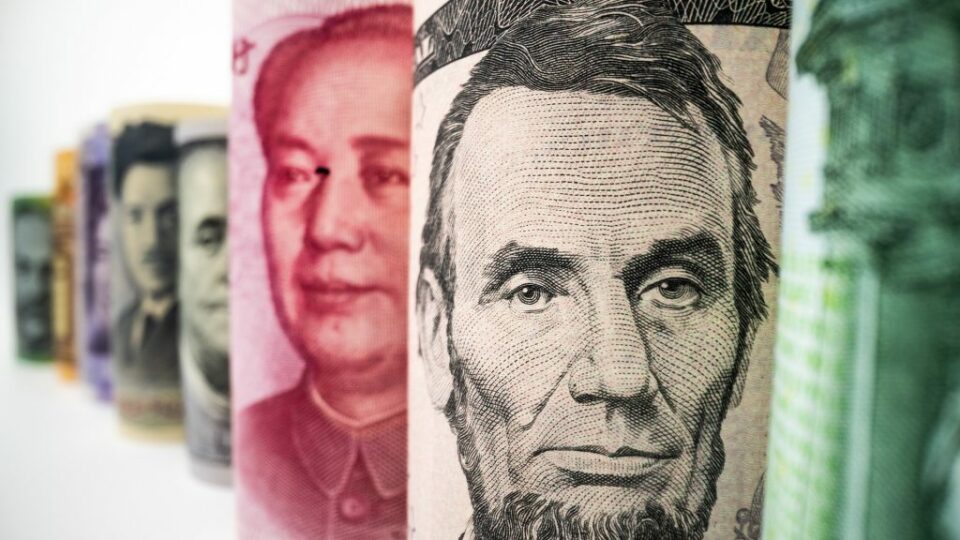

The world’s largest nations are fighting the US dollar reserve system. The only suitable replacement is gold.

Key Takeaways:

- The US dollar has been the dominant global currency since World War II, but its reign may be coming to an end as non-Western nations fight for a post-dollar world.

- The only real alternative to the dollar is gold. The yuan, euro, and yen are simply not stable enough to replace the dollar.

- Controlling the global reserve currency has allowed the US government to adopt dangerously unsustainable fiscal and monetary habits, which may come back to bite as other nations reduce their reliance on the dollar.

King of Currencies

Since the end of World War II, the US dollar has served as the global reserve currency. Governments, central banks, corporations, and individuals all use the dollar to settle international transactions and store their wealth.

Originally this made sense because the dollar was tied directly to gold. Until 1971, dollar holdings were essentially just gold holdings. After ending the gold standard, the United States succeeded in preserving dollar hegemony though the petrodollar system.

Under the petrodollar, Saudi Arabia and other oil-producing nations agreed to accept only US dollars in exchange for oil. This forced any nation who wanted oil (a.k.a. all of them) to aquire huge reserves of US dollars for international trade.

Today the dollar is still the king of currencies…but its reign may be coming to an end.

Waging War on the Dollar

Nearly every non-Western nation in the world is actively searching for alternatives to the dollar-dominated system.

Russia is leading the charge. Directly after the invasion of Ukraine, the US government imposed strict sanctions and froze billions of Russian central bank reserves held at the Federal Reserve Bank of New York. The US also removed Russia from the international payment network known as SWIFT, essentially cutting them off from the world market.

These sanctions certainly damaged Russia’s economy. However, the US underestimated the willingness of other nations to come to Russia’s aid. As soon as Western nations stopped buying Russian oil, India and China picked up the slack.

On March 15th, the WSJ reported that Saudi Arabia will consider accepting Chinese Yuan in exchange for oil, rather than dollars.

China recently brokered peace between Iran and Saudi Arabia, an unbelievable achievement that has many questioning the United States’ role as “global policemen.”

Brazil also struck a deal with China that will eliminate the need for US dollars. The nations will exchange their currencies directly, rather than using the dollar as an intermediary.

The Reckoning

These developments pose a critical threat to the US financial system. Controlling the global reserve currency is quite a privilege; no matter how much money the government prints, it will always be absorbed by international markets.

US capital markets are larger, deeper, and more liquid than any other market in the world. US companies can get funding whenever they want, financial assets can always fetch the highest market prices, and dollar holders can trust the stability of their currency.

Their privileged position has allowed the US government to adopt dangerously unsustainable fiscal and monetary habits. Policymakers print money to their heart’s content because they can use the entire global economy as their backstop. They operate with massive budget deficits without having to worry about other nations losing trust in the currency.

The Fed’s balance sheet has increased more than 1,000% over the last 20 years. Government debt has increased by 400%, topping $30 trillion last year. The more China, Russia, Saudi Arabia, Iran, South Africa, Brazil, and other powerful nations reduce their reliance on the dollar, the more these poor monetary decisions come back to bite.

De-Dollarization and Gold

De-dollarization and deglobalization threaten decades of relative peace across the world. Without a stable store of value and unit of account for international trade, we may see a deterioration toward nationalism and protectionism – the primary motivators for total war.

The truth is, no fiat currency can replace the dollar. The yuan needs larger and deeper capital markets to take on the role of global reserve currency. The ruble, euro, pound, and other leading currencies are not stable enough to replace the dollar.

The only real alternative is gold. China knows other nations will be reluctant to hold large reserves of yuan, so the People’s Bank of China (PBoC) is buying massive gold reserves to shore up their currency. According to the World Gold Council, Chinese gold reserves reached 2,050 tons at the end of February.

As the war on the dollar accelerates, we will continue to see central banks buying physical gold at a record pace.

Secure gold savings, without the excessive fees

Your weekly gold market commentary comes from our internal team of researchers and technical experts. Vaulted gives modern investors access to physical gold ownership at the best cost structure in the industry. With personal advising from industry experts and access to premier precious metals strategies, Vaulted is the key to life-long financial prosperity. Start protecting your portfolio today.

As always, thank you so much for reading – and happy investing!