Gold is putting in higher highs, signaling a bullish reversal that could finally end 2021’s short-term bear market.

Key Takeaways:

-

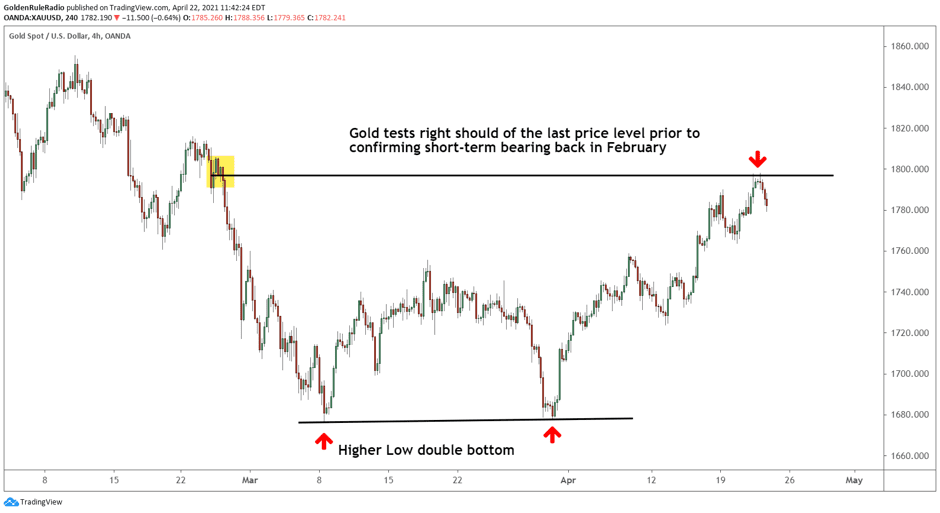

- Gold is stair-stepping toward $1,800 after hitting a double bottom in March at $1,680.

- Investors are hoping this bullish reversal marks the beginning of a continuation of gold’s third great bull market, which began in December 2015.

- Expanding federal deficits and accommodative monetary policy from the Fed are putting downward pressure on the US dollar index, which has declined 2.5% since March 31st. The declining dollar environment should continue to push gold higher.

The bullish trend holds steady

Gold tested the $1,800 price level yesterday after climbing steadily the entire month of April. In late March, gold bounced off a key level of $1,680 for the second time. Three weeks ago, we predicted this could be a double bounce that marked the bottom of gold’s short-term bear market. We are now getting confirmation of the prediction with each new rally in the gold price.

Why is $1,680 such an important price level? Gold could not break through the $1,680 floor, despite multiple attempts in March. $1,680 represents a price level where gold traders were willing to step in and purchase the metal in droves, believing that the bear market had run its course. While it is still very possible to see gold turn around again and retest the March floor, the short-term trend is certainly bullish.

Gold has retested the $1,760 line twice since the breakout last week, both times failing to push below. The upward stair-stepping pattern is a great sign for investors who entered the market in the last two months.

Has the short-term bear ended?

Gold is in the middle of its third great bull market, which began in December of 2015. At the time, gold was priced around $1,050/ounce. Last summer, gold hit an all-time peak of $2,058. Since its peak, gold has undergone a major correction back down to $1,680. Gold investors have taken a beating over the last few months as other asset classes out shadowed precious metals, but it looks like they are finally making a comeback.

Gold is now testing the 50% line from the start of the short-term bear market that began in January 2021. The .618 fib is around $1,831, so we would expect to meet resistance at this level. On the chart below, you can see where the .618 fib lines up with a few price action points as gold was moving down through February.

After pushing past $1,831, we need to get above the shelf at $1,873. If gold rises to the $1,850 – $1,900 range in the coming weeks, we will have a stronger confirmation of the bullish trend in the short term and medium term.

The US dollar continues to decline

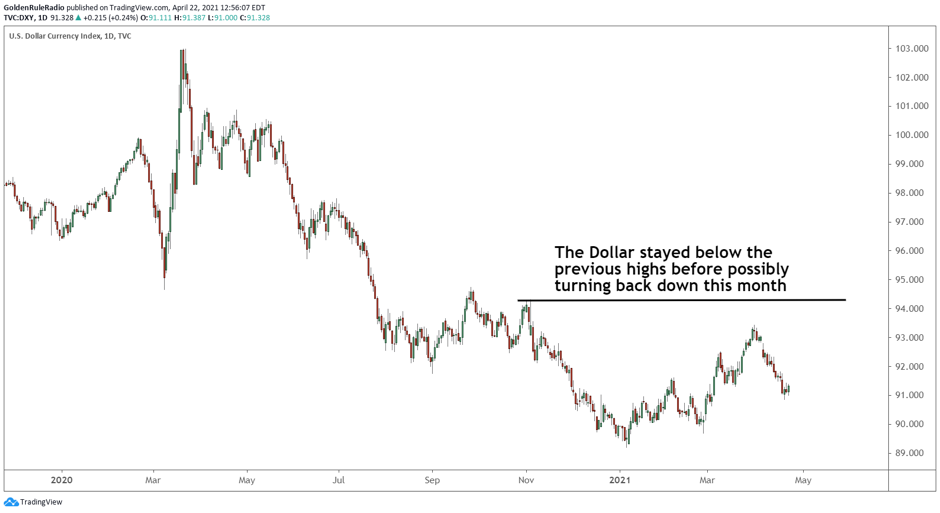

The dollar index, which measures the strength of the US dollar against a basket of other fiat currencies, declined this week to 91.1. The currency is down over 2.5% in the last three weeks. A declining dollar increases the attractiveness of gold, which is priced in US dollars. Gold should be climb as long as the declining dollar environment continues.

