The futures market is flashing a very clear, and very rare, signal. Gold's jump from $1,680 to $1,800 could the be the beginning of a significant move higher. Right now, gold is still on the sale of the century.

Record Speculation on Gold

How do precious metals investors know when to buy gold? They look at many indicators, including interest rates, inflation, and stock market weakness. However, there is one extremely powerful indicator that is often ignored by the mainstream media.

Over the last 20 years, this signal has revealed opportunities and produced returns that most investors missed. So what is it?

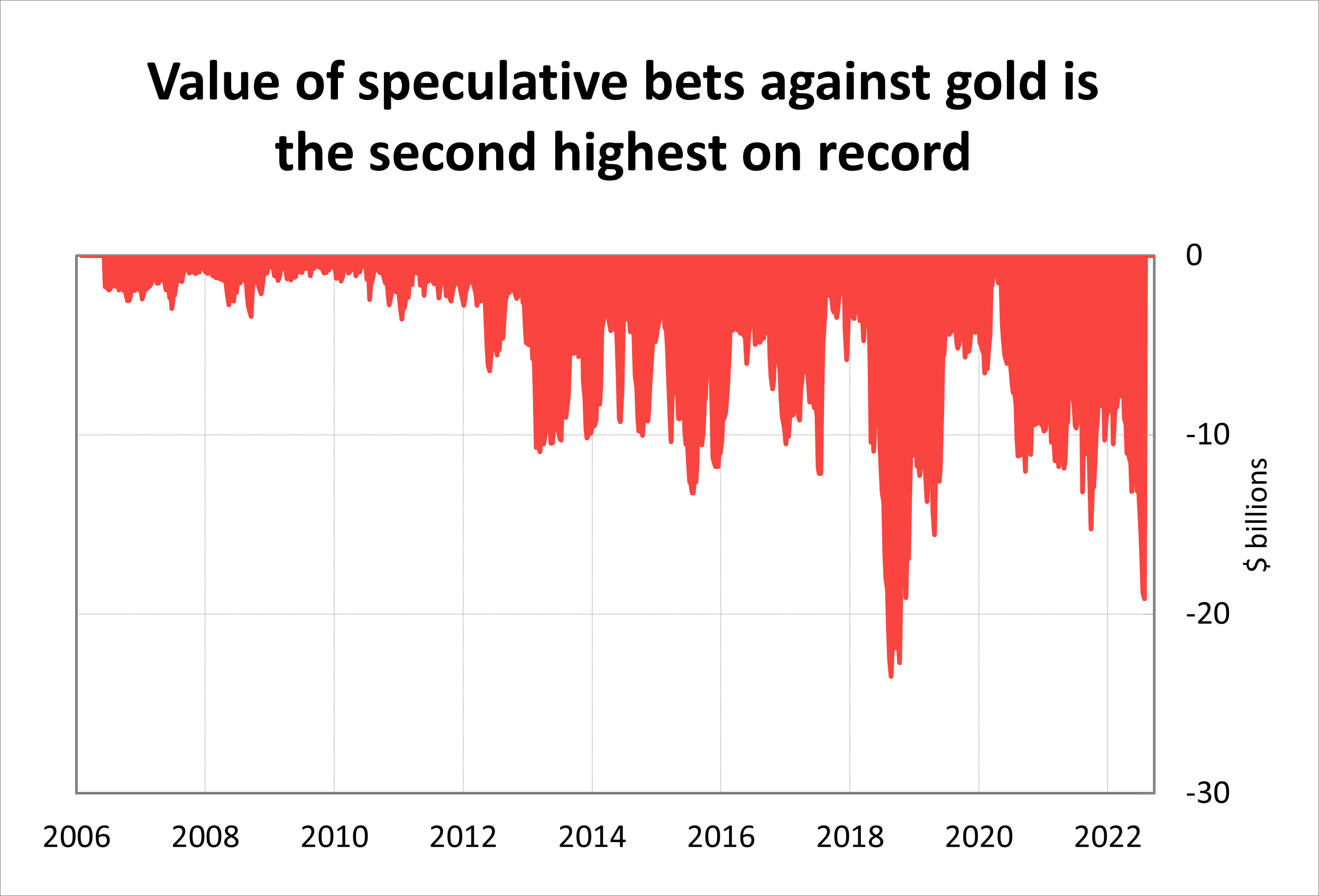

It all comes down to how professional investors are betting on the price of gold. Right now, “managed money” is aggressively betting that the price of gold will fall. In fact, the value of speculative bets against gold is at its second highest on record.

