Gold vs. Bitcoin: Current threats and opportunities

Bitcoin soared to a record high of $93,320 after Donald Trump’s election victory, driven by investor optimism for a more crypto-friendly regulatory environment. To continue gaining acceptance, Bitcoin must overcome fears of sharp price swings, vulnerability to cyberattacks, and crackdowns by regulators.

Gold reached a record high of $2,790/oz in October, capping a steep 50% rise in the previous 12 months. If the Federal Reserve keeps interest rates higher for longer, gold could face strong headwinds. However, high U.S. debt and deficit levels strongly favor gold, as they amplify concerns about the long-term stability of the dollar and the broader economy.

Key Takeaways:

- Bitcoin is in the spotlight for good reason. A 26,000% return in a single decade is unprecedented.

- Gold has stood the 5,000-year test; cryptocurrencies have stood the 15-year test. Bitcoin’s growth potential is high, but still carries significant risks (such as regulation).

- Bitcoin rivals some of gold’s revered characteristics, such as scarcity and decentralization. Unlike gold, Bitcoin supports near-instant transactions across space.

- Gold stands above Bitcoin in terms of intrinsic value, wealth preservation, and performance during market downturns.

Carthage vs. Rome; Bitcoin vs. Gold

In 218 BC, Hannibal of Carthage marched his army of men, cavalry, and war elephants through the Alps to attack Rome on its own soil, launching one of the greatest military feats in history. It became an unforgettable allegory of the “underdog” challenging the incumbent.

If Bitcoin is Carthage, gold is the Roman Empire. Cryptocurrencies are on a daring campaign to conquer the financial system. Bitcoin has none of the elephants but all of the risk. The question is, which asset will prevail?

The case for Bitcoin is clear. The technology is revolutionary. Bitcoin’s adoption rate has steadily increased since its inception, thus de-risking the mysterious asset. It is hard to ignore Bitcoin’s mind-boggling returns. Some say the rise of cryptocurrency challenges the time-tested precious metal as the top choice for hedging against the U.S. dollar and other fiat currencies.

However, the hype surrounding crypto has pressured individuals to frantically buy into a technology at extremely high valuations. This kind of speculative behavior has made some people very rich, but has also destroyed the wealth of those unlucky enough to catch the top of the market.

People should be wary of idolizing the underdog, lest we forget that Rome won the Punic Wars, forcing the Carthaginians out of Europe and establishing ultimate sovereignty over the Mediterranean for another 500 years. Pitting Bitcoin against gold makes for an exciting topic of conversation, although the “gold vs. Bitcoin” debate distracts from bigger questions: Why do we need alternative currencies? How does crypto bring light to the structural issues plaguing the world’s monetary system? How do I protect my wealth?

Why should we care about alternative currencies?

Modern economies function on fiat currencies. Fiat currencies have no intrinsic value, instead deriving their value from a government promise. Without any physical backing, governments have the freedom to print their currency to their hearts’ content.

This raises the question…why is the U.S. dollar valuable? We give a complete answer here: What Backs the United States Dollar?

