Gold is immune to inflation, valued across every culture, and independent of banks, governments, and corporations. Today, gold's greatest benefit for investors is its ability to improve risk-adjusted returns in a portfolio.

Gold is just a shiny rock. Does it really belong in a modern portfolio?

We should ask the central banks, who collectively own over a billion ounces of gold to protect their currencies against recessions, inflation, and war.

While there are many reasons you might personally own precious metals, here are the top 5 benefits of investing in gold:

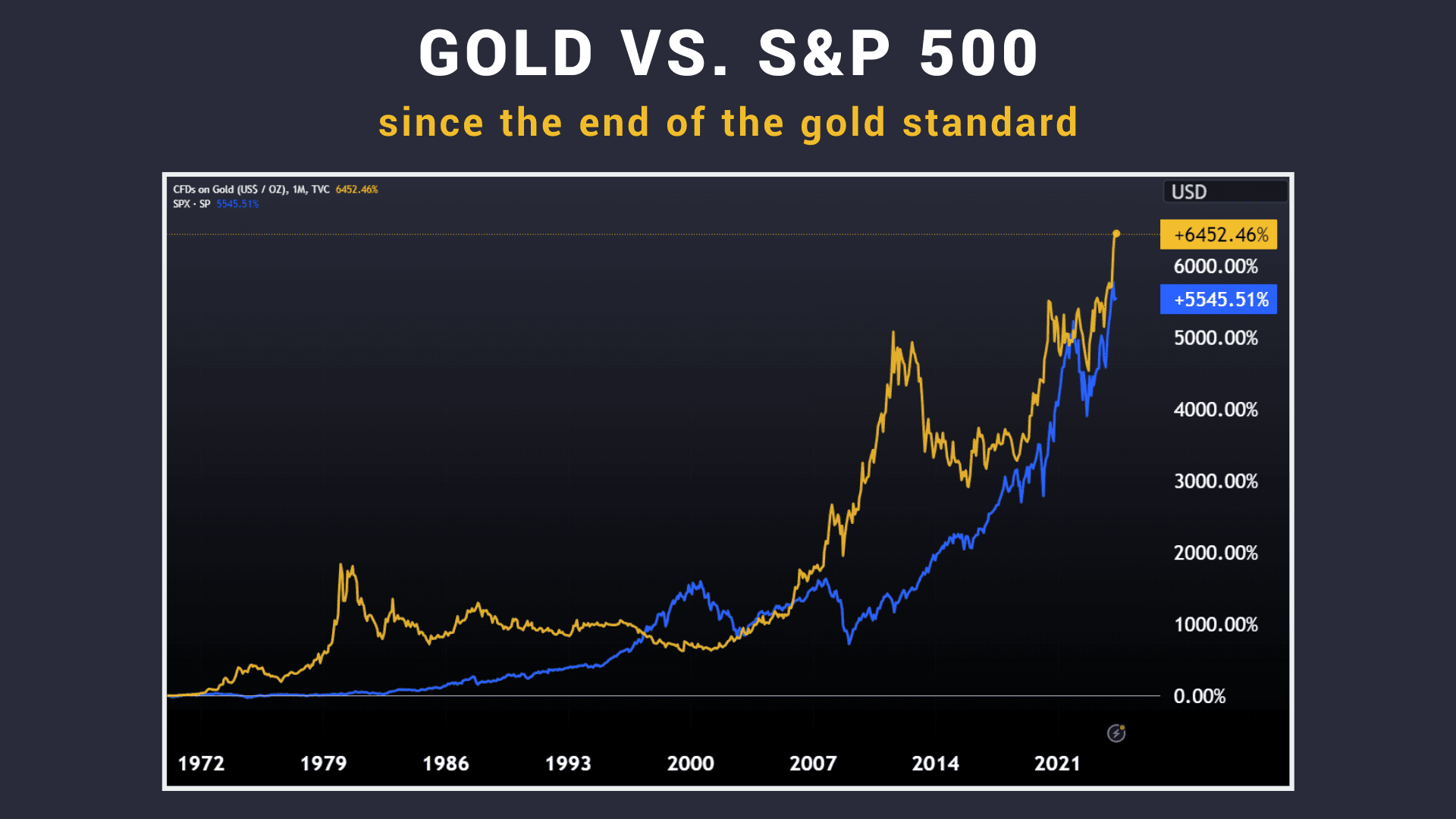

Gold has strong long-term returns

Gold has delivered strong performance over the last 50 years, averaging annualized returns of 9–10%.

