Because the entire global financial system was built on gold. Today, the gold price sends important signals about the economic health of the world’s most powerful nations.

Gold bugs often debate the scope and impact of gold price manipulation. Some of these accusations are absolutely true, while others enter the realm of conspiracy.

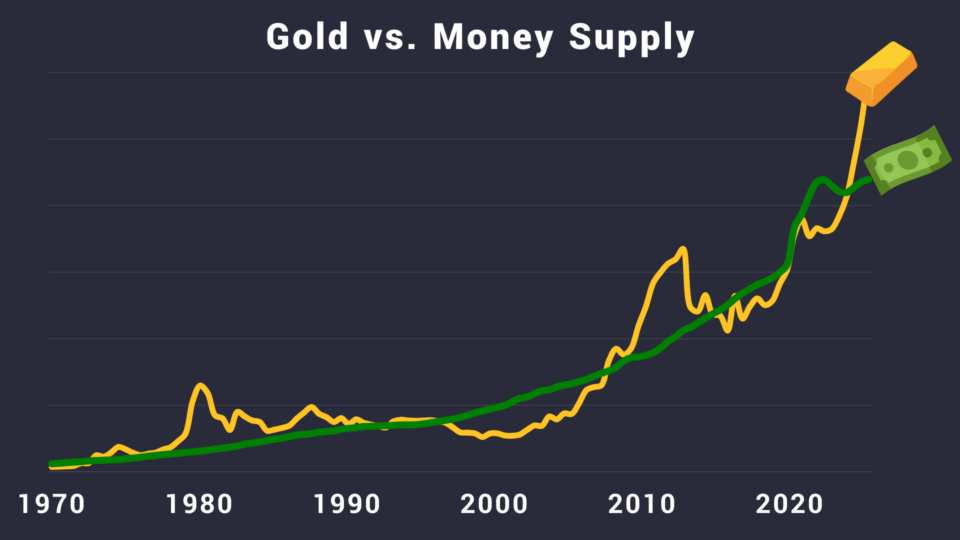

The long-term risks of quantitative easing, including eroding the credibility of the US dollar, are closely linked to gold’s performance.