Should the Fed pay attention to the IMF’s warnings about global financial risks and deteriorating market conditions? Probably, but more red-hot inflation data means their hands are tied.

Rising interest rates reveal the consequences of exorbitant debt and leverage. When the free money disappears, what remains tends to flow into real assets.

The current pace of rate hikes has no modern precedent. With recessionary red flags popping up everywhere, what will it take for the Fed to reverse course?

Inflation and money supply indicate that gold has room to run. How long can rising interest rates and dollar strength suppress the price?

Inflation has peaked, right? The stock market is certainly acting like it, but there are many reasons to believe we are not out of the woods yet.

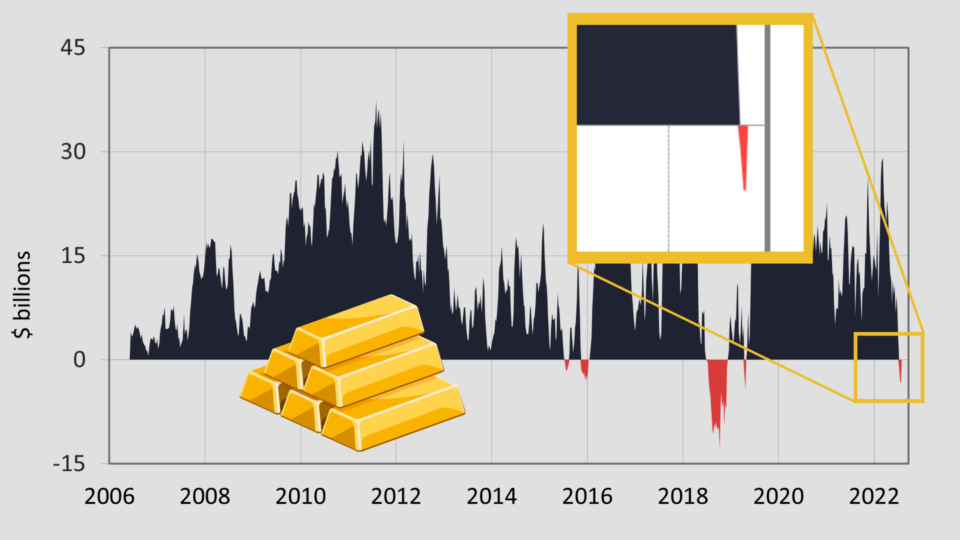

Gold bugs often debate the scope and impact of gold price manipulation. Some of these accusations are absolutely true, while others enter the realm of conspiracy.

The futures market is flashing a very clear, and very rare, signal. Gold’s jump from $1,680 to $1,800 could the be the beginning of a significant move higher. Right now, gold is still on the sale of the century.

Gold is supposed to be a reliable hedge against inflation and economic disasters, but right now it’s stuck in the mud. When will gold shine again?

Demand destruction and the growing threat of recession crushed commodities in Q2. The Fed succeeded in slamming on the breaks, but did they go too far?

Gold bull markets are correlated with secular drops in consumer sentiment. Today’s sentiment numbers will help support gold’s next move.

The long-term risks of quantitative easing, including eroding the credibility of the US dollar, are closely linked to gold’s performance.

The past few years have been a violent whipsaw of recession and inflation. If the Fed has to pick between the two, which will they choose?