While gold doesn’t pay dividends (like some stocks) or interest (like bonds), it does consistently increase in value over time. Adding gold to a portfolio helps provide stability and improve performance.

Since the end of the gold standard in 1971, gold has outperformed the S&P 500.

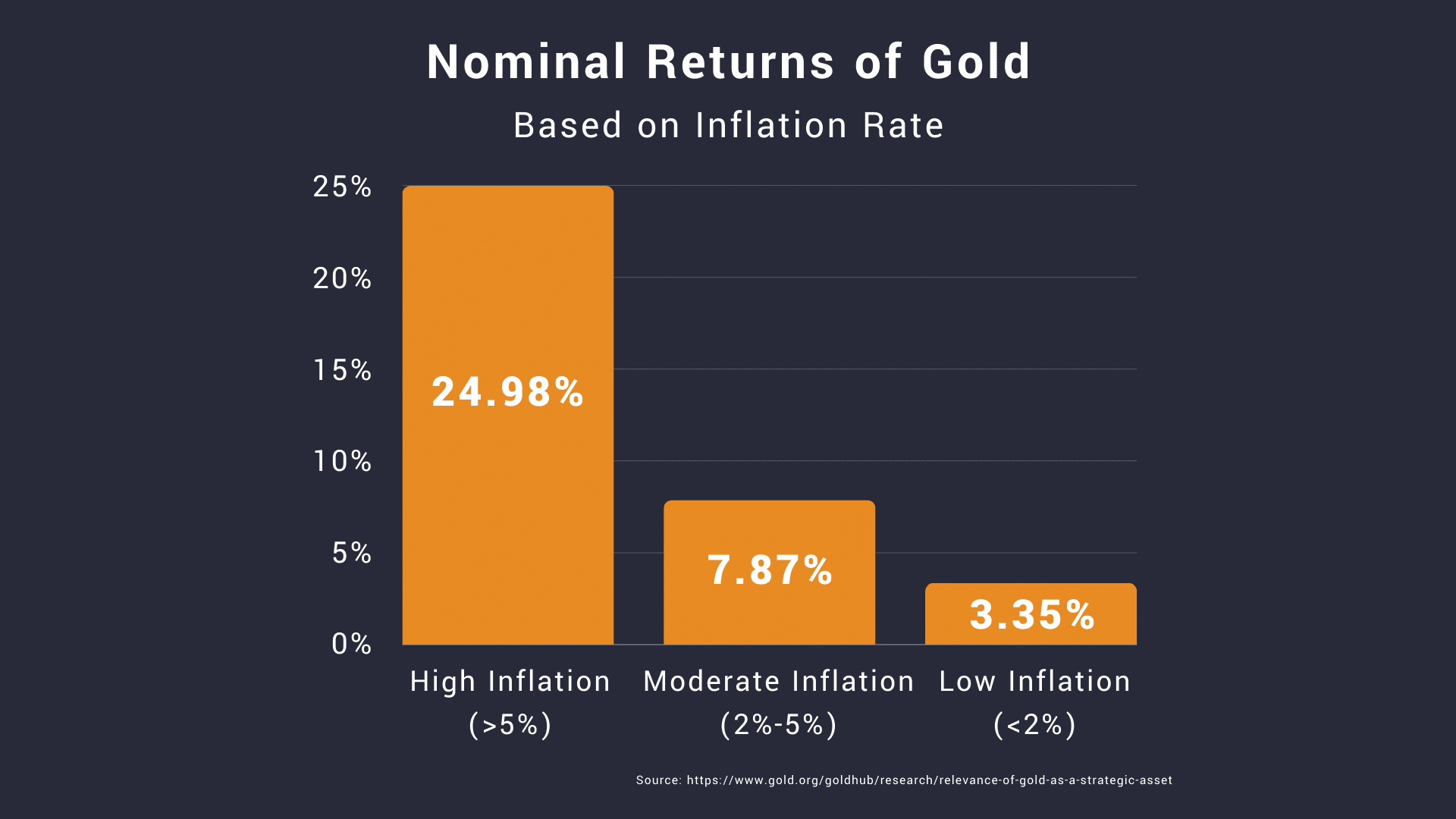

Gold rises when we print money

Fiat currencies are in a constant state of devaluation because governments can print them at will.

Raising taxes and cutting spending are both unpopular, so printing money is always the politically expedient solution. The more money that is pumped into the system, the more prices rise—including the price of gold.

The massive increase in the price of gold over the last 50 years mostly reflects the erosion of the dollar. Gold doesn’t change, but the dollar does.

Owning gold ensures that you have the means to pay for groceries and gas years or decades into the future, regardless of what happens with monetary policy.

