The Fed is headed for an annual operating loss for the first time in 108 years. They will soon be forced to print the money to cover their expenses. A conundrum, indeed!

Key Takeaways:

- Interest rate hikes will push the Fed’s annual expenses over revenues for the first time since 1915.

- The Fed is stuck: trying to tighten policy, but forced to print money to cover losses.

- Financial conditions (the general availability of credit) are looser now than they were at the beginning of the hiking cycle!

Bleeding money

The Fed has two primary sources of revenue: interest earned on its portfolio of government bonds and loans to commercial banks.

The Fed has several sources of expenses: interest paid on reverse repo agreements, operating expenses (salaries and such), and costs associated with producing and retiring currency. But the main expense we are concerned with here is known as the IORB rate: the interest rate paid on reserve balances (the money that commercial banks hold at the Fed). The Fed started paying interest on reserves in 2008.

Typically, revenues exceed expenses. The Fed sends all its profits to the US Treasury, providing a source of revenue to the US government.

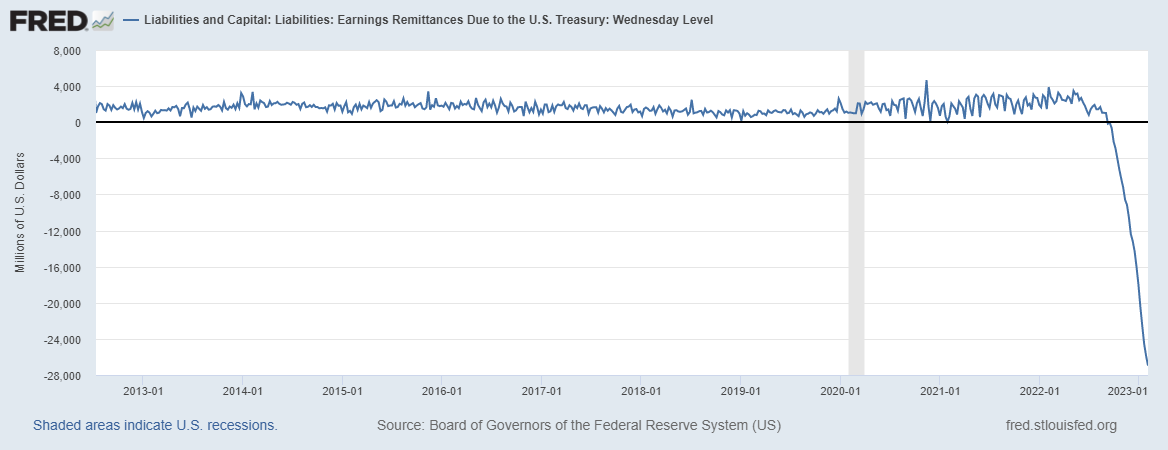

In the case that Fed expenses exceed revenues, the Fed will record a “deferred asset” on its books, defined as “the amount of net earnings the Reserve Banks will need to realize before their remittances to the U.S. Treasury resume.” (A fancy way of saying, “we are losing money!”)

The Federal Reserve Banks’ deferred assets totaled $18.8 billion the end of 2022. However, the Fed still made a profit – like it has every year since 1915.

This year is different. In 2023, the Fed is set to post its first operating loss in 108 years!

Quantitative easing in disguise?

As the Fed raises interest rates, it raises its own expenses (such as the IORB rate). Right now, the Fed is paying 4.65% on reserve balances, up from a mere 0.1% in 2021.

Here’s the problem: to cover its rising expenses, the Fed must create money.

The Fed is the lender of last resort. If it needs money, its only option is to print it. This seems comically – perhaps tragically – counterproductive when the Fed is attempting its most aggressive monetary tightening campaign in four decades.

When the Fed operates at a prolonged deficit, the effect is strikingly similar to quantitative easing. The Fed ends up creating new money to pay interest on commercial bank reserves, which the banks can then pump into the economy through consumer/business loans and asset purchases.

So, to summarize: the Fed’s rate hikes have pushed them into an operating deficit, which forces them to print money to cover the deficit!

Losing $2 Billion every week

But surely the economists at the central banks are aware of this…right?

Yes. The Federal Reserve Board has long understood the risks of operating at a loss.

