Because the entire global financial system was built on gold. Today, the gold price sends important signals about the economic health of the world’s most powerful nations.

If you want to understand the financial markets, you could track the S&P 500 and Dow Jones like everyone else. However, if you want to gain an edge, you might try following gold.

Why?

Because throughout much of human history, “gold” and “money” were synonymous.

The United States, United Kingdom, Japan, China, France, the Netherlands, Australia, and Germany all rose to prominence in the 19th/20th centuries on the gold standard. Long before that, the Romans, Greeks, and Egyptians used the illustrious yellow metal as money. We track the gold price today because it reveals truths about the global monetary system that would otherwise remain invisible.

Gold is a currency. It is decentralized, which means it carries no geopolitical risk. It is intrinsically valuable. It cannot be printed or inflated. These features make it an excellent benchmark for the dollar, euro, yuan, and other currencies that do not share these features.

What does gold tell us?

The gold price sends several important signals:

- Geopolitical risk (a rising gold price can signal heightened risk of war, trade tensions, and political instability)

- Economic sentiment (a rising gold price can signal deteriorating trust in central bankers, as well as heightened risk of inflation, debt crises, and recession)

- Currency devaluation (a rising gold price indicates a loss of purchasing power, typically because of excessive money printing)

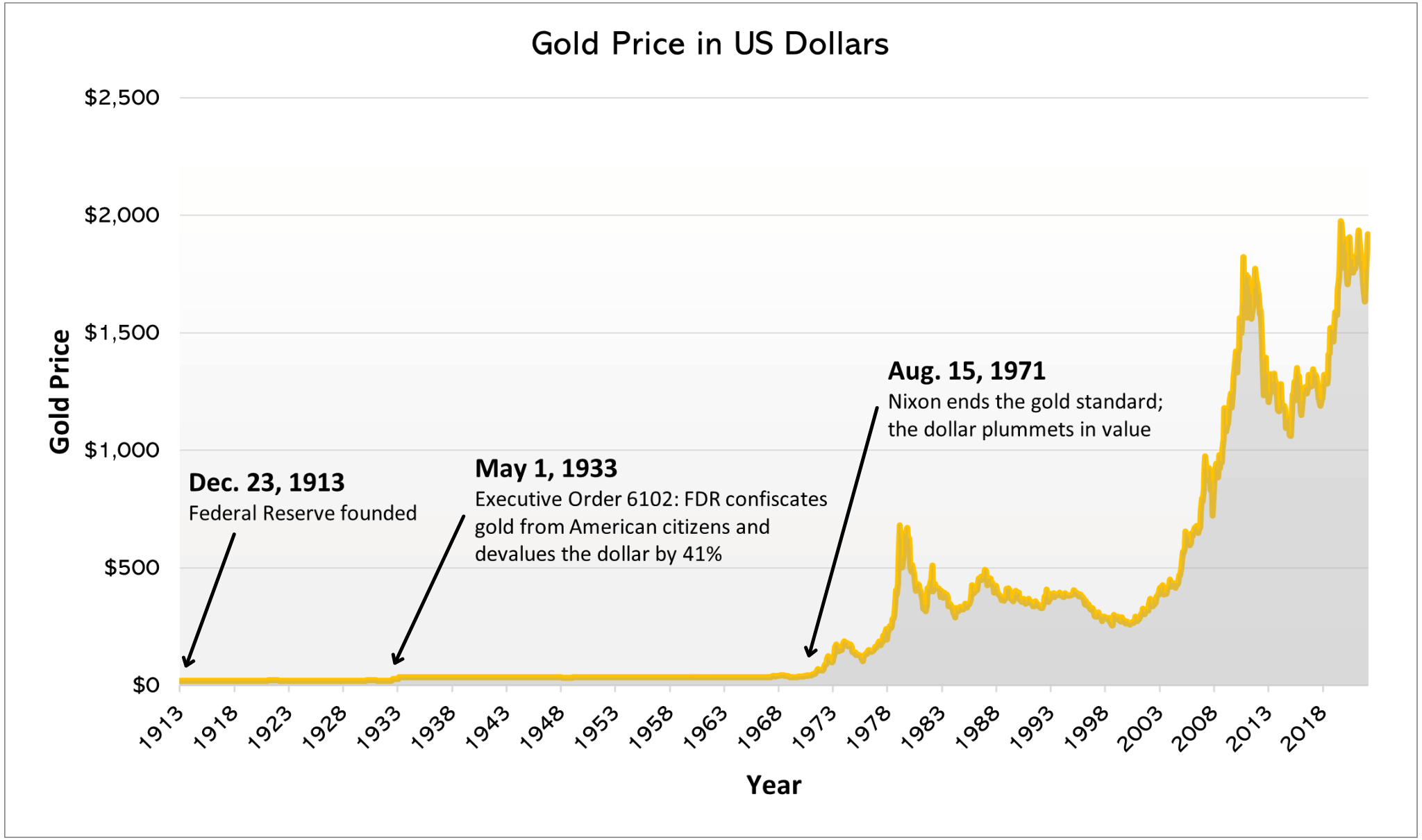

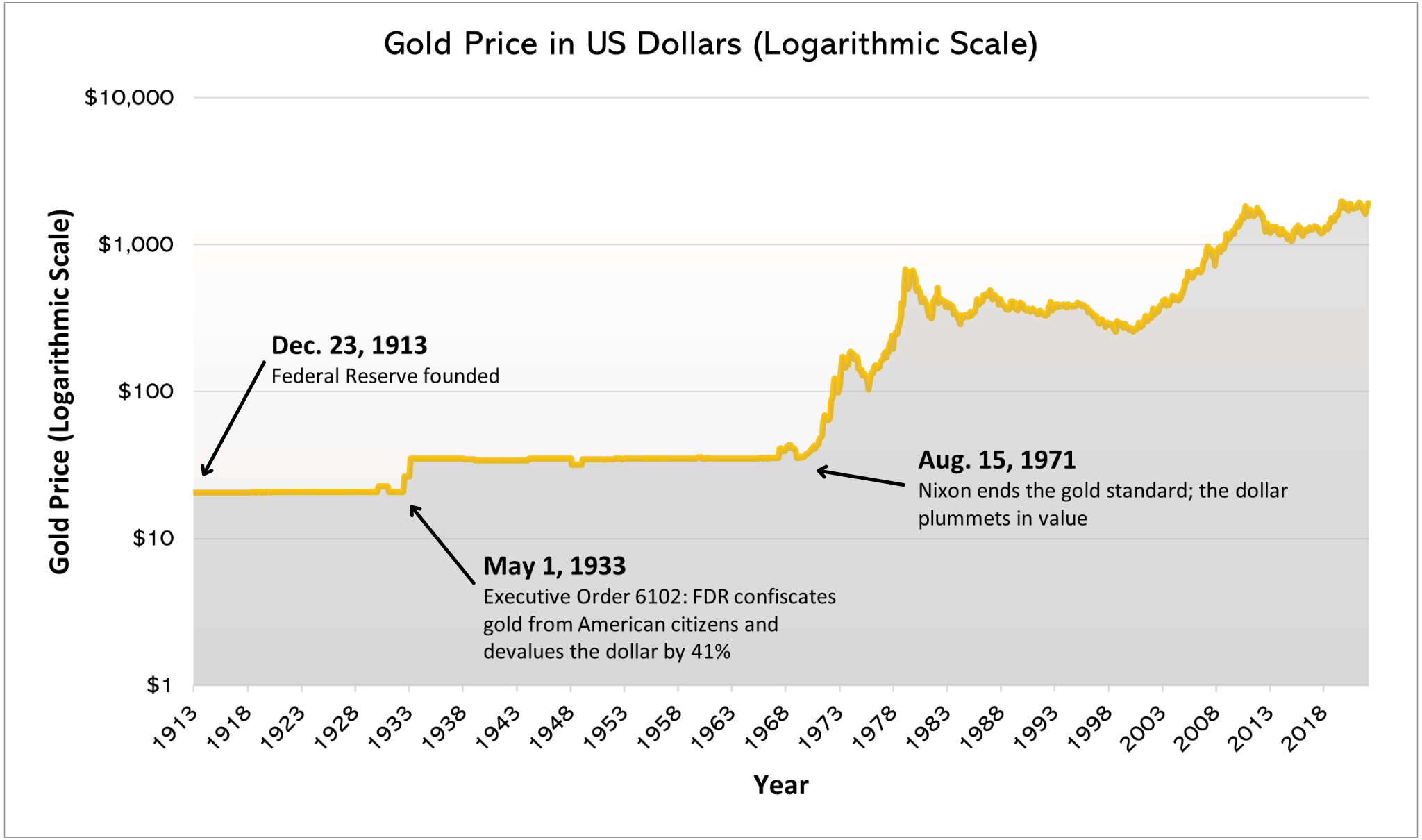

Below is a gold price chart dating back to 1913, when the US Federal Reserve was founded.

It helps to look at long-term charts on a logarithmic scale. We can see two events that caused an explosion in the gold price in the 20th century:

- Confiscation of privately owned gold during the Great Depression (Executive Order 6102)

- The end of the gold standard in 1971 (Nixon shock)

