Gold is continuing its lackluster short-term performance, but the fundamentals are now shaping up to trigger the second phase of its massive bull market.

When will gold turn around?

Gold investors are getting antsy as the metal continues a disappointing performance since hitting an all-time high last summer. However, we must remember that price corrections can be very healthy. Throughout history, we have repeatedly seen these kinds of corrections in the middle of bull gold markets. And yet, gold has still outperformed the S&P 500 index by more than 300% since the year 2000.

Gold is sitting at the bottom of its declining trading channel. The next leg of the bull market could be fast approaching based on the following trends:

- Rise physical gold demand

- Concerns with rising the consumer price index (CPI)

- Central banks buying gold

The rise in physical gold demand

Demand is rising, but the spot price of gold has yet to reflect the trend. Premiums on certain gold and silver coins are rapidly climbing, which points to possible supply chain issues. For context: some gold coins are worth more than their pure weight in gold. Any extra value on top of the coin’s weight in gold is called a “premium.” The premium on gold coins reflects the overall demand for that coin. If suppliers cannot get coins out to investors fast enough, premiums rise. Premium action has been very strong recently, which means a lot of people want to purchase physical gold products.

Consumer Price Index

But why do people want to buy physical gold? One answer could be the CPI – or in other words, inflation. The CPI, or Consumer Price Index, is a measure of the average increase of prices paid for regular goods. The index is composed of food, housing, apparel, transportation, medical care, recreation, and education/communication.

When the CPI rises, it means inflation is also rising. Gold is often used as a hedge against inflation, so increases in the CPI correlate with increases in gold demand. Food inflation is already spiking above 5%, and several other components of CPI are getting dangerously high. Energy prices have been keeping CPI down because oil prices have been so low. However, oil prices are now reversing, which will send CPI even higher.

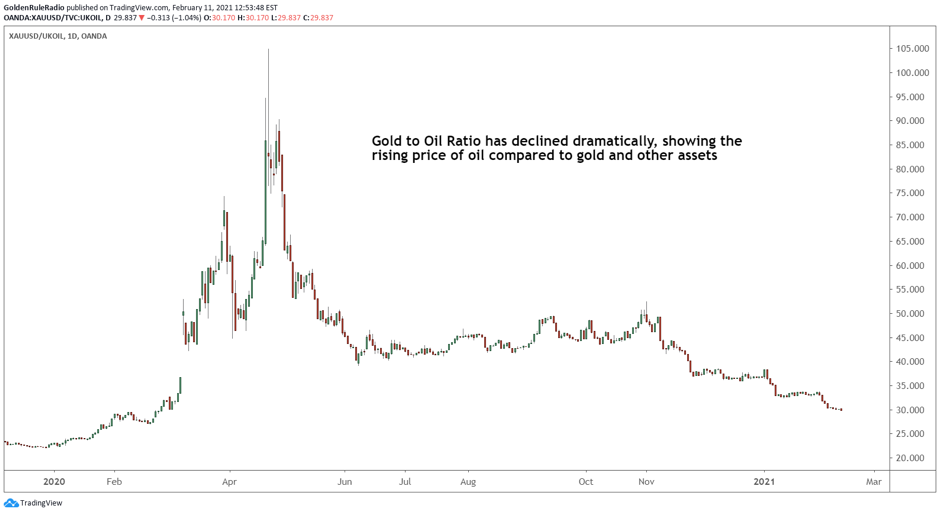

Below is a chart of the Gold to Oil ratio, which has declined dramatically since the price of oil went negative last summer. The point is: the higher the price of oil, the more you have to pay for gasoline. As the CPI and inflation climb, so will the demand for gold.

Central Banks Buying Gold

Central banks have been buying more gold in recent years than they have for decades. In fact, Central banks bought more gold in 2018 than they had since 1971, when Nixon took the Dollar off the gold standard. Then they bought even MORE in 2019. Heavy gold buying continued into 2020, however it dropped off compared to record 2019 numbers.

Why?

Russia is one of the primary reasons for this pattern. Russia had been raking in high profits in 2018 and 2019 when oil prices were high. They would then turn around and spend those revenues on gold. When oil prices plummeted this year (actually reaching negative prices for a short period of time), Russia had less capital to acquire gold. Russia halted gold purchases in April, 2020 and the gold price peaked just a few months later.

China also did not report gold purchases in 2020. Now that the gold price has softened by $300.00 off its all-time high, and oil prices are back up, we will likely see Russia continue their gold purchases. If central banks really do step back in and resume massive gold purchases, which can only mean one thing: the gold price is going higher.

How should I react?

Many experts agree that the equities markets are in a runaway bubble. Fed credit creation and fiscal stimulus are being injected into equities prices, keeping the major indexes on a steady upward trajectory. But paradise cannot last forever. Having some exposure to these gains is vitally important, but all investors should also have a portion of their portfolio dedicated to safe-haven assets such as gold.

One thing is for sure: we are in unprecedented economic times. The Biden Administration is actively considering a federal $15.00 minimum wage and student debt forgiveness by executive action. Many Americans and politicians on both sides are torn on these issues. Many Americans need these actions to get through the next few years as the economy continues to suffer, although no one knows what kind of long-term impact of such measures.

Congress recently passed Biden’s $1.9 trillion stimulus package, the second-largest in U.S. history. The plan is second only to last year’s CARES act, which added trillions in fiscal stimulus. In three months, we increased the deficit more than the last five recessions combined. In six weeks, the Fed bought more Treasuries than in 10 years under former Federal Reserve Chairs Bernanke and Yellen. Not to mention, the new administration has pledged 2 trillion for clean energy and 1.5 trillion for manufacturing and childcare.

That is a lot of spending. And a lot of debt.

Are we borrowing from our future? Are we taking the necessary precautions to protect the economy? Are we pushing the breaking point of our system?

No one really knows. Fortunately, there is a way to prepare for the unexpected, and her name is gold. Short term price trends can be very exciting or very disappointing, but they rarely matter in the grand scheme of building wealth. Focusing on long-term fundamentals is the name of the game, and these fundamentals currently favor precious metals more than any other asset class.

If you are considering adding gold to your portfolio, Vaulted is the only way to go. With the lowest cost structure in the industry, personal advising, and direct access to premier precious metals strategies (ratio trading, silver investments, rare coins, etc.), Vaulted is the only platform that ensures you are maximizing your precious metals portfolio’s performance.

Create your Vaulted account in 3 minutes and start building your legacy today.