Prior to 1971, the US dollar was backed by gold. Today, the dollar is backed by 2 things: the government’s ability to generate revenues (via debt or taxes), and its authority to compel economic participants to transact in dollars.

If you ask 100 people what backs the US dollar today, you might get 100 different answers.

Is it the “full faith and credit of the US government”? The “strength of the US economy”? Is it the “trust of those who use it”? Monetary policy? Depth and liquidity of US capital markets? Its role in international finance? US political stability?

None of these answers are sufficient.

Perhaps the answer is: absolutely nothing. But if the US dollar is really backed by nothing, why are people willing to use it as a store of value and medium of exchange?

Precious Metals to Paper: A Quick History of the Dollar

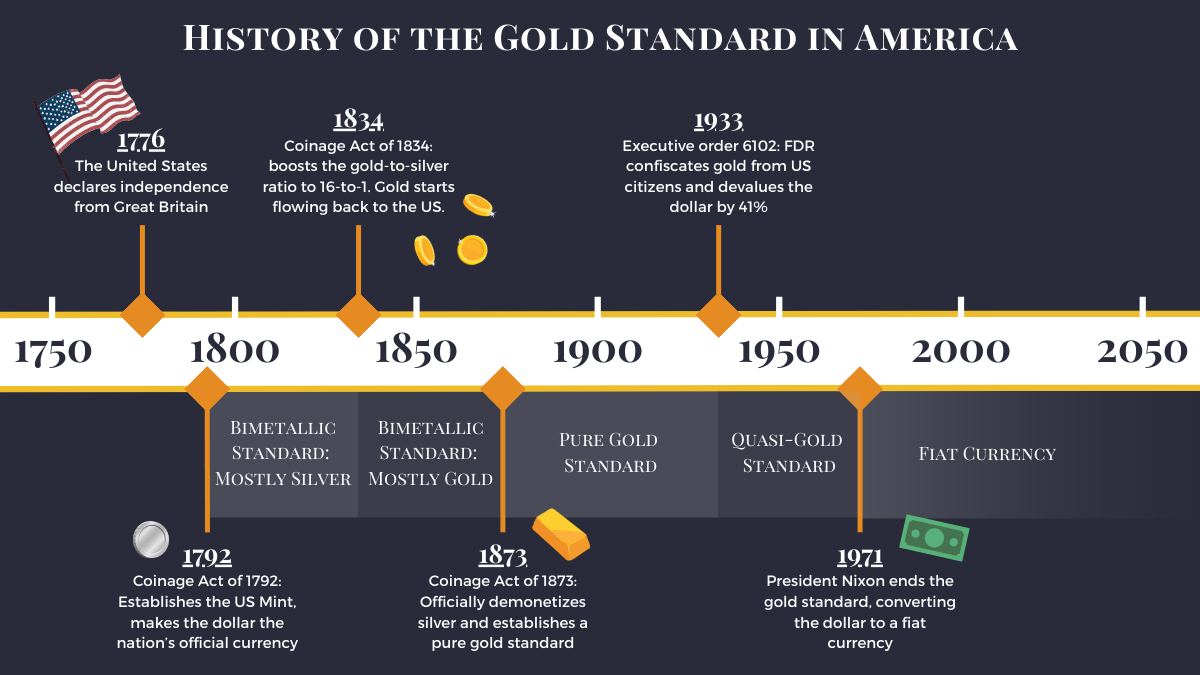

For most of US history, the dollar was backed by gold, silver, or a combination of both.

In fact, until 1933, the word “dollar” was literally defined as 1/20 of a gold ounce (just like England’s “pound sterling” literally meant “one pound of sterling silver”). It took 200 years for the US government to erode the link between the dollar and gold.

In 1971, President Nixon officially ended the gold standard and made the United States dollar a fiat currency. Fiat means “let it be done” in Latin. Therefore, a “fiat currency” derives its value from government decree rather than any physical commodity.

Here is a timeline of the dollar’s transition from precious metals to paper:

Check out History of the Gold Standard in America for a comprehensive history.