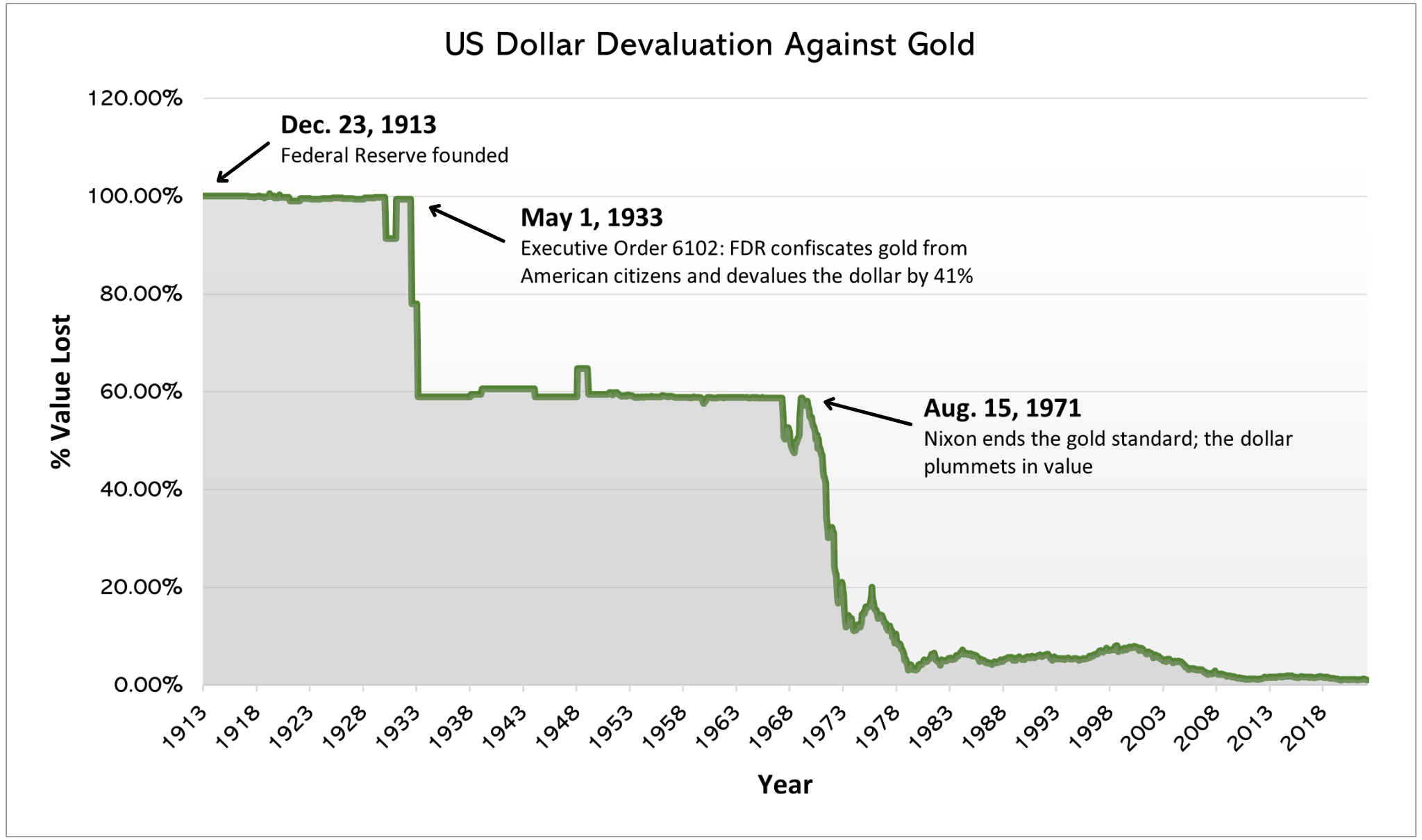

Instead of looking at gold priced in dollars, let’s look at dollars priced in gold. Gold serves as an excellent benchmark for US dollar devaluation, because they were once the same thing.

The chart below reveals the evisceration of the dollar’s purchasing power over the last century.

The dollar has lost nearly 99% of its purchasing power against gold.

How do I track the gold price?

The LBMA Gold Price is used as an international benchmark for the spot price of gold. The LBMA price is set twice daily. You can find it here.

The World Gold Council is also a great place to track the gold price and find lots of other helpful data and analysis. You can find it here.

Golden Rule Radio is an excellent YouTube show that tracks the gold price on a weekly basis. They also track silver, platinum, palladium, the US dollar index, stocks, and other charts that are helpful for understanding gold market dynamics. You can find it here.

The Vaulted app displays a chart of the wholesale gold price from 1971, which is when the United States officially dropped the gold standard. You can access your Vaulted account here.

These charts are helpful, but do not deliver a full understanding of the gold market. Tracking the price of gold is not as simple as tracking the price of a stock. Gold is mined on every continent (except Antarctica) and traded in every nation across the globe, making it difficult to pinpoint a single gold price.

Not to mention, prices vary significantly depending on the product. Small gold coins carry a higher premium than larger products, such as kilo bars.

Because of these difficulties, we highly recommend speaking to an expert before making any investment decisions. Vaulted assigns a personal advisor to every single client to help provide expert analysis and guidance. Vaulted advisors have spent decades finding entry and exit points and helping clients understand precious metals.

The Price of Gold

We hope this post helps you gain valuable insights into long-term currency devaluation, economic risk, and public trust in government-sponsored fiat currencies. If you need more information, please do not hesitate to set up a Vaulted account and contact your advisor.

As always, thank you so much for reading – and happy investing!