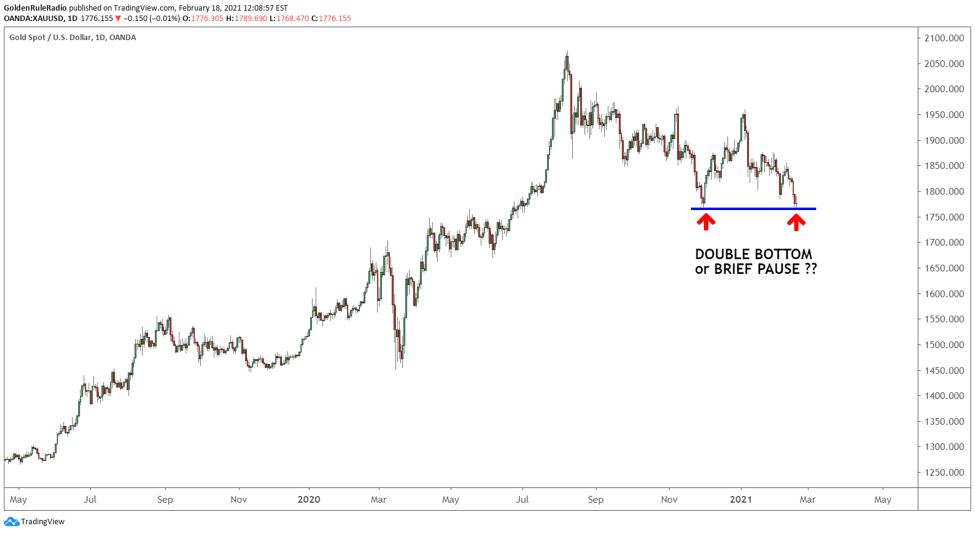

Gold looks to continue its downward momentum after a double bottom at its November 30th lows.

Will gold continue to correct?

Gold dropped slightly below its November 30th lows this week, signaling a continuation of the short-term bear market. Until we see confirmation that this pattern has turned around, we will be cautious to announce that the bull is back. The long-term fundamentals are still extremely bullish for gold, however, no one can guess the exact timing of the price bounce.

Since November, gold has been bouncing up and down between mid-$1,700s low to mid-$1,900 range. The price failed in a higher high at the key level of $1,960. Gold bulls would certainly like to see the line hold around $1,765 and then turn up, but history tells us that we could see lower prices.

From a macro perspective, lower prices are not overly concerning. If we rewind to the start of the bull market in 2016 and draw Fibonacci retracement levels, we will see that gold is currently sitting at the most shallow correction zone (the .382 Fib). For that reason, gold still looks bullish, even if we continue the downward momentum for the time being.

Are any technical signals confirming the downward momentum?

After hitting the Fibonacci retracement level of $1,763 back on November 30th, we did recover a fair bit. Gold reached $1,956 on January 5th but failed to surpass the previous high of $1,963 on November 6th, 2020. This week, gold put in a lower low compared to November 30th. For these reasons, we would expect to see continued movement down from a technical charting perspective.

Why is the Dollar Index rallying?

The recent Dollar rally is confusing to many people. If the U.S. government is printing money at a record pace, shouldn’t the Dollar be losing value? The answer is yes. Although, we must remember that the chart below references the Dollar in comparison to other global fiat currencies, not its objective value in terms of purchasing power.

The recent Dollar Index rally shows that the Dollar is currently gaining strength compared to other fiat currencies. The Dollar is losing value and purchasing power – but so is every other fiat currency. This is one of the greatest reasons to own alternative currencies such as gold. When the Dollar loses purchasing power, gold rises in value.

Zooming out a little, we see this loss of value in action. Last year, the Dollar failed to push above its early 2017 highs and has been locked in a downward pattern ever since. It is extremely unlikely we will see this pattern reverse, considering the government’s commitment to stimulus spending and the Fed’s target of increased inflation.

How should I react?

Be aware of your options for alternative currencies. The history of fiat currencies does not bode well for the few that are still intact today. Modern monetary and fiscal policies are pushing all global fiat currencies into unprecedented territory, forcing investors to seek allocations in cryptocurrencies and precious metals.

Vaulted is designed as a banking alternative for those who are aware of these trends and concerned about the future of the fiat currency system. Gold is the world’s most trusted and secure currency and has provided investors with protection and superior returns for decades. Vaulted is the best way to invest in gold, and there is no better way to start than right now. Creating a free account means you get direct access to a personal precious metals advisor that can walk you through proven strategies for ratio trading, banking with gold, and portfolio diversification.

As always, thank you for reading, and good luck out there!