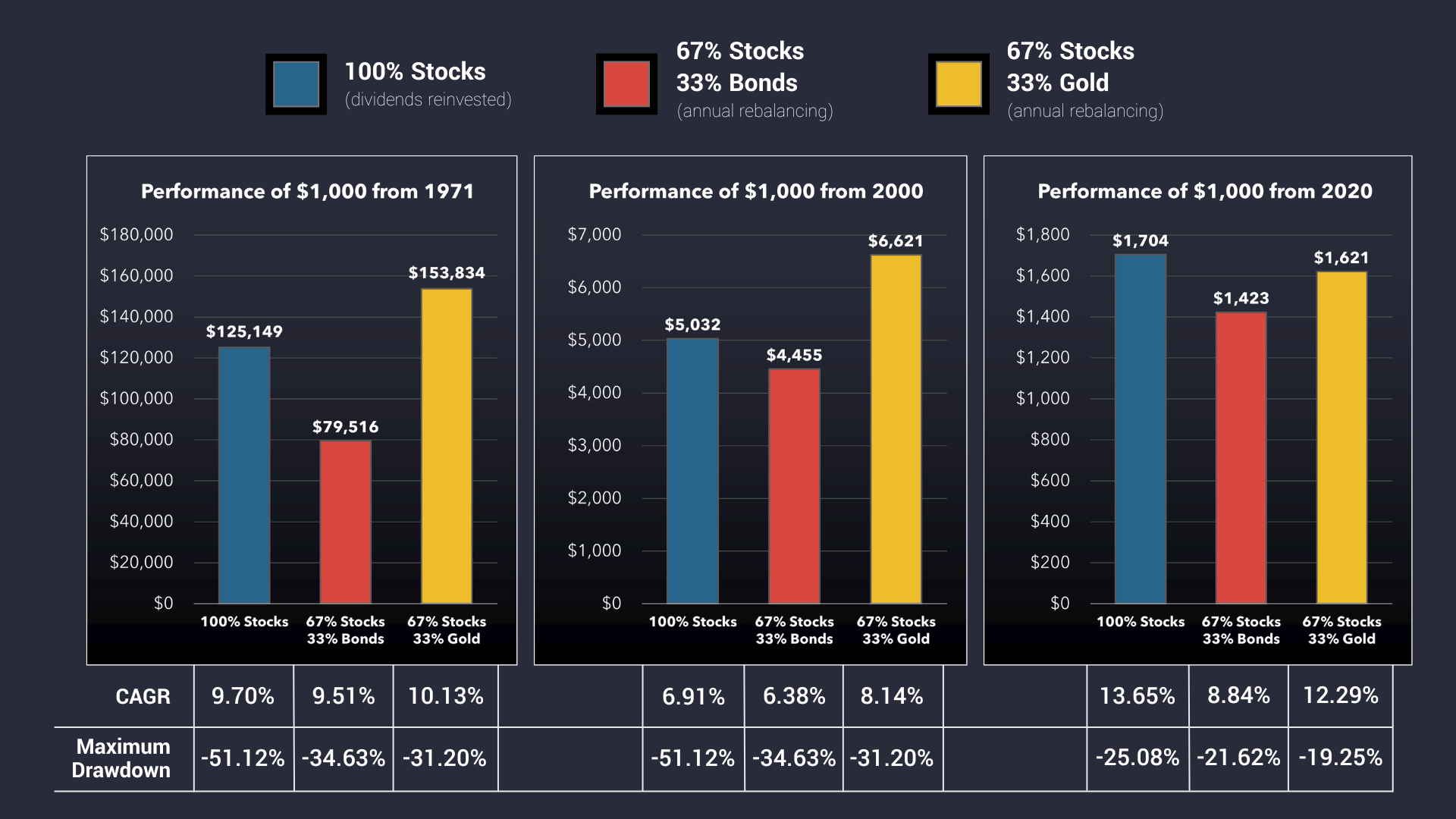

Gold improves risk-adjusted returns

When financial markets and currencies perform poorly, gold performs well.

Because physical gold has no counterparty risk, individual investors, businesses, and banks use it as a safe-haven asset when other assets fail (especially during recessions, war, and other crises).

This allows gold to act as a buffer against market downturns. Minimizing drawdowns is essential for maximizing long-term returns.

In fact, gold has historically served as a better buffer for stocks than the traditional bond allocation. The charts below show the performance of three different portfolios over three different time periods:

- 100% stocks (dividends reinvested)

- 67% stocks, 33% bonds (annual rebalancing)

- 67% stocks, 33% gold (annual rebalancing)

Gold ensures financial independence

Gold is the only major asset that holds its value independently of government decree and the banking system.

When you own gold, your wealth does not rely on the decisions of any politician or corporation. By reducing dependence on governments and banks, gold is the best way to guarantee autonomy over your financial life.

Gold delivers a level of privacy unmatched by any other asset. Unlike cryptocurrencies, gold can be owned and transacted without leaving a digital trail.

Even though crypto transactions are pseudo-anonymous, the Bitcoin and Ethereum blockchains are publicly visible. According to coin ledger, the IRS can trace anonymous transactions to known individuals.

Gold is liquid

You can quickly buy and sell gold anywhere in the world. Its universal recognition means that no matter where you are, gold is always accepted as real money.

The best example of gold’s liquidity occurred during the 2008 financial crisis.

