History, economic theory, and empirical evidence: three arguments supporting gold as the purest form of money.

In 1912, J.P. Morgan made a bold statement in his testimony before Congress: “Gold is money. Everything else is credit.”

According to former Fed chairman Alan Greenspan, “I view gold as the primary global currency. It is the only currency, along with silver, that does not require a counterparty signature.”

Ron Paul says, “Because gold is honest money, it is disliked by dishonest men.”

There is even a book on the subject.

But what do these quotes mean? No one shows up at the grocery store holding gold coins…we use green pieces of paper and plastic cards. So why do people say “gold is real money”?

Reason #1: Gold matches the core characteristics of “money” better than any other commodity or currency.

Money has taken many forms throughout history. The ancient Egyptians used grain and cloth. The Romans used precious metals, salt, and leather. Tribes in West Africa and Oceania used cowrie shells. Settlers and indigenous tribes in colonial America used tobacco.

This raises the question: What is money?

The historical record proves that money is not a specific thing, but rather a set of characteristics:

- Marketability (easily exchanged at the highest market rate)

- Divisibility (easily split up to pay for things)

- Scarcity (limited supply = higher exchange value)

- Credibility (widely accepted)

- Portability (easily transported from the buyer to the seller)

- Durability (ability to withstand pressure or damage)

When a good or commodity meets these characteristics, people are more likely to use it as a store of value and medium of exchange.

But we still must confront the question: Where does money get its value?

We will use cowrie shells for this demonstration, although all forms of money earn their designation in the same way.

First, someone decides to exchange the good in question with another good (let’s say, 10 cowrie shells for one apple), because they expect more utility from the apple than the cowrie shells. This establishes a price for both goods: One cowrie shell costs 1/10th of an apple; one apple costs 10 cowrie shells.

Other economic participants establish their own exchange ratios when they expect some utility from cowrie shells (perhaps they would like to make a necklace). As supply and demand meet, a consistent market exchange ratio begins to emerge. Economists call this the market-clearing price.

At some point, a savvy tradesman realizes that cowrie shells hold their value pretty well. He trades some apples (or legal services, or books, or semiconductors, or whatever else he produces) to acquire cowrie shells not for their direct utility, but for the purpose of reselling those shells for something else he desires.

This step represents an evolution beyond the barter system. As more producers do this, market demand for cowrie shells increases. Notice this is an entirely different type of demand than what originally made the shells valuable. Before, people were only acquiring shells for their direct utility. Now they are acquiring them as a medium of exchange and store of value.

As market demand rises, more people start collecting cowrie shells and selling them into the market. Marketability and credibility rise, solidifying the shells’ position as “money.”

And voila! We have a functional currency.

How Gold Became Money

As the global economy grew and intertwined, economic participants converged on the good that best represented the core characteristics of money.

Gold is portable, divisible, scarce, and saleable across time and space. It is mined on every continent (except Antarctica), and has excellent industrial applications due to its conductivity and resistance to corrosion. Gold’s physical beauty made it a universal symbol of prosperity.

These characteristics helped gold crush its competitors. Salt, leather, tobacco, cloth, grain, land, cattle, and cowrie shells simply could not keep up with the demands of a modern economy.

It is important to realize that we will never discover another element which can challenge gold. The periodic table is complete. Of all the physical materials on earth, none meet the characteristics of money as well as gold (although silver, platinum and palladium are the closest).

Legal Tender

Many people assume that gold became money through government decree. The truth is the exact opposite. Governments tied their currencies to gold because gold already met the characteristics of money. The metal already had well-established exchange ratios with goods and services all over the economy, which would have been impossible for a centralized authority to fabricate.

When a government elevates a certain good to the status of “legal tender,” economic participants must acquire the good to pay taxes and settle debts. However, a legal tender designation does not automatically bestow “moneyness” onto something. It may encourage citizens to accept the currency as a medium of exchange, but without the other characteristics of money, the currency is doomed to failure.

Consider the record of hyper-inflated fiat currencies: The German Papiermark, Hungarian pengő, Yugoslav dinar, Argentine peso/austral, Zimbabwean dollar, Greek drachma, Peruvian inti, and Angolan kwanza all had legal tender status, which did nothing to save them when economic participants lost trust in the currency.

Gold bestowed the status of “money” upon the US dollar, British pound, and other government currencies – not the other way around.

Reason #2: Human civilizations repeatedly selected gold as the purest form of money.

Now that we conceptually understand what money is and how it emerges, let’s examine the historical events surrounding gold’s ascendance.

