Gold mounted a comeback this week as investors turned their attention sharply toward inflation hedges and safe haven strategies.

Key Takeaways:

- CPI rose to 5.4%. The Social Security cost-of-living adjustment came in at 5.9%.

- Gold jumped back into the $1,800 range, but still has to climb $35 to make a run at the $1,833 ceiling.

- The S&P 500 suffered its largest drop all year in September, revealing vulnerability in a stagflationary environment.

The gold bugs were right

A few months ago, doomsdayers, gold bugs, and cryptocurrency apologists were the only ones crazy enough to warn against stagflation. We were emerging from the pandemic, the economy was growing at a record pace, stocks were exploding, and pessimists were relegated to the fringes. Sure, nearly half of U.S. dollars in existence today were printed in the last year and a half. But Jerome Powell and the Federal Reserve were clear: any jumps in inflation are T-R-A-N-S-I-T-O-R-Y. For the past decade, investors’ best bet has been to trust the Fed – why would anything change now?

Unfortunately, it looks like this time is different. Market participants are starting to lose confidence in the central bank’s assessment as the economic environment of the last four decades (declining interest rates and low inflation) reaches a secular turning point. Stagflation is an economist’s (and everyone else’s) worst nightmare: a slowdown in growth and rising unemployment combined with rising costs for goods and services.

Jerome Powell’s hypothesis rests on the assumption that all inflationary pressures are stemming from short-term supply chain disruptions from the pandemic. But every week, new data challenges that notion. Crude oil is back above $80 per barrel. Commodities appear to have entered a new super cycle. Durable goods are leading the inflationary charge, but services aren’t far behind. Rent and housing prices are rising faster than they have decades.

Discrepancies in inflation measurements

Year-over-year CPI jumped back up to 5.4% in September. But the data point that has captured the most attention is the Social Security Cost-of-Living Allowance (COLA), which came in at 5.9%. Social Security recipients are entitled to yearly adjustments to their benefits to account for increases in the cost of living. This is the highest COLA increase since 1982.

The discrepancy between COLA and CPI is concerning because it indicates that recent increases in the cost of living are higher than what CPI suggests. The calculation for CPI changes all the time, and would likely be much higher today if the Bureau of Labor Statistics was using the CPI calculation methods that the used in the 70’s.

Economic growth MUST keep up

Accounting maneuvers can only do so much to suppress inflation data. Now, lawmakers and central bankers only have one option: fight desperately to ensure economic growth keeps up with price increases.

The other option would be jacking up interest rates, like Paul Volker did in the early 1980’s to combat stagflation. But we know they won’t do that because such an act would force the government to pay an unsustainable amount of interest on their outrageous debt levels. Not to mention, it would crush the stock market and likely trigger a recession.

Fortunately, recent corporate earnings have been very strong. If earnings and profits stay healthy, economic growth could theoretically keep up with inflation. Corporate earnings relieved some of the pressure investors are feeling over the threat of stagflation this week.

Gross domestic product (total value of goods and services in an economy) is still expected to grow this year at the highest rate in almost four decades. Growth looks promising, although many estimates have been steadily declining since the optimistic highs from a few months ago. The International Monetary Fund recently cut its growth forecast for advanced economies to 5.2% (down from 5.6%).

To avoid the stagflationary malaise of the 1970’s, wages also need to accelerate with inflation. Right now, most companies have some slack to plug back into labor, but margins get tighter and tighter as rising input costs eat up corporate profits.