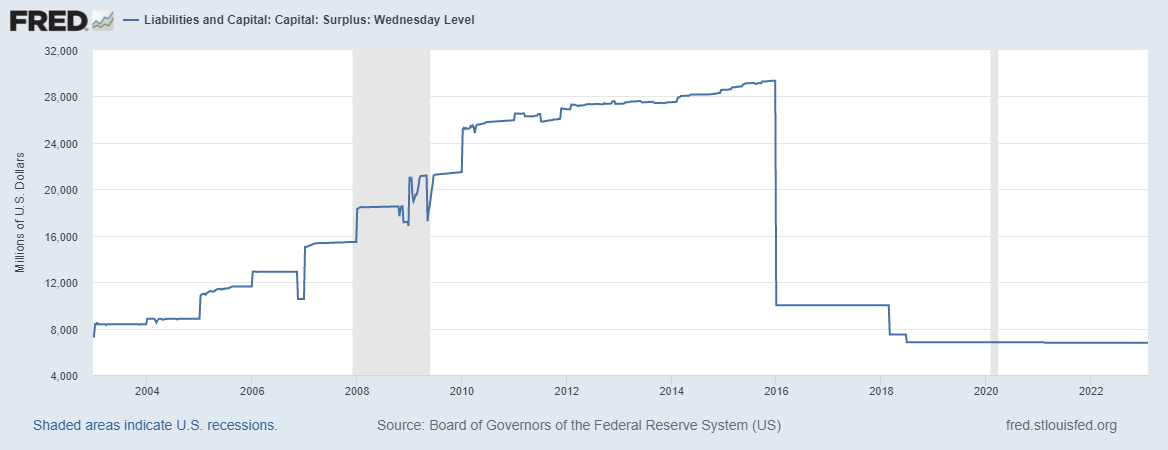

The Fed does maintain a “capital surplus” account, intended to absorb losses and prevent the necessity of paying interest with freshly printed money. According to this report from the United States General Accounting Office, “the primary purpose of the surplus account is to provide capital to supplement paid-in capital for use in the event of loss.”

The report goes on to say, “Federal Reserve Board officials noted, however, that it could be argued that any central bank, including the Federal Reserve System, may not need to hold capital to absorb losses, mainly because a central bank can create additional domestic currency to meet any obligation denominated in that currency.”

In other words, they don’t need extra reserves because they can just print the money!

Today, the total surplus capital of all 12 Federal Reserve Banks is currently a mere $6.8 billion.

The Fed is currently losing $2.2 billion per week, which puts us on track for nearly $120 billion of “deferred assets” by the end of the year. So, this capital cushion doesn’t help much. For another bit of tragic comedy, check out this Fed press release from July 15, 2022. Current losses are close to exceeding the worst-case scenario Fed analysts predicted just eight months ago. Glad to see those trusty “stochastic simulations” are doing their job again!

The chart below shows the impact of Fed losses.

A conundrum, indeed

So why doesn’t the Fed just stop paying interest on reserves?

They certainly could, although reducing the IORB rate would cause other problems.

When Treasury yields rise, the Fed is forced to pay a higher rate on reserves as well, or commercial banks will simply turn around and buy treasuries. This would push rates back down, loosen financial conditions and negate the effect of rate hikes altogether!

But wait…it gets better.

When banks find themselves earning an extra 4.65% of reserves per year, they prefer to do something with the money (they are profit-seeking enterprises, after all). Whatever they end up doing – buying treasuries, creating consumer loans, or spending – the effect is monetary loosening.

If banks loan out the new reserves, they will increase the money supply and provide upward pressure on inflation, which is exactly the opposite of what the Fed wants.

The burden of Fed losses will inevitably end up on the taxpayer, either through higher taxes, public debt, or a devalued currency.

Financial Conditions are Loosening

You would think record rate hikes would cause tightening of financial conditions. “Financial conditions” refers to the general availability of credit in the economy. However, according to the Chicago Fed National Financial Conditions Index (NFCI), financial conditions are looser now than they were at the beginning of the hiking cycle!

Below is a view of the NFCI since 2000. A positive number on the NFCI indicates tighter-than-average financial conditions. A negative number on the NFCI indicates looser-than-average conditions. This hiking cycle did not get us up to average.

This dynamic reveals the difficulty (impossibility, perhaps) of putting the brakes on an economy that runs on cheap credit. If conditions continue to loosen, inflation might find a foothold again.

We can’t help but chuckle at the insane situations that occur under a fiat currency system.

Secure gold savings, without the excessive fees

Your weekly gold market commentary comes from our internal team of researchers and technical experts. Vaulted gives modern investors access to physical gold ownership at the best cost structure in the industry. With personal advising from industry experts and access to premier precious metals strategies, Vaulted is the key to life-long financial prosperity. Start protecting your portfolio today.

As always, thank you so much for reading – and happy investing!