Gold in the Ancient World

The link between gold and money can be traced back to the roots of human civilization. The earliest primary source to mention gold as a medium of exchange is the Code of Hammurabi, an ancient Babylonian legal code recorded on a 7-foot tall basalt slab around 1700 BC.

Law 198 states: “If he puts out the eye of a freed man, or breaks the bone of a freed man, he shall pay one gold mina.” (The mina is one of the earliest known units of weight and currency.)

We see hundreds of references to gold in the Vedas, a collection of religious texts composed between 1500 and 900 BC in Ancient India.

Gold also appears throughout the Old and New Testaments of the Bible, playing an especially important role in the Book of Exodus (written in the 6th century BC).

Greek historian Herodotus wrote about gold currency in Lydia (modern-day Turkey), Egypt, and Persia. The Lydian Empire was the first to mint an official gold coin, known as the Stater, between 619-560 BC. The Stater was stamped with the image of a roaring lion.

From the 1st century AD onward, every prominent civilization adopted gold coins as its primary form of money. The Roman Empire had the Aureus; Islamic Empire, the Dinar; Byzantine Empire, the Solidus; Republic of Venice, the Ducat; Spanish Empire, the Escudo and the Doubloon.

International Gold Standard

The metal really took hold as a global currency during the Age of Exploration in the 15th and 16th centuries. As explorers established new trade routes and connected Europe with distant lands, gold’s universal recognition made it the most valued commodity for global trade.

During the 19th century, nearly all developed economies pegged their national currency to gold. The British pound, US dollar, German mark, French franc, Swedish krona, and Japanese yen all had different names, but were essentially just gold substitutes. The international gold standard helped stabilize national economies and facilitate trade between them.

The era of sound money under the gold standard ushered in unprecedented technological innovation and economic development. We got the internal combustion engine (1872), telephone (1876), steam turbine (1884), automobile (1885), radio (1895), airplane (1903), and dozens of other life-changing inventions. Kerosene lamps turned into electric light bulbs. Horse-drawn carriages turned into cars, trains, and trolleys. Agricultural technology released millions of farmers from the burden of manual labor.

Merits of the Gold Standard

Of all the things that can destroy a civilization, there are really only two that demand our attention: war and flawed economics.

The gold-based monetary system is not perfect, but it does succeed in hedging against these two detrimental outcomes. Warmongering governments hate the gold standard, because they cannot recklessly print money to pay for guns, bombs, and armies. Instead, they must raise money directly through taxation. The gold standard also prevents politicians from acting on ideas like “printing money makes everyone richer” – perhaps the greatest economic fallacy of all time which we cannot seem to squash.

In the words of Nobel Prize-winning economist F.A. Hayek: “With the exception only of the period of the gold standard, practically all governments of history have used their exclusive power to issue money to defraud and plunder the people.”

Unfortunately, during the 20th century, the warmongers and money printers won. For that reason, the gold standard was destined for a short life.

To better understand the rise and fall of the US gold standard, check out this article: History of the Gold Standard in America

The World Wars

During World War I, European nations abandoned the gold standard to finance the war effort. Extreme debt levels and trade deficits throughout Europe made it impossible to re-establish a stable gold standard after the war.

In the early 1920s, excessive money printing gave rise to history’s most infamous case of hyperinflation: The Weimar Republic. As we now know, the economic devastation in post-WWI Germany pushed the population to the edge of despair and resentment, which left the nation vulnerable to Hitler’s fanaticism.

It is relevant here to highlight Hitler’s thoughts: “Gold is not necessary. I have no interest in gold. We’ll build a solid state, without an ounce of gold behind it. Anyone who sells above the set prices, let him be marched off to a concentration. That’s the bastion of money.”

