The gold/silver ratio = price of gold divided by the price of silver. Here is how to use the ratio to spot opportunities in the precious metals market.

What is the Gold/Silver Ratio?

The gold/silver ratio (or mint ratio) tells you how many silver ounces you need to buy one ounce of gold.

If the ratio is 50, it takes 50 oz of silver to buy 1 oz of gold (in other words, gold is 50 times the value of silver).

When the gold/silver ratio is rising, gold is outperforming silver. When it is falling, silver is outperforming gold.

Gold/Silver Ratio History

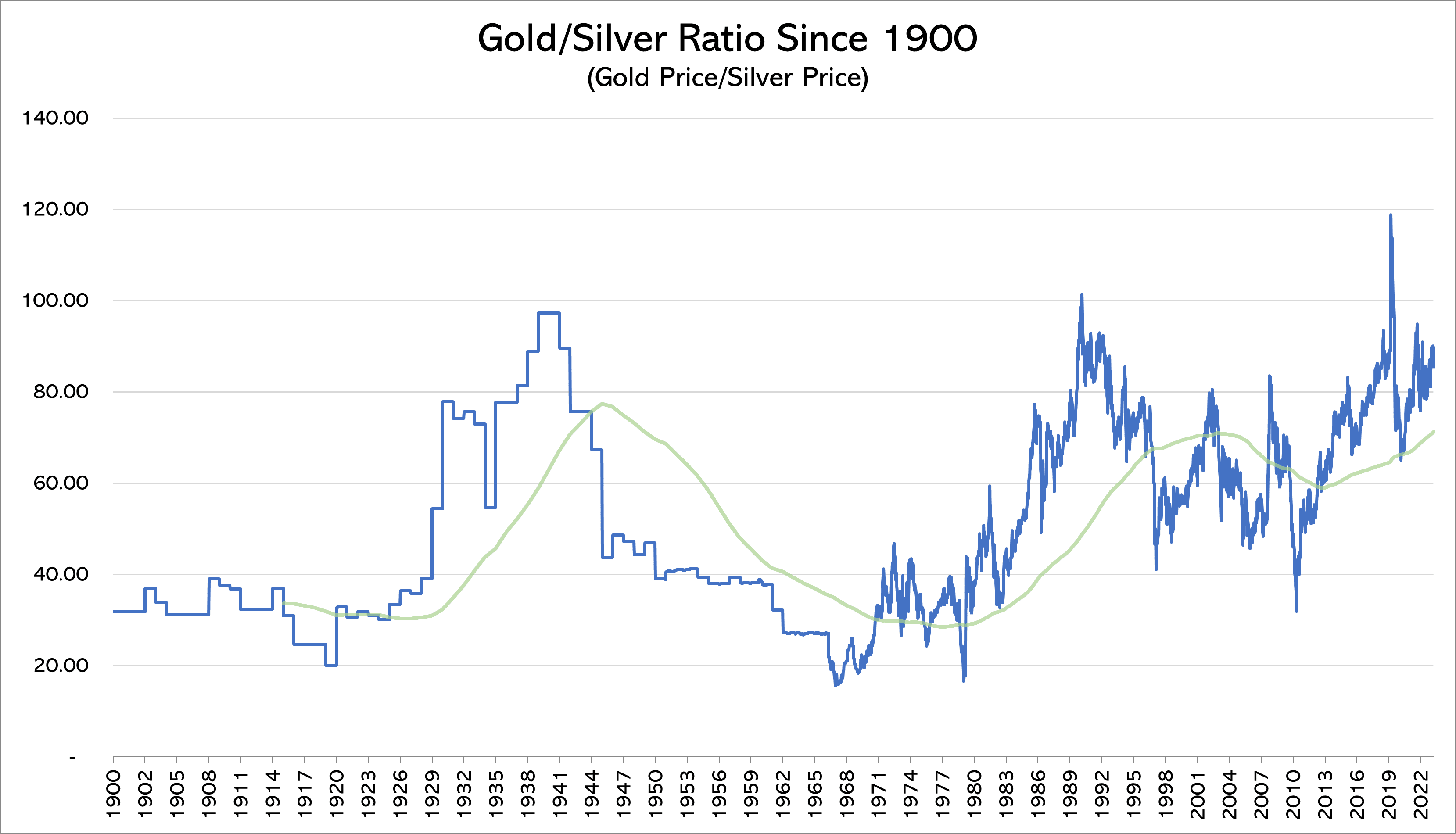

Below is a chart of the gold/silver ratio dating back to the year 1900.

In ancient and medieval times, the gold/silver ratio hovered around 15, meaning gold was 15 times more valuable than silver.

When governments detached their currencies from gold and silver in the 20th century, the ratio began to float between 40 and 60. In modern times, the ratio has swung wildly, reaching an all-time high of 126 in early 2020.