When the U.S. housing bubble burst, major banks collapsed, mortgage-backed securities evaporated in value, and interbank lending froze. Investors who held assets tied to stocks, real estate, or corporate debt suddenly found themselves unable to sell without massive losses, or unable to sell at all. Liquidity vanished from nearly every market.

Gold, however, told a different story. While the S&P 500 lost over 50% of its value between late 2007 and early 2009, gold gained 25%. Unlike real estate, which took years to recover, gold was liquid every single day. Buyers and sellers worldwide were still trading it at transparent, readily available prices.

This liquidity mattered. Investors facing margin calls, frozen credit lines, or collapsing portfolios could convert gold into cash quickly, without taking extreme losses. It’s why, even as stocks, bonds, and housing markets buckled, gold became one of the only assets that preserved its value.

The lesson of 2008 is clear: when financial systems lock up and paper assets become impossible to trade, gold remains universally recognized money. Its deep markets and enduring demand ensure that in times of crisis, you can always find a buyer (often at higher prices than before).

How can I invest in gold?

Gold is an excellent alternative savings vehicle if you want to benefit from endless money printing and minimize portfolio drawdowns.

The best way for you to invest in gold will depend on your personal situation. You can learn more about the best ways to invest in our guide, How to Invest in Gold: 7 Methods You Should Know About.

Vaulted is the easiest way to own real gold

With just a few taps, you can own physical gold in any quantity. It takes 30 seconds to set up your free Vaulted account.

Once you securely transfer funds, you will be able to buy real gold instantly. You will get direct ownership of specific, serial-numbered bars. You can even take delivery of your gold if you wish!