“Demonetizing” Gold

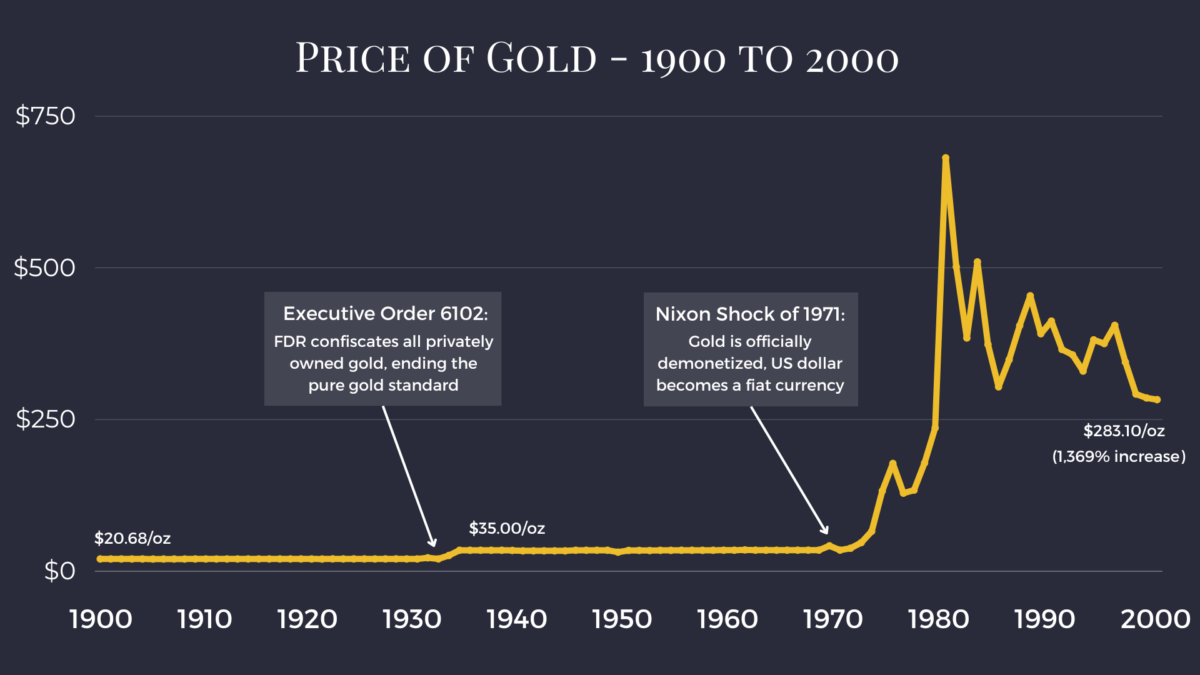

The Great Depression was the final nail in the coffin. Governments decided the gold standard was too restrictive, and abandoned it to allow themselves the freedom (or tyranny) of the printing press. On May 1st, 1933, President Franklin D. Roosevelt signed executive order 6102, which required all US citizens to sell their gold holdings to the government. After confiscating the gold, he raised the gold price from $20.68/oz to $35/ounce, effectively devaluing the dollar by 41%.

In 1971, President Richard Nixon officially ended the dollar’s convertibility to gold. From that point on, all major currencies were considered “fiat” – backed by public trust in the governments that print them. (For more on this question, check out What Backs the US Dollar?)

So, after thousands of years as humanity’s primary form of money, gold lost its seat on the throne…

Or did it?

Gold’s demonetization may actually prove, rather than disprove, that gold is money.

Reason #3: Gold’s value did not fall when it was demonetized; it skyrocketed.

When a commodity is used as a medium of exchange, it has two sources of demand.

The first is production/consumption demand. This demand stems from the commodity’s direct utility for producers and consumers, including all industrial applications. Typically, commodity prices are dominated by their production/consumption demand.

The second is money demand. Money demand stems from people using the commodity as a medium of exchange. As a commodity is gradually adopted as a form of money, more of the commodity’s demand stems from the desire to use it to acquire other goods. To buy the goods they want, people must first acquire the commodity. This boosts the commodity’s exchange value.

When a commodity is demonetized, and is therefore no longer used as a medium of exchange, it loses the second source of demand. Therefore, demonetization necessarily causes a collapse in the commodity’s exchange value, other things being equal.

This has been true for the hundreds of commodity-based mediums of exchange throughout history (shells, stones, beads, cattle, etc).