The clear winner during stagflation: gold

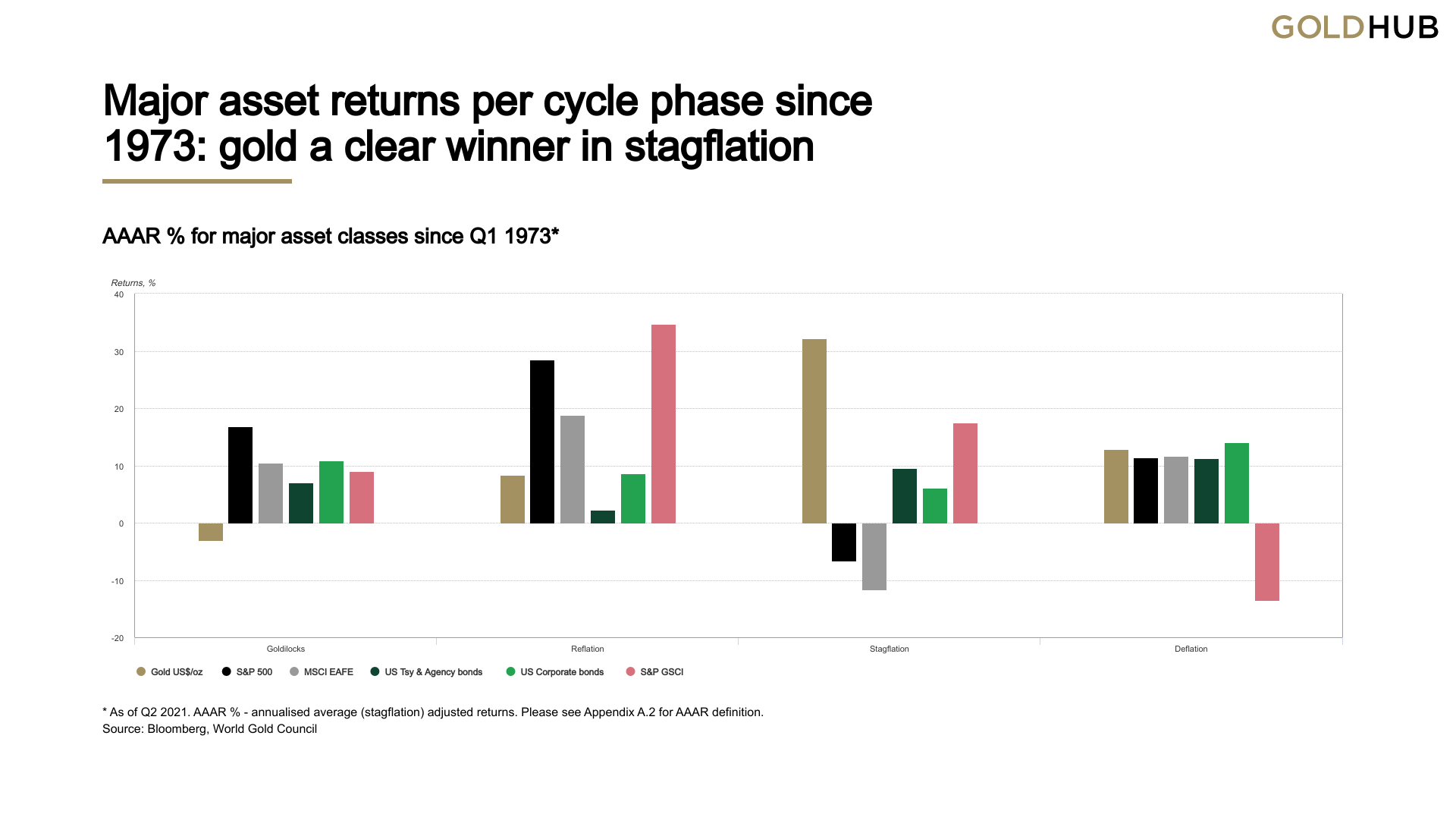

The U.S. economy has encountered stagflation many times before. The chart below compares different asset classes and their historical performance during four different economic cycle phases: Goldilocks, Reflation, Stagflation, and Deflation.

As you can see, gold is the clear winner during stagflationary periods. The biggest threat to gold in coming years is the possibility of stagflation shifting into reflation, although the likelihood of such a shift appears extremely low considering the current environment.

Stagflation and equities

The chart also reveals how much damage stagflation can inflict on equities prices. The S&P 500 has notched 54 all-time highs this year, rising 107% from its COVID-19 bottom to its September 2021 all-time high.

In September, the S&P 500 suffered its deepest drop since the start of the pandemic: 5.2%. Riding the stock market wave of 2021 has been great for most investors. However, analysts are worried equities are now overpriced, overextended, and vulnerable to a sudden change in the market environment.

Secure gold savings, without the excessive fees

Your weekly gold market commentary comes from our internal team of researchers and technical experts. Vaulted gives modern investors access to physical gold ownership at the best cost structure in the industry. With personal advising from industry experts and access to premier precious metals strategies, Vaulted is the key to life-long financial prosperity. Start protecting your portfolio today.

As always, thank you so much for reading – and happy investing!