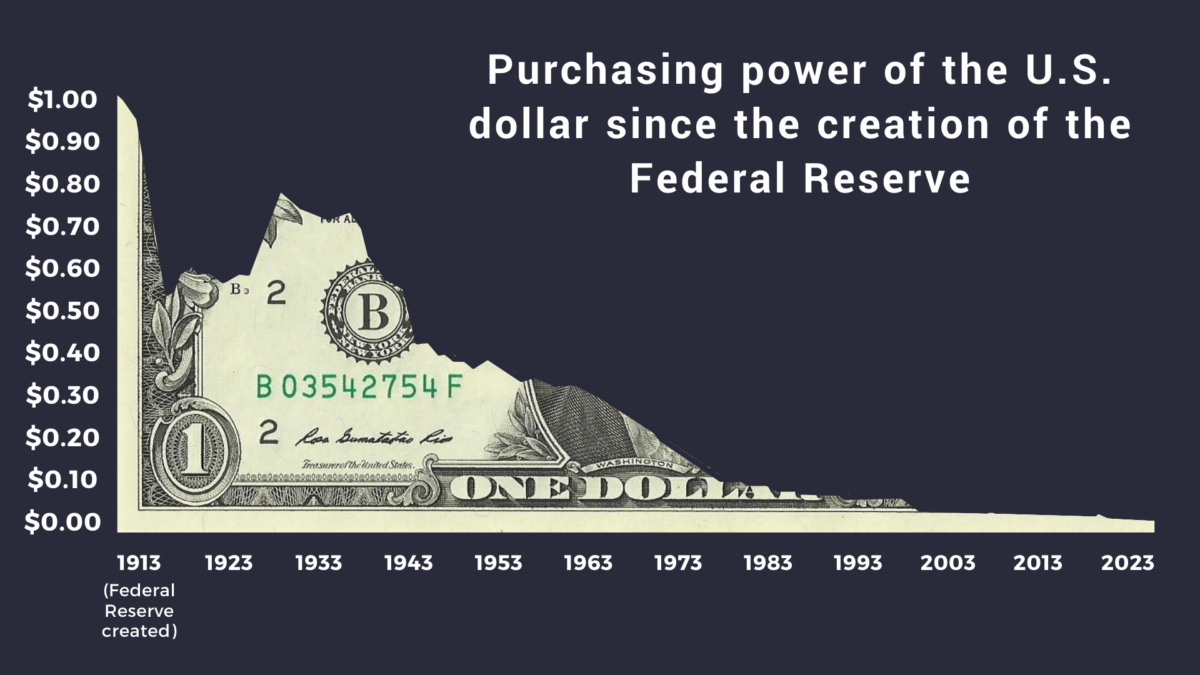

Governments employ central banks to control the money supply and interest rates. As you can imagine, controlling the most important aspect of an economy, money, is an impossible task – which is why central banks have such a poor track record. The U.S. dollar has lost 98% of its purchasing power since the creation of the Federal Reserve in 1913.

History is full of reasons to hedge against fiat currency. Of the hundreds of fiat currencies that have existed throughout history, few have survived longer than 100 years. Most have failed due to hyperinflation, war, or monetary mismanagement by the government.

Is the U.S. dollar any different?

From a fundamental standpoint, no. When President Nixon removed the United States from the gold standard in 1971, the dollar lost all remnants of scarcity. Scarcity is what makes something valuable – that is the entire purpose of money. When the government has complete control over the money supply, they tend to crank up the money printers, devaluing their own currency to pay off debts or inject credit into the economy.

Ballooning budget deficits, ultra-low interest rates, and free money have characterized the global economy since 2008. These factors have contributed to unprecedented growth in the stock market and other risky asset classes. Unfortunately, interest rates can only go so low and debt can only go so high. We have seen this pattern time and time again throughout history.

Investors are aware of this problem, which is exactly why gold and cryptos are heating up. The current monetary system is wrought with structural instability. Investors want to reclaim control and pave the future of money.

A Deeper Look into Gold

Nearly every developed culture throughout history used gold for monetary exchange. Humans have been digging up gold from riverbanks, veins, and ore deposits on every continent (except Antarctica) for thousands of years. We ascribe value to the yellow metal for several reasons:

- Durability – gold does not corrode or tarnish

- Malleability – gold can be molded and shaped for industrial, monetary, and symbolic applications

- Aesthetics – gold perpetually holds its brilliance, shine, and natural beauty

Modern investors are interested in gold’s unique characteristics as a portfolio diversifier and reliable store of wealth. Portfolios with a gold allocation have historically provided higher returns with reduced drawdowns and lower risk.

Gold provides a strategic role in any portfolio by hedging against the market. The metal is inversely correlated with equities, meaning it tends to perform well when the stock market is dropping. Gold also tends to perform well during periods of high inflation.

A Deeper Look into Bitcoin

Bitcoin started making headlines in 2009 when an anonymous person (or group of people) named Satoshi Nakamoto launched a new system of digital currency. Here are some key terms in the cryptocurrency universe:

- Decentralized: Bitcoin has no central authority. The vast network of Bitcoin investors, users, and miners collectively control the supply and value of the currency.