Source: CFTC

This is bad news for gold investors, right? Actually no, not at all!

This is an extremely bullish indicator for gold.

You might think you want to buy when hedge funds are betting on the price to rise. In reality, the exact opposite is true. If the historical pattern holds, we could be looking at one of the best buying opportunities in the last 20 years. This article explains why.

Why the Futures Market Matters

Every week, the Commodity Futures Trading Commission (CFTC) releases data on how managed money is positioned in the futures market. Managed money includes hedge funds, professional investment advisors, and other organizations that trade futures contracts on behalf of clients.

When trading commodity futures, an investor can be either “long” or “short.” When they are “long,” they are betting on the price of gold to rise. To do this, they lock in an order to buy gold in the future at today’s price.

When an investor is “short,” they are betting on the price of gold to fall. To do this, they lock in an order to sell gold in the future at today’s price.

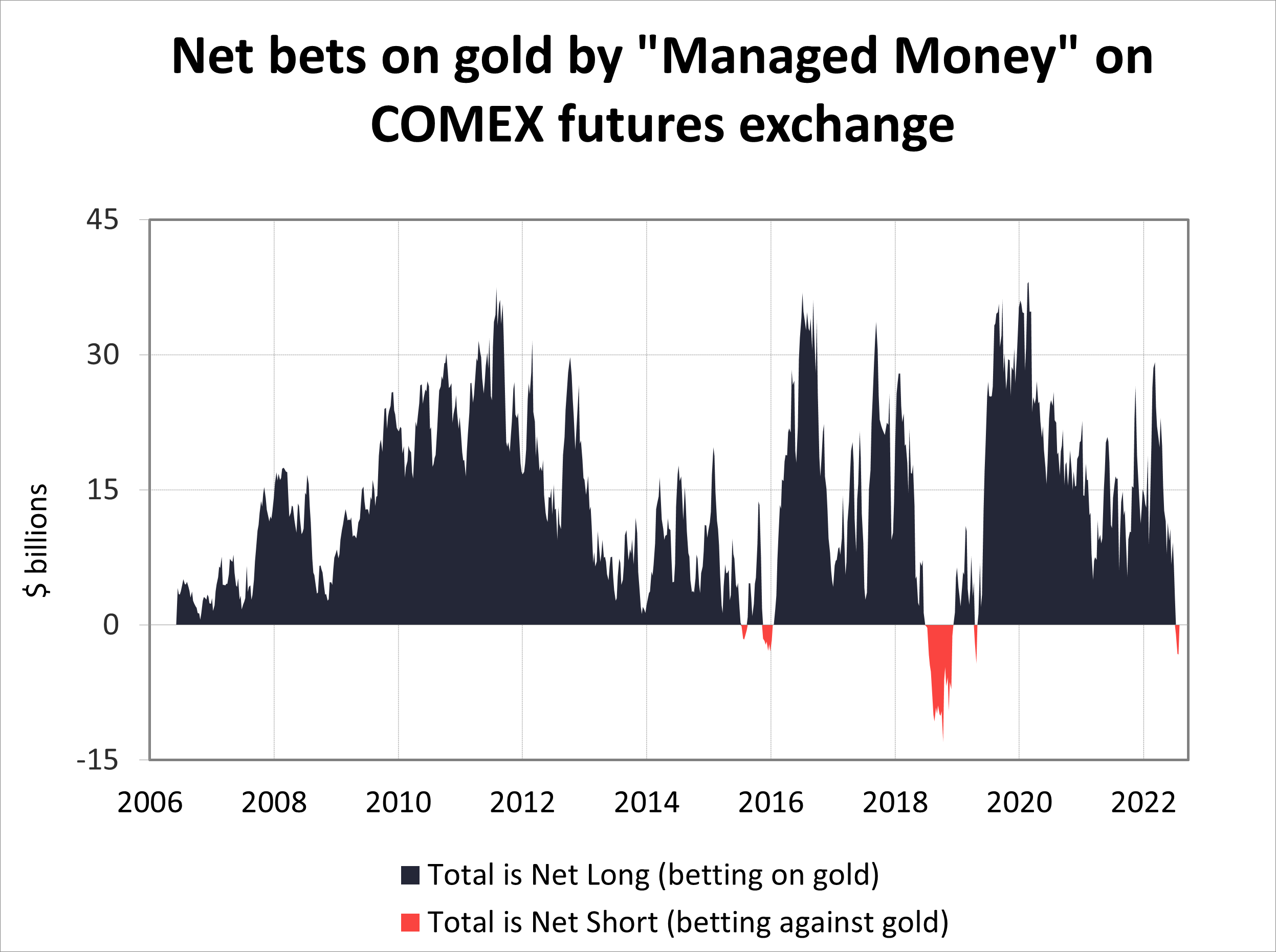

The CFTC report tells us how many “long” contracts and “short” contracts hedge funds are holding. If you subtract the number of short contracts from the number of long contracts, you get the net positioning.

You can find the latest report on the CFTC website. If that text file makes no sense, don’t worry. We’ve mapped out all the data below.

Source: CFTC

It Pays to be a Contrarian

As you can see, professional investors are net long the vast majority of the time. However, sometimes managed money goes net short. This happened in 2015, 2016, 2018, and 2019. In every case, the signal correlated perfectly with a significant trough in the gold market.

But why? When speculators lock in orders to sell gold in a few months (“short” contracts), they expect the price of gold to fall. They hope to buy the metal again at a lower price later to cover their obligations to sell. When the price stops going down, these speculators will rush to cancel their short bets. This forces them to buy gold again, which puts pressure on the price to climb.

Right now, speculators have a total of $19 billion bet against gold ($19,145,704,545 to be exact). Therefore, to cancel the total amount of short bets, speculators would need to purchase $19 billion worth of gold.

