The current pace of rate hikes has no modern precedent. With recessionary red flags popping up everywhere, what will it take for the Fed to reverse course?

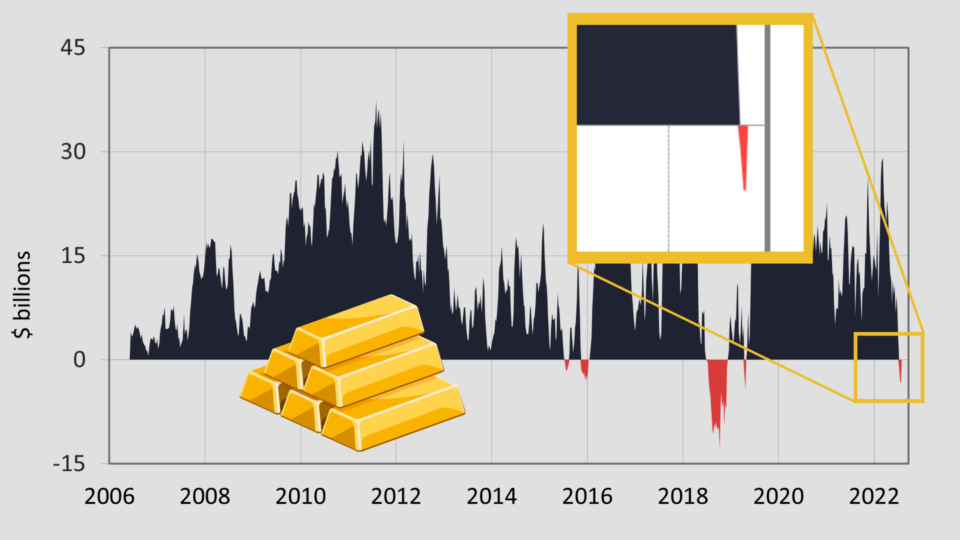

Inflation and money supply indicate that gold has room to run. How long can rising interest rates and dollar strength suppress the price?

Inflation has peaked, right? The stock market is certainly acting like it, but there are many reasons to believe we are not out of the woods yet.

The futures market is flashing a very clear, and very rare, signal. Gold’s jump from $1,680 to $1,800 could the be the beginning of a significant move higher. Right now, gold is still on the sale of the century.

Gold is supposed to be a reliable hedge against inflation and economic disasters, but right now it’s stuck in the mud. When will gold shine again?

Demand destruction and the growing threat of recession crushed commodities in Q2. The Fed succeeded in slamming on the breaks, but did they go too far?

Gold bull markets are correlated with secular drops in consumer sentiment. Today’s sentiment numbers will help support gold’s next move.

The past few years have been a violent whipsaw of recession and inflation. If the Fed has to pick between the two, which will they choose?

The stock market is a casualty in the Fed’s fight against inflation. Will the entire economy follow? If so, will the Fed make a dovish pivot?

As global food and commodity prices surge, nations are turning inward to protect their own food security. For emerging economies, inflation has a particularly nasty bite.

166 Turner Drive

Durango, CO 81303

USA

Durango, CO 81303

USA

Vaulted is backed by McAlvany Financial Group, one of the largest and longest continuously operating full-service gold brokerage firms in the United States.

© Vaulted. All rights reserved.

Vaulted is a McAlvany Financial Group company

Privacy Policy

Terms of Use

Vaulted is a McAlvany Financial Group company

Privacy Policy

Terms of Use