Fiat Currency: Backed by Government Decree?

But surely a government decree is not sufficient to turn paper into money. If the government passed a law that said all greeting cards, or printer paper, or pages ripped from a dictionary will now serve as money, we would scoff.

Plus, it is not just those under the US jurisdiction that use the dollar. The dollar is the global reserve currency, which means individuals, institutions, and central banks all over the world use it as a medium of exchange and a store of value.

Ultimately, all currencies must be backed by something valuable. Either the currency is intrinsically valuable (gold and silver coins, for example), or it represents something valuable.

The Gold Standard vs. The Fiat Dollar

Gold has its own market value independent of any counterparty or government. Under the gold standard, the value of the dollar was directly linked to the amount of gold held in reserves. No one needed to trust the issuer of the currency; they just needed to be able to redeem their dollars for gold at a 1:1 ratio.

Government fiat, on the other hand, has no intrinsic value. If a government wants to manage its own currency, it must create its own demand. It must prove that it has a consistent source of revenue – a way to access real economic value – to back up the currency.

The Dollar is Backed by US Government’s Ability to Generate Revenues

There are two ways for the government to generate revenue:

- Taxes: Market participants (workers, entrepreneurs, investors) create wealth when they produce and exchange goods and services. The government extracts a portion of this wealth via taxes. Capital gains, income, corporate, payroll, sales, property, excise, and estate taxes are all ways of extracting wealth at different stages of the market process.

- Debt: The government extracts wealth from the future and brings it to the present by selling government bonds (Treasury securities). Of course, all debt must be paid back with interest, or else no one will lend the money in the first place.

So, rather than allowing users to redeem their dollars for a valuable asset like gold, the government ties the value of its fiat currency to its ability to generate revenues through taxation and debt. Both are a way of saying, “we have access to something valuable, therefore you can trust that the dollars in your pocket will always be worth something.”

The stronger and more stable the economy, the better. The government has access to a huge reservoir of economic value as long as the market process continues. The government itself produces little to no wealth, although it does maintain the legal structures to make production, exchange, and wealth creation more efficient.

The United States has the largest and most diverse economy in the world. Its capital markets are deep, transparent, and stable, which increases trust and encourages both domestic and international market participants to use the dollar for transactions.

Is the Dollar Backed by Government Debt?

In some ways, yes. Congress requires the Federal Reserve to hold a portfolio of government bonds (mostly Treasury securities) that covers the total value of physical dollar bills in circulation.

If we check the Fed’s latest balance sheet report (H.4.1), we can confirm that “Securities held outright” exceeds “Currency in circulation”.

So, dollars in circulation are backed by government debt. However, it is important to realize that physical currency is only a tiny portion of the total money supply. This is because most money is created by commercial banks, not the Federal Reserve.

The US government ensures the value of Treasuries (and thereby the dollar) by ensuring that foreign and domestic economic participants trust that the United States will always pay back its debts. Indeed, investors often consider Treasuries to be “risk-free” because US creditworthiness is so strong.

How the Government Ensures the Dollar’s Exchange Value

We still haven’t covered the whole story. A functional currency needs to be highly marketable, which means people need to use it for everyday transactions.

The US government uses four mechanisms to guarantee the economy’s dependence on the dollar, thereby maintaining its exchange value:

- Legal tender laws

- Regulation of the banking system

- Monetary policy

- International trade agreements

Legal Tender Laws

When a government designates a currency as “legal tender,” it means the court system recognizes the currency as a valid means for settling debts. By law, individuals and businesses must accept it as a form of payment and acquire it to pay taxes.

The Mint Act of 1792 authorized the US dollar as legal tender, guaranteeing its widespread acceptance.

Regulation of the Banking System

Banks manage the flow of credit by connecting creditors (those looking to lend) with debtors (those looking to borrow). Naturally, if you want to control the nation’s currency, the banking system is the place to start.

It is no coincidence that the banking system is one of the most heavily regulated and centralized industries in the United States. Banks operate privately, but only under a strict regulatory framework. Banks are required to have accounts at the Fed, where they hold reserves in US dollars.

