The value of central bank gold reserves just surpassed the value of foreign U.S. Treasury holdings. When the biggest players in the world swap bonds for bullion, it’s worth paying attention.

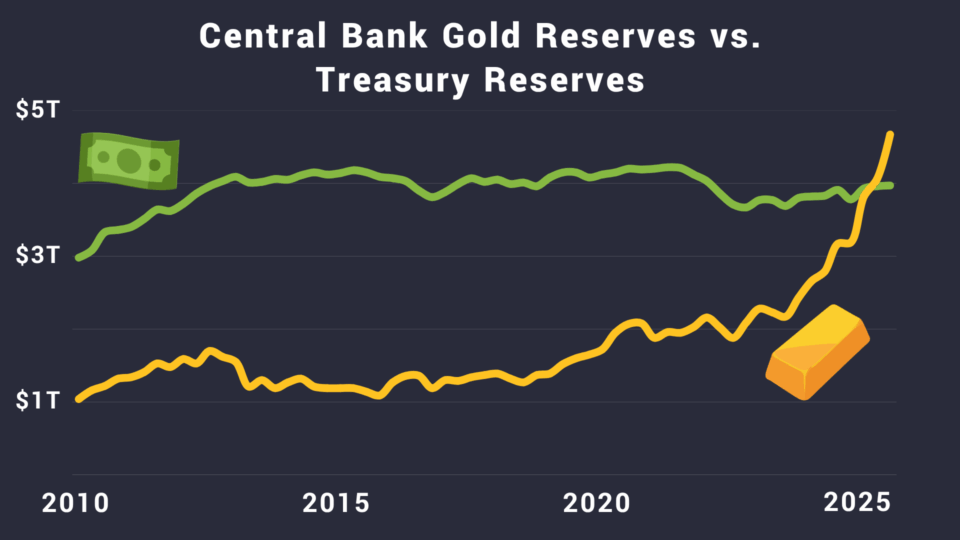

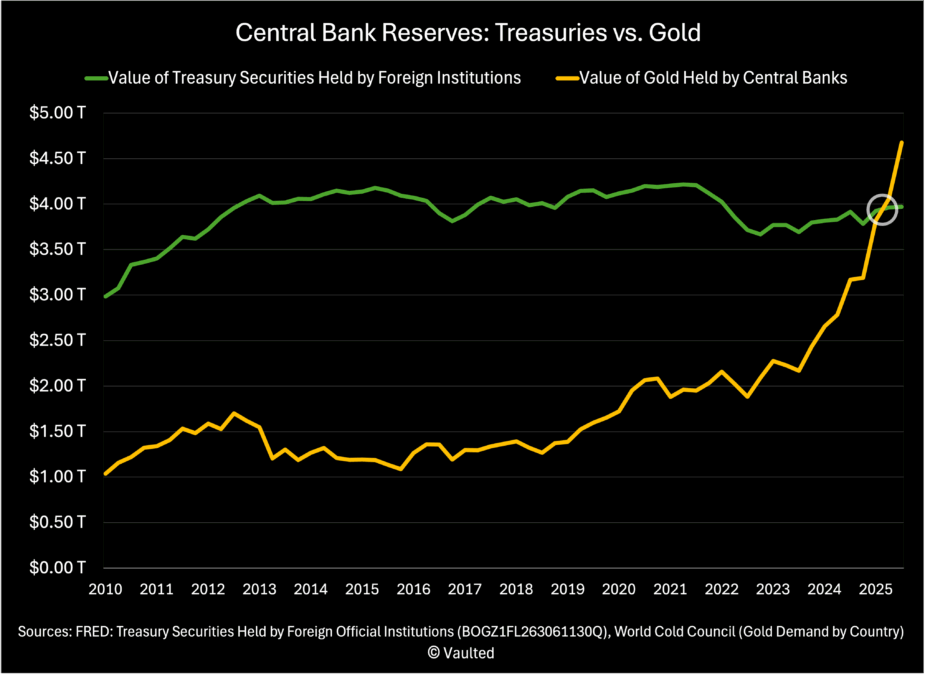

Central Bank Gold Reserves vs. Treasuries

For decades, U.S. Treasuries were the crown jewel of central bank reserves. Stable, liquid, and backed by the “full faith and credit” of the U.S. government.

Is that era fading?

In 2025, central bank gold reserves officially overtook Treasuries. This is the first time since 1996 that gold has taken a bigger slice of reserves than U.S. Treasuries.

According to the World Gold Council, central banks collectively own about 18% of all gold ever mined: 38,214 metric tons. Their gold is worth $4.6 trillion at today’s prices.

This chart shows the total value of foreign treasury reserves vs. the total value of gold reserves held by central banks since 2010:

In the 2010s, Treasuries made up more than 30% of central bank reserves. That number has now dropped to 23%, while gold’s share has risen to 27%.

Why Central Banks Are Choosing Gold Over Treasuries

In each of the last three years, central banks have collectively purchased over 1,000 tonnes of gold (double the annual average from the previous decade).

The WGC reports that 76% of central banks expect to increase their gold holdings over the next five years, while 73% said they expect their dollar reserves to decline.

Here are the reasons:

- Post-pandemic inflation has eroded confidence in fiat currencies.

- U.S. fiscal health is deteriorating. Rising deficits and debt levels make U.S. Treasuries more risky.

- Treasuries are vulnerable to U.S. sanctions. BRICS nations want reserves that cannot be frozen or blocked by the U.S. government.

- Federal Reserve independence is under question, raising doubts about long-term monetary stability in the U.S.

- Geopolitical instability makes “neutral” assets like gold more appealing for settling transactions between nations.

Simply put: Treasuries come with strings attached. Gold does not.

Why This Matters for Investors

Central banks don’t chase trends. When they move, they move deliberately, and usually for the long term. Their pivot toward gold signals a profound realignment in the global financial system.

For individual investors, this shift reinforces gold’s role as:

- A store of value that outlasts political cycles

- A hedge against inflation and currency risk

- A counterbalance to both bonds and equities in a diversified portfolio

The fact that central banks now hold more gold than Treasuries is the clearest sign yet that trust in paper promises is waning.

Unlike central banks, you don’t need a trillion-dollar balance sheet to start buying gold.

With Vaulted, you can buy and hold physical gold with just a few taps.