Demonetization and Collapse of Silver

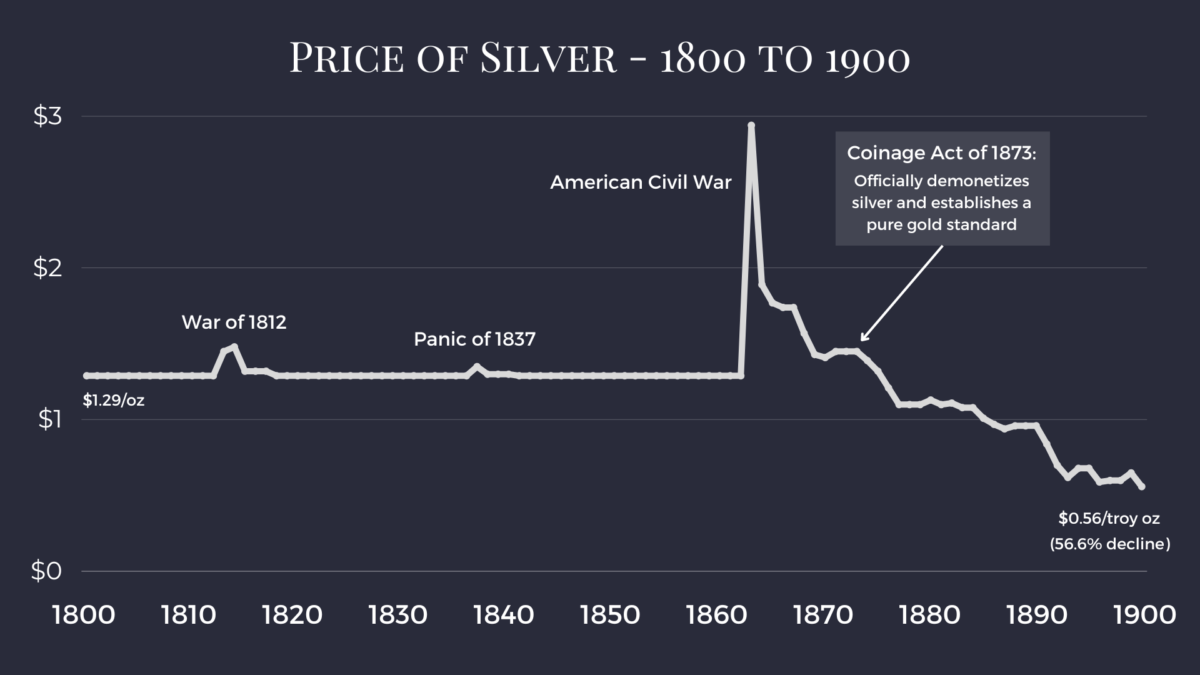

We can clearly observe this demonetization effect in the price of silver in the 19th century. Up until the 1870s, nearly all developed economies functioned on a bimetallic standard.

When Otto von Bismarck united Germany in 1871, the new German Empire replaced its multiple silver-based currencies with a unified gold backing. As a result, the price of silver began to collapse, pressuring France, Belgium, Italy, Switzerland (the Latin Monetary Union), Denmark, Sweden, Norway (the Scandinavian Monetary Union), the Netherlands, the United States, and other nations to follow suit.

President Ulysses S. Grant officially demonetized silver with the Coinage Act of 1873, which ended the bimetallic standard in the US.

Silver Price in the 19th Century

The chart below shows the price of silver in US dollars from 1800 to 1900. For the first three-quarters of the century, one US dollar was pegged to 371.25 grains of pure silver (equivalent to 0.773 troy ounces). This equates to a silver price of $1.29 per troy ounce.

We can see three times when the silver price deviated from its official price:

- War of 1812: The US government printed dollars and took on debt to cover war expenses, pushing up the price of gold and silver.

- Panic of 1837: A financial crisis triggered a bank run. Banks ran out of precious metals, forcing them to suspend convertibility of banknotes at full face value.

- American Civil War: The US government printed its first fiat currency – the greenback – to cover war expenses. Greenbacks flooded the economy, triggering inflation and forcing the government to remove them from circulation and reinstate the bimetallic backing.

Silver plummeted after its demonetization in 1873.

We should add here that silver has made an epic comeback. Precious metals investors should absolutely own silver as a complement to gold (especially right now). For more info about the modern case for silver, click here.

