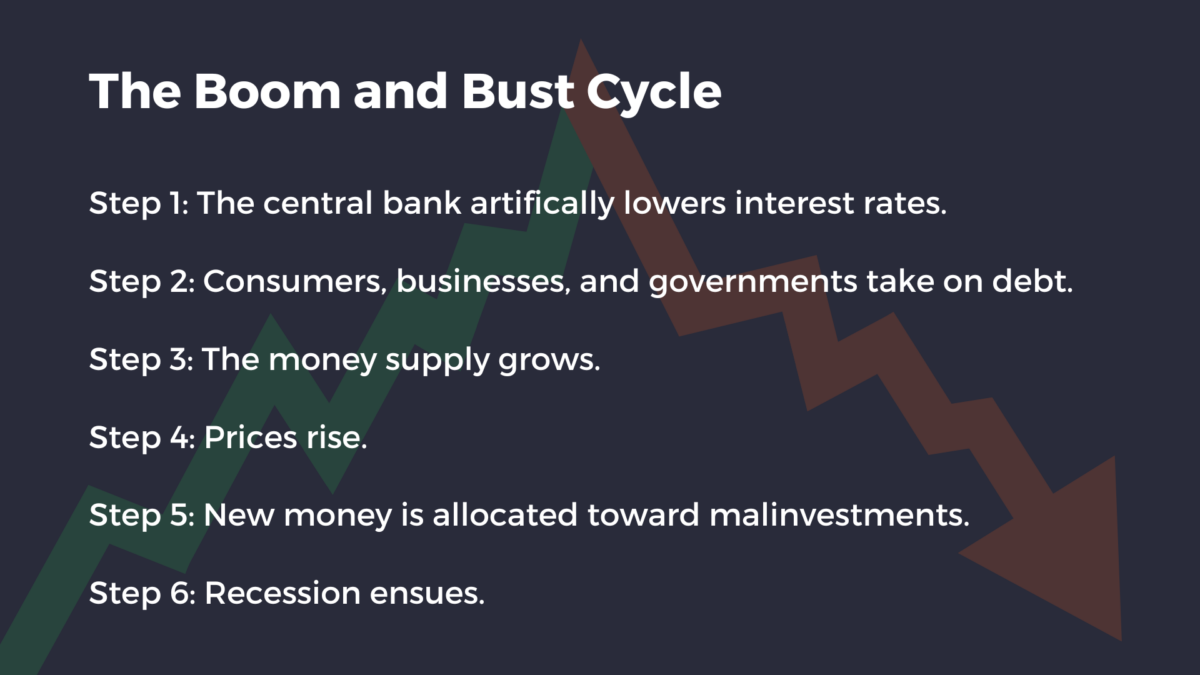

The pattern goes something like this:

Step 1: The central bank artifically lowers interest rates.

The Federal Reserve lowers interest rates by purchasing government bonds in the open market (a process known as Open Market Operations). This increases the supply of reserves in the banking system, thereby making loanable funds more plentiful. This decreases the Fed Funds Rate – the interest rate at which banks can lend reserves to other banks.

The Fed Funds Rate is a benchmark for the whole economy. By targeting a lower Fed Funds Rate, the Fed also puts downward pressure on bond yields, credit card rates, and mortgage rates.

Step 2: Consumers, businesses, and governments take on debt.

They can borrow at a cheaper rate, so why not?

When people take on debt and spend borrowed money, future spending is brought forward in time. This is a problem, because low interest rates suggest the exact opposite.

Step 3: The money supply grows.

Falling interest rates trigger credit expansion. When banks extend loans, they increase the amount of money in circulation.

Step 4: Prices rise.

Prices can rise either in the form of consumer inflation (rising costs of goods and services) or asset appreciation (rising stock, bond, and/or housing prices).

By artificially lowering the cost of borrowing money, the central bank ends up raising the price of everything else. This leads to a credit-induced boom, where economic growth exceeds what is justified by future demand.

Step 5: New money is allocated toward malinvestments.

Malinvestments occur when capital and resources are poorly allocated because of a false signal given by an artificially low interest rate.

For example, if a car company expects massive demand in the future, they may take out a loan and begin construction on a factory that takes 5 years to build. They spend the borrowed money on land, materials, architects, and contractors. They hire new employees and construct optimistic business plans in preparation for the influx of spending. But the spending never comes. The interest rate gave a false signal, and now the company is riddled with debt and owns an unprofitable factory.

This happens all over the economy. Entrepreneurs and investors are willing to take extreme risks during the boom period because everyone believes the boom will last forever. Ballooning money supply and increased consumer spending, which has been artificially shifted toward the present, only confirms their hypothesis.

Unfortunately, the boom cannot last forever. Governments, corporations, and consumers are all left holding the bag (of debt, that is).

Step 6: Recession ensues.

Eventually, investors and entrepreneurs come face-to-face with their malinvestments. Ventures that appeared profitable during the boom period suddenly go under. Businesses are forced to restructure and adapt to lower demand, which typically involves laying off employees and selling assets. Unemployment rises; GDP falls.

Here, central banks have a choice. Either they allow the economy to painfully self-correct, or they simply print more money.

Of course, when the central bank responds to the recession with more money printing and interest rate cuts, they restart the entire process. They perpetuate the false signals by creating demand out of thin air, which only reinforces malinvestments.

And so, the cycle continues. Every time the central bank tries to raise interest rates, the malinvestments become unprofitable, the economy hits a rough patch, and policymakers capitulate. Over time, the economy grows increasingly dependent on fresh injections of liquidity and ever-cheaper debt.

How to Avoid the Crash

No one knows when exactly the bust will hit, how long it will last, or how severe it will be.

We do know that malinvestments will occur because economic participants are functioning on faulty signals. In the late 1990’s, easy money found its way into technology stocks, precipitating the dot-com bubble. In the early 2000’s, easy money found its way into real estate, precipitating the 2008 Global Financial Crisis.

As we approach the next recession, we will face the consequences of malinvestments that have accumulated over decades of easy money. The trillions of dollars created in the aftermath of the GFC and COVID-19 have have incentivized excessive borrowing, speculative investments, inflated asset prices, and misallocation of capital into “zombie companies”.

While individual investors cannot prevent the next recession, they can take proactive steps to prepare their investment portfolio. We hope Vaulted can be part of your solution.

Secure gold savings, without the excess fees

Vaulted allows you to own physical gold and silver at the best cost structure in the industry. You own segregated, serial-numbered bars, stored in the most secure vaults in the world. You can take delivery of your gold on demand.

As always, thank you so much for reading – and happy investing!