What is the Average Gold/Silver Ratio?

The average gold/silver ratio over the last 30 years is about 68. This means that, on average, gold is 68 times the value of silver.

The ratio tends to rise during times of crisis when investors rush to gold. It drifts back down when silver catches up in recovery periods.

Low values indicate that gold is undervalued, while the high values indicate that silver is undervalued.

How to Trade the Gold/Silver Ratio

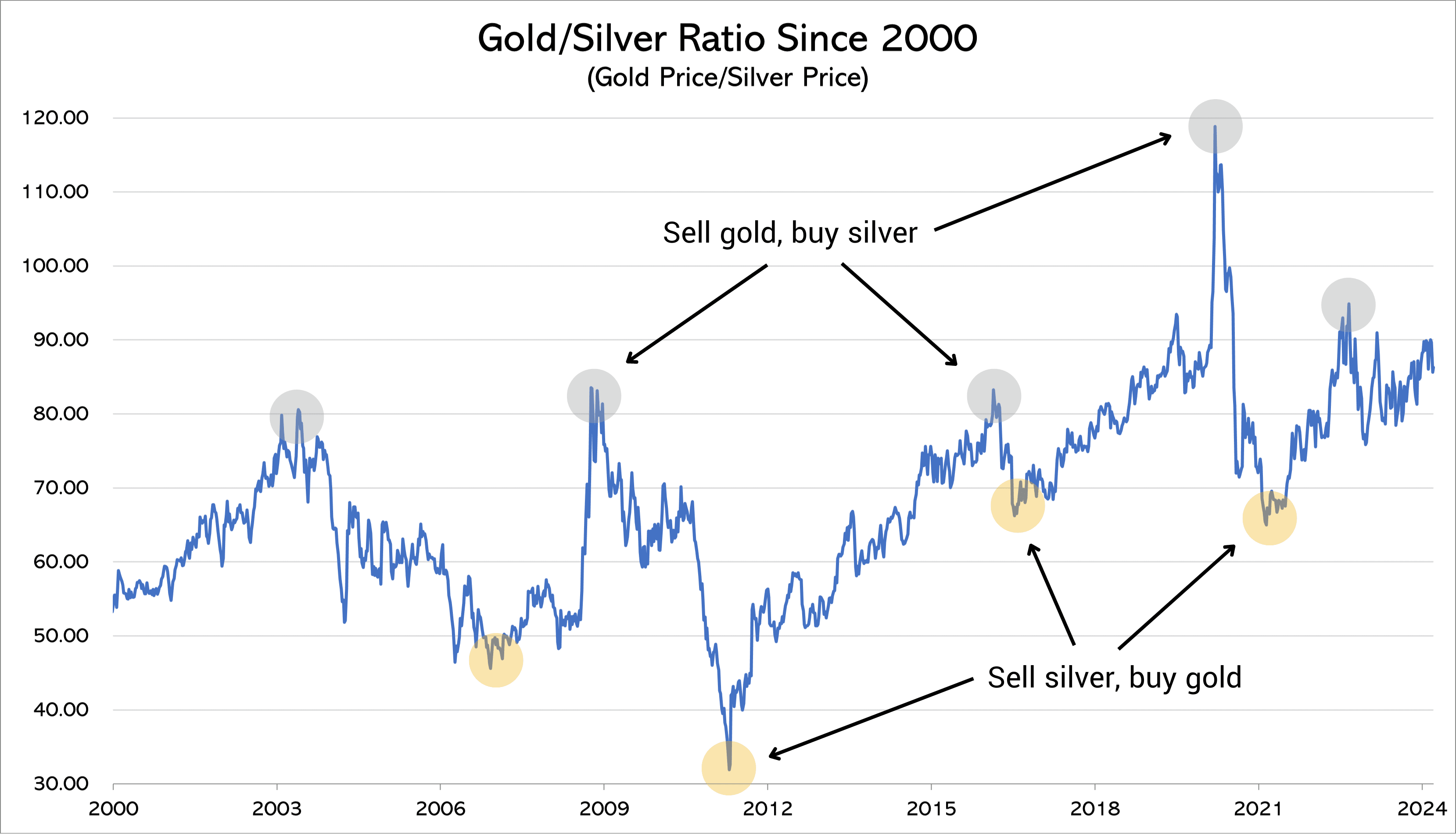

Investors use the gold/silver ratio to decide when to trade one metal for the other.

A “ratio trade” involves selling gold and buying silver (or vice versa) when the ratio is in an extreme position.

The gold/silver ratio provides trading opportunities that no other asset class provides. Stocks, bonds, real estate, cryptocurrencies, and other commodities do not have a proven pattern of long-term mean reversion, which means they are unsuitable for ratio trading.

The strategy goes something like this:

- Allocate heavily to gold when gold is undervalued relative to silver.