Trying to Replace Gold

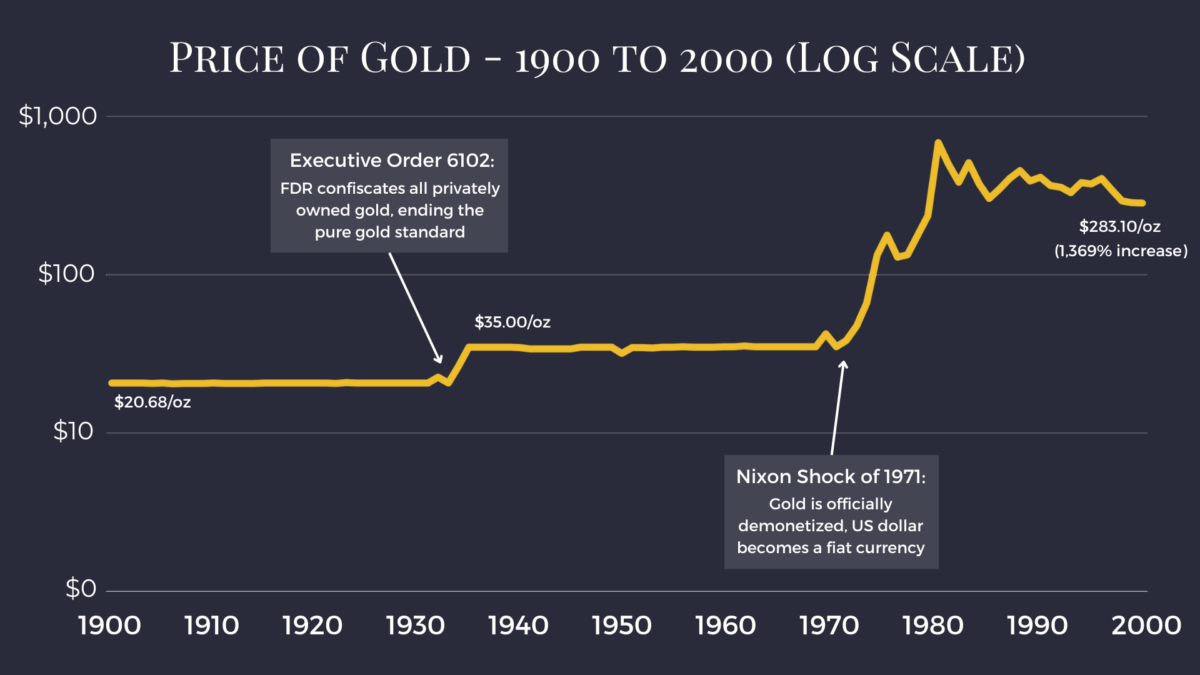

It would have been reasonable to expect the same pattern with gold in the 20th century. But instead, something curious happened. When gold was demonetized, its exchange value did not fall; it skyrocketed.

The trend is better visualized on a logarithmic scale:

We must add an amendment to the rule outlined above. Demonetization necessarily causes a collapse in the commodity’s exchange value when there is a valid replacement. In the case of gold, there was (and is) no valid replacement. If market participants had voluntarily replaced gold with cowrie shells, unobtanium, or anything else, gold’s exchange value would have collapsed. But they did not.

Fiat currencies are not a valid replacement for gold. They can mimic most of the characteristics of money: portability, divisibility, credibility, marketability – but they have no enforcement on scarcity. As it turns out, scarcity happens to be one of the most important characteristics of a functional currency.

Both major events in the demonetization of gold, FDR’s confiscation in 1933 and Nixon’s termination of international convertibility in 1971, were top-down state decisions, not decisions of the free market. These acts may have legally demonetized gold, but they did not sever the link between gold and money.

Gold’s value continues to rise even though no one uses gold coins to pay for their morning coffee. Gold appears to have no “money demand,” yet its price dynamics cannot be explained simply by its commercial applications.

Central banks still hold huge quantities of gold in their reserves. Individual investors, corporations, and investment funds purchase physical gold not to wear as jewelry, but to hedge against the recklessness of monetary policymakers.

The Great “Money Split”

In 1971, the concept of “money” was split in half. The U.S. dollar remained the world’s reserve currency and primary medium of exchange. Gold took the role of “store of value.”

We now find ourselves in quite a predicament. Since 1971, we have seen an unprecedented explosion of debt levels all over the world, surging wealth inequality, falling real wages, increased frequency of global hyperinflationary episodes, widening political division, and a destruction of the American middle class.

Of course, each disaster gives politicians more reason to increase their control over the monetary system – promising to correct the evils of their political opponents rather than confront the root problem.

How We Know That Gold Is Money

While it may not be the “perfect” form of money, gold is the best we’ve got. Investors’ and central bankers’ affinity for the illustrious yellow metal continues to prove this fact.

To review, here are the three reasons we know that gold is money:

- Economic theory: Gold matches the core characteristics of “money” better than any other commodity or currency.

- History: Human civilizations repeatedly selected gold as the purest form of money.

- Empirical evidence: Gold’s value did not fall when it was demonetized; it skyrocketed (which means removing gold’s legal designation did nothing to impact its true identity as money).

Breaking the Monopoly on Money

We launched Vaulted because we believe a failing currency threatens any free and prosperous society. The current fiat system requires an exponential increase in the purchasing power we steal from future generations. We can’t stop the government from borrowing and printing, but we can own a better form of money.

Vaulted allows you to buy physical, serial-numbered gold bars at the best cost structure in the industry. We store your metals in world-class vaults, and allow you to take delivery at any time.

We would be thrilled to welcome you into our growing investor community. Join Vaulted today and see the difference.