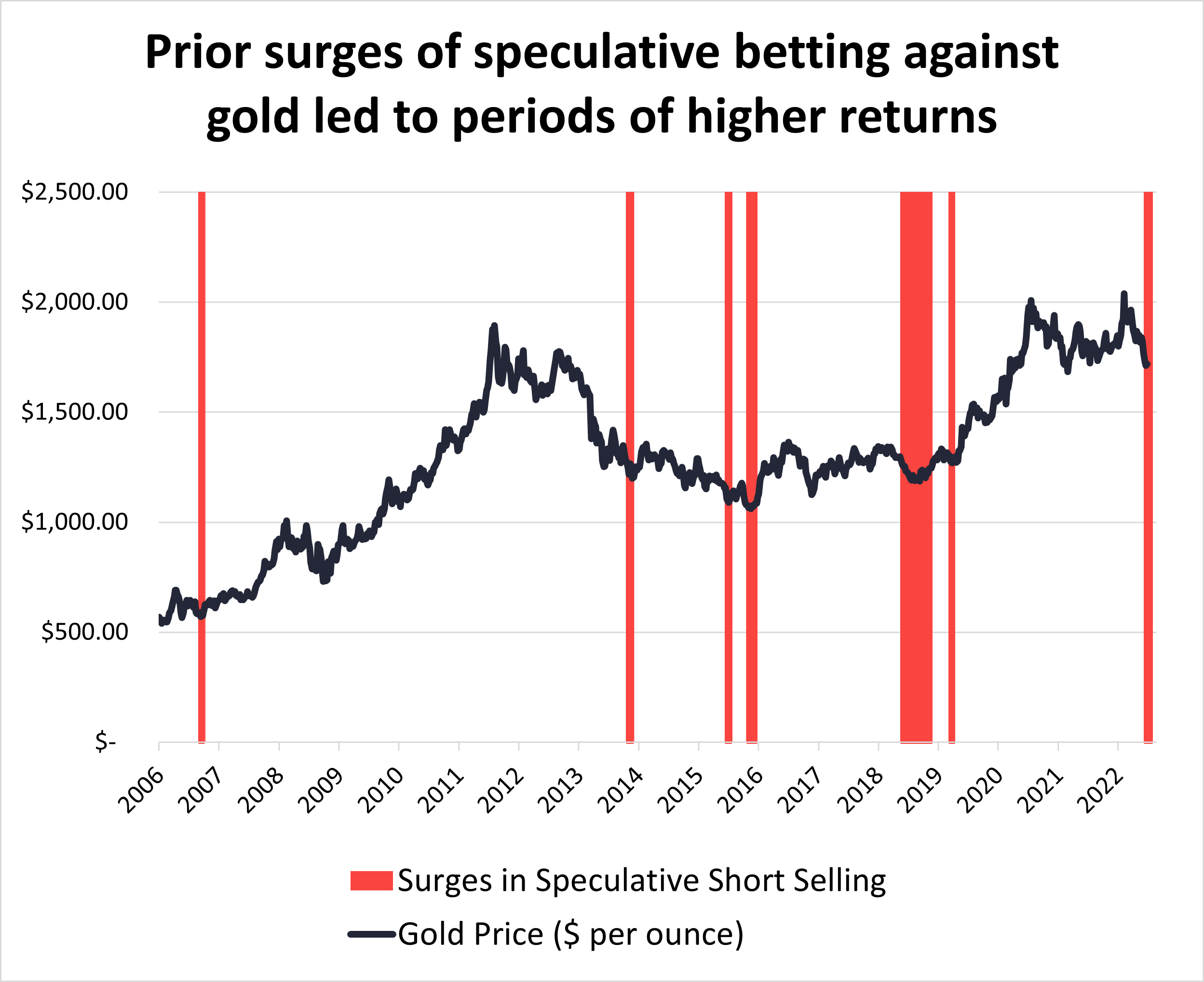

When surges of speculative short-selling end, they are consistently followed by periods of superior price performance. The last five times gold experienced similar upsurges in short-selling, the price of gold saw an average return of 12% in the following six months, and a 19% average return in the following 12 months. Click here for a chart that shows gold’s historical returns after the speculative short signal.

On September 16, 2018, we published an article calling out the same signal: The 21,072,650,508 Reasons Why Insiders Are Buying Gold Now. After this prediction, gold rose from $1,200 to $2,070 in 2 years – a 73% return. There is no guarantee that history will repeat itself, but the data tells an extremely compelling story.

Just look at this record!

Data sources: CFTC, LBMA, and World Gold Council; an extended surge of “Managed Money” shorting is defined as a period when the net amount of gold futures held by “Managed Money” traders drops under $2 billion long or zero (i.e.: becomes net short) and remains below the respective level for more than 30 days

Running Out of Sellers

To simplify the argument: the price of any asset falls when it runs out of buyers. On the other hand, the price rises when it runs out of sellers.

When managed money goes net short, it means the gold market is running out of sellers. When the selling pressure releases, massive returns follow.

Other indicators in the gold market are also extremely bullish. Gold is undervalued compared to the stock market and M2 money supply. Inflation is at a 40-year high. The economy is stagnating. Recession signals are everywhere.

Individually, all of these indicators make for a strong case for gold. Seeing them all align so perfectly is unprecedented.

Why Insiders are Buying

The story this year has been a strong U.S. dollar. Gold, like most commodities, is priced in dollars. Many currency traders bet on a rising dollar by “shorting” gold—but this practice is not sustainable. Gold is a limited resource, whereas currencies are subject to significant fluctuations in quantity and value. Over the long term, fiat currencies devalue significantly against gold. Eventually, speculators will have to go out and buy gold to cancel out their short bets. When they do, the price will rise.

When it comes to gold investing, it pays to take a contrarian stance against the Wall Street speculators.

Most investors will miss out on this opportunity. If you’re thinking of adding more gold to your portfolio, it is better to buy before the price begins to surge. These are the times when the market rewards those who go against the trend.

Secure gold savings, without the excessive fees

Your weekly gold market commentary comes from our internal team of researchers and technical experts. Vaulted gives modern investors access to physical gold ownership at the best cost structure in the industry. With personal advising from industry experts and access to premier precious metals strategies, Vaulted is the key to life-long financial prosperity. Start protecting your portfolio today.

As always, thank you so much for reading – and happy investing!