- Blockchain: All Bitcoin transactions are recorded on a distributed ledger called a blockchain. The blockchain allows two parties to agree on a transaction and record it in an ever-expanding chain of chronological data points. The chain, separated by individual “blocks” of information, records every Bitcoin transaction. These transactions cannot be changed or edited. The distributed ledger is open source (publicly available), so anyone can investigate the code for themselves at any time. For this reason, Bitcoin transactions are not necessarily anonymous, although it is extremely difficult to link a certain line of code to a specific person.

- Peer-to-peer: Usually an intermediary, such as a bank, must oversee financial transactions. The blockchain removes the need for such intermediaries and allows for true peer-to-peer exchanges.

- Mining: Bitcoin miners are compensated in Bitcoin to record transactions on the blockchain. Anyone can become a Bitcoin miner, although many miners organize into “mining pools” to maximize computing power. This process is intentionally difficult and time-consuming.

Bitcoin was not the first digital cash technology, and is far from the last. Tens of thousands of cryptocurrencies currently exist, although Bitcoin is the clear leader in terms of market capitalization and trading volume.

Comparing the Currencies

Gold and Bitcoin are both positioned to deliver superior returns, liquidity, and protection against devaluation of fiat currencies. They both allow investors to “exit the system” with an asset that the banks and government can’t touch. However, the assets differ in major ways.

Security:

- Gold: Investors have many options for securing their assets, which introduce certain risks and rewards in terms of security. They can store their gold in a depository or bank, a personal safe, or under their mattress. Gold bugs have an important safety net when it comes to security: if the world ends, their gold will still be there.

- Bitcoin: Bitcoin has proven itself as one of the most secure cryptocurrencies. However, no technology is infallible. The crypto universe is notorious for fraudulent activity. If investors want complete protection against theft or loss, they must set up a cold wallet, which is disconnected from the internet. Just don’t forget your password!

Liquidity:

- Gold: When you want to sell your gold, there is always a buyer. Gold is one of the most frequently traded assets in the world, providing a very high level of liquidity and supporting the price. Of course, selling your gold can be difficult if you store it under your mattress.

- Bitcoin: Bitcoin is also a very liquid asset. The currency has a healthy population of buyers and sellers all over the world.

Longevity:

- Gold: A 5,000-year history of stable purchasing power proves that gold cannot be replaced by another metal. No other element shares gold’s unique characteristics. Even other monetary metals, such as silver, platinum, and palladium, serve very different industrial and investment purposes.

- Bitcoin: Bitcoin has been around long enough to prove the system works. However, Bitcoin investors must bank on the fact that Bitcoin will remain the top crypto. Technology never stops improving. Bitcoin does have a first-mover advantage and a huge population of loyal holders, but a competitor could theoretically replace Bitcoin.

Volatility:

- Gold: Gold is revered for its low volatility. In fact, some economists argue that all prices should be measured against gold because gold is the most fundamental source of monetary value. The price can still rapidly rise and fall based on market demand, but over the long term, gold is a stable store of wealth.

- Bitcoin: High volatility is a hallmark of Bitcoin: high risk, high reward. Some investors love high-risk assets. Bitcoin offers greater upside potential than gold—albeit with equally great downside risk.

We could dive into other aspects of a healthy currency, such as fungibility, divisibility, and supply limitations. Both gold and Bitcoin meet these criteria.

Investors need to know that gold and Bitcoin serve very different strategic roles in a portfolio. Gold is a hedge. Investors turn to the safe haven when things look unstable. Bitcoin, on the other hand, behaves like a risk asset, generating massive returns when the economy is doing well and crashing when the economy struggles. For this reason, Bitcoin tends to be correlated with the stock market.

Strengthened by the past, prepared for the future

Perhaps the battle between Bitcoin and gold will help investors move past the conception of “price” as an objective measure of value. By default, we price everything in U.S. dollars. Dollar prices only measure an asset against the value of the U.S. dollar, which is itself subject to inflation and manipulation. We may struggle to understand how a particular asset is performing in the grand scheme of things.

Gold and Bitcoin help us consider different measures of value, such as exchange rates between assets (the gold/S&P 500 ratio, for example).

Diversify your exposure against fiat currency. Gold and cryptocurrencies will both play a vital role in protecting the financial future of those daring enough to invest in a new monetary system – one strengthened by the past and prepared for the future.