- Wait for the ratio to reach a potential peak (indicating silver is undervalued).

- Execute a ratio trade from gold to silver.

- Wait for the ratio to reach a potential trough (indicating gold is undervalued).

- Execute a ratio trade from silver to gold.

The Risks of Ratio Trading

A successful ratio trading strategy requires a careful analysis of various technical and fundamental indicators, including risk appetite, inflation forecasts, relative strength of the US dollar, momentum indicators, geopolitical stability, and speculative positioning in the futures market.

Ratio trading also requires a very long-term investment horizon. As you can see from the chart above, market cycles can last years or even decades.

If you intend to employ a ratio trading strategy in your precious metals portfolio, it is crucial to seek guidance from a professional. When you open a Vaulted account, you not only gain access to physical gold and silver at a fraction of the cost but also benefit from the expertise of a dedicated personal advisor.

Vaulted advisors have an average tenure of 15 years in the industry and are here to ensure you make informed decisions every step of the way.

Ratio Trading: Historical Performance

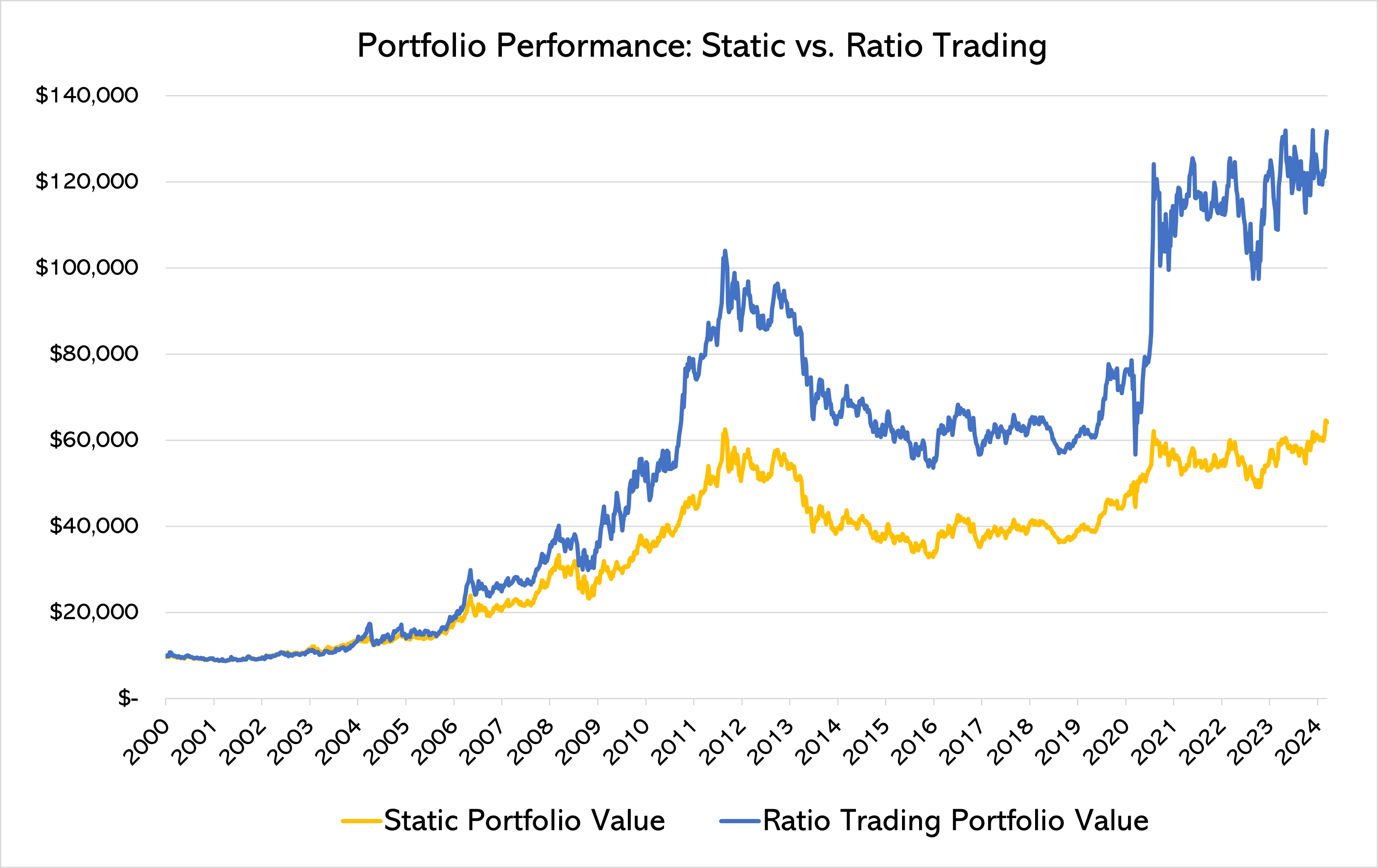

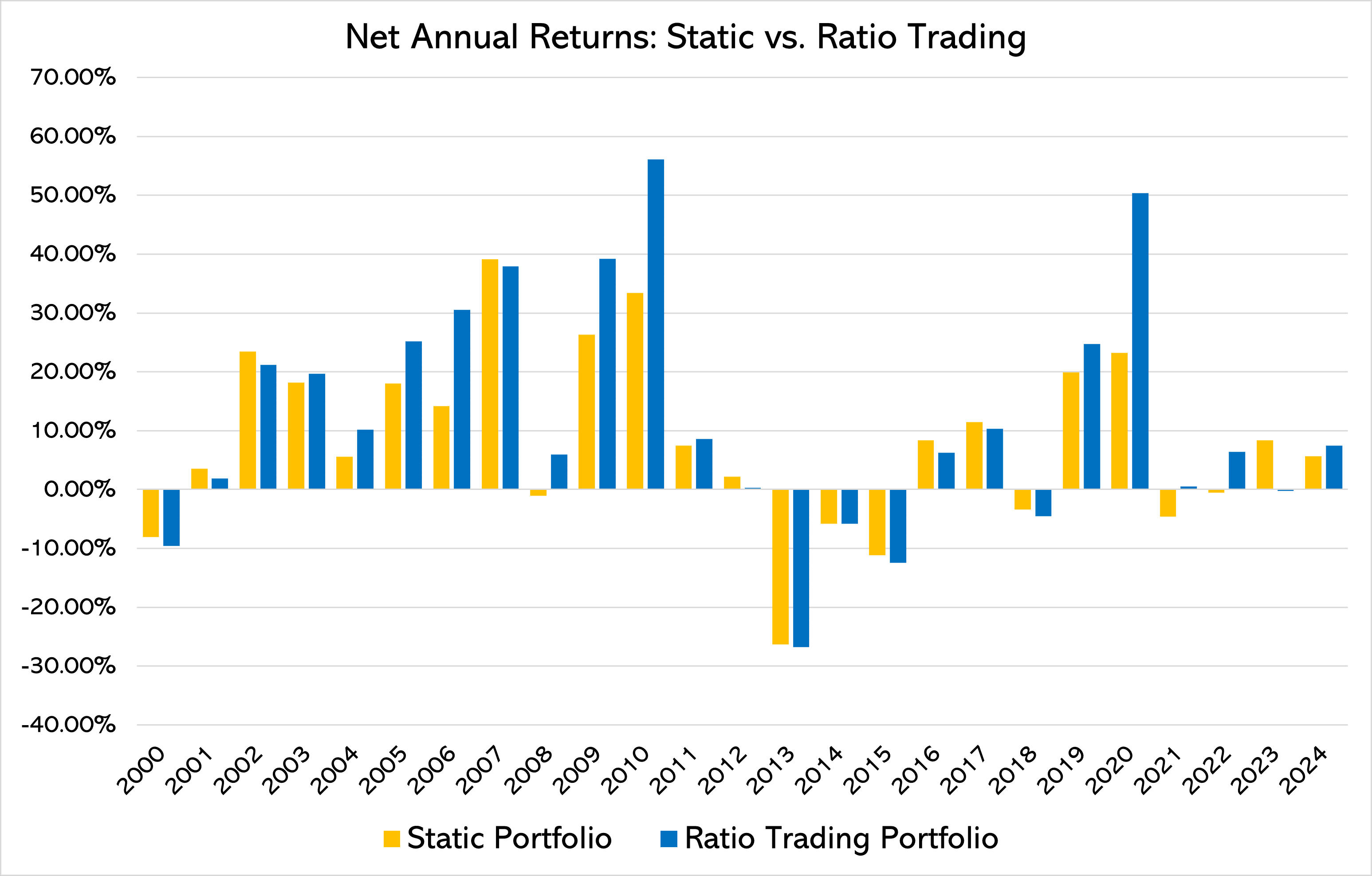

The chart below shows an example of a static gold and silver portfolio vs. a ratio trading portfolio:

Initial investment: $10,000

Time horizon: Beginning in 2000, ending in 2024

Starting allocation: 90% gold, 10% silver

Final Portfolio Value:

- Static: $64,151.22

- Ratio Trading: $131,196.55

CAGR:

- Static: 7.72%

- Ratio Trading: 10.85%

Total Return:

- Static: 541.5%

- Ratio Trading: 1,212.0%

The performance of portfolios presented above are not indicative of future performance. Investors should be aware that all investments carry risk. These example portfolios are for illustrative purposes only and do not constitute investment advice, recommendation, or endorsement.

If you are interested in ratio trading, we highly recommend you open a free Vaulted account and set up a consultation with your personal advisor.

Set up a Vaulted account to learn more.