Whenever you get a loan from a bank, you get it in dollars. US banks will typically only accept deposits in dollars. If you want to use a different currency, you will be almost entirely cut off from the banking system.

Monetary Policy

Lastly, the Federal Reserve uses monetary policy to control the value of the dollar by setting short-term interest rates and controlling the money supply.

Raising interest rates can attract foreign capital seeking higher returns on U.S. investments. This drives up demand for the dollar, leading to an appreciation in its value. Lowering interest rates can discourage foreign investment, leading to a depreciation of the dollar as investors seek higher yields elsewhere.

The Federal Reserve often buys and sells US Treasury securities in the open market to influence the money supply, which, in turn, affects the value of the dollar.

Properly implemented, monetary policy can enhance stability and trust in the currency. However, the numerous hyperinflationary episodes across history remind us that governments often mismanage their currencies to the point of collapse.

International Trade Agreements

The US frequently enters into bilateral and multilateral trade agreements which impact the demand for the dollar. Trade partnerships influence the flow of the currency in global transactions.

When discussing “what backs the US dollar?” we would be remiss not to mention the petrodollar. The petrodollar system is perhaps the best example of how a government can ensure its own currency’s exchange value on the international market.

The Petrodollar: Backed by Oil?

After the collapse of the gold standard in 1971, the US entered into agreements with Saudi Arabia and other oil-producing nations where they agreed to price and sell their oil exclusively in US dollars. In return, the United States agreed to provide military support to these countries.

This arrangement created strong global demand for dollars because countries needed them to purchase oil, a crucial commodity for all economies. As a result, the US dollar became the dominant global reserve currency.

In recent years, the petrodollar system has come under fire. Some countries (especially BRICS nations – Brazil, Russia, India, China, and South Africa) have explored alternatives to the US dollar for international trade, such as other currencies and even gold.

Weaknesses of the Fiat System

Fiat currencies are the accepted paradigm across all modern economies. However, the structural weaknesses in the fiat currency system may eventually bring it to a close.

The first weakness of a fiat system is the lack of safeguards on money printing. According to Nobel Laureate F.A. Hayek, inflation is politically impossible to avoid under a fiat system because it always provides “temporary escape from acute difficulties.” Printing money and stacking on debt can “quickly remove the causes of discontent of particular groups…but are bound in the long run to disorganise and ultimately to destroy the market order.”

Nearly 250 years ago, Adam Smith wrote in The Wealth of Nations, “There is no art which one government sooner learns of another than that of draining money from the pockets of the people.”

Unfortunately, these great economists have been proven correct. Since the creation of the Federal Reserve in 1913, the U.S. dollar has lost 98% of its purchasing power.

The ability to create money removes fiscal discipline. Governments tend to rely on currency creation rather than making tough fiscal choices, leading to unsustainable debt levels and economic instability. A debt-based monetary system requires pulling more and more purchasing power from the future. Under this system, perpetual devaluation of the currency is all but guaranteed.

Hayek and other economists have proposed systems which allow banks to issue their own currencies, thereby removing the government’s monopoly on money. In theory, this would allow consumers to choose currencies that are stable and well-managed, rather than being compelled to use the government’s fiat currency.

What Will Back the Dollar Tomorrow?

Are cryptocurrencies the future? Unlikely, considering they have no claim on anything valuable. Fiat money represents the government’s authority to tax, take on debt, and compel economic participants to transact in dollars. Cryptos have none of these.

A Central Bank Digital Currency (CBDC) would theoretically combine the merits of both systems. A “digital dollar” would be backed by US dollars at the Fed, giving the government even tighter control of the currency and its users.

Unfortunately, this would not address the problems of inflation, debt, and devaluation endemic to fiat money.

Wherever the dollar ends up, we are encouraged that investors have ways to back their own wealth with something more solid than “decree” or “trust.” We hope Vaulted can reunite your portfolio with the asset that backed the dollar for most of US history.