This year the dollar index saw a pop from 89 all the way up to 94, but we stayed pretty substantially below the mid-2020 highs around 95. Without a higher high on the chart, we will assume the long-term bearish trend will continue. The dollar hasn’t seen any real bullish action, just an expected upward correction after significant declines from last summer.

In fact, the dollar has been in a downward trend since 2017. The index failed to put in a higher high last year, sending the currency on a downward trajectory that is unlikely to end anytime soon.

Federal deficits are expanding at a record pace. The Federal Reserve is usually expected to tighten monetary policy when deficits are under pressure. However, Fed Chairman Jerome Powell has been clear in his commitment to easy money policies such as ultra-low interest rates. These pressures limit any extended dollar rally.

If bonds yields remain steady in the short term, the gold price should increase as the dollar declines. This is exactly what we’ve seen happen since last Sunday. However, if the dollar rallies and the bond rates climb further, that would put serious downward pressure on gold. Fortunately for gold investors, this hasn’t been happening. The 10-year Treasury yield topped out at 1.75% and is now down to 1.55%, removing some gold’s recent headwinds.

How should I react?

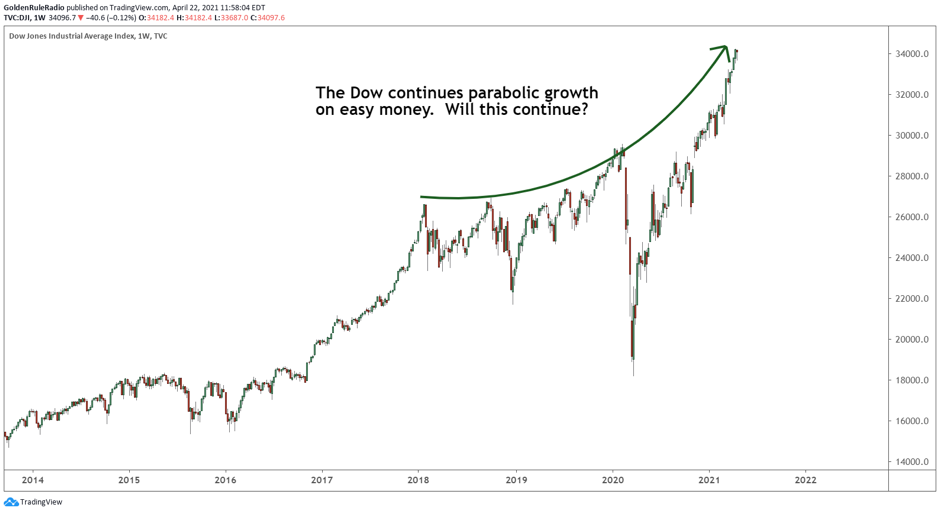

Here’s a question we should all be asking: does the Federal Reserve have enough power to overcome the natural movement of the markets? Judging by stock market performance following the COVID-19 crash a year ago, it certainly seems so. Record quantitative easing, stimulus measures, and near-zero interest rates have pushed equities markets higher than anyone ever thought possible during a worldwide pandemic. Just look at the Dow Jones performance dating back a few years:

The problem is, much of the growth has come from speculative mania, fueled by massive credit creation. Behind the soaring stock market lies ballooning budget deficits, rapidly expanding money supply, and inflationary pressures the country hasn’t seen since the 1970s. What is the catalyst that causes natural markets to overcome manipulated markets? When will these pressures finally come to fruition? Maybe tomorrow, maybe never.

Fortunately, we don’t need to predict the future. All we can do is build a diversified portfolio that is prepared for more unprecedented times that are fast approaching. Gold has withstood the test of time and has produced massive gains since trading became legal in 1971. The yellow metal is a key portfolio diversifier, perpetually maintaining its purchasing power and serving as a hedge against both inflation and deflation. Gold might not remain at these discounted prices for long, so now is the time to start investing!

If you want to leverage the world’s most trusted currency, Vaulted is the way to go. We cut out 70% of the traditional gold supply chain, which means you can own physical gold at a fraction of the cost. Vaulted helps you take control of your financial future.

Thanks for reading, and happy investing!

Login to your Vaulted account today.

Watch Golden Rule Radio for more of what’s in store for precious metals in 2021.