Indian wedding season, Christmas, Chinese Lunar New Year, and other seasonal patterns can significantly impact the price of gold.

What is the best time to buy gold?

Adding hard assets like gold and silver to your portfolio is a sure way to protect against market volatility and inflation — and there’s rarely a bad time to increase your holdings. However, investors should be aware of the seasonal patterns that favor precious metals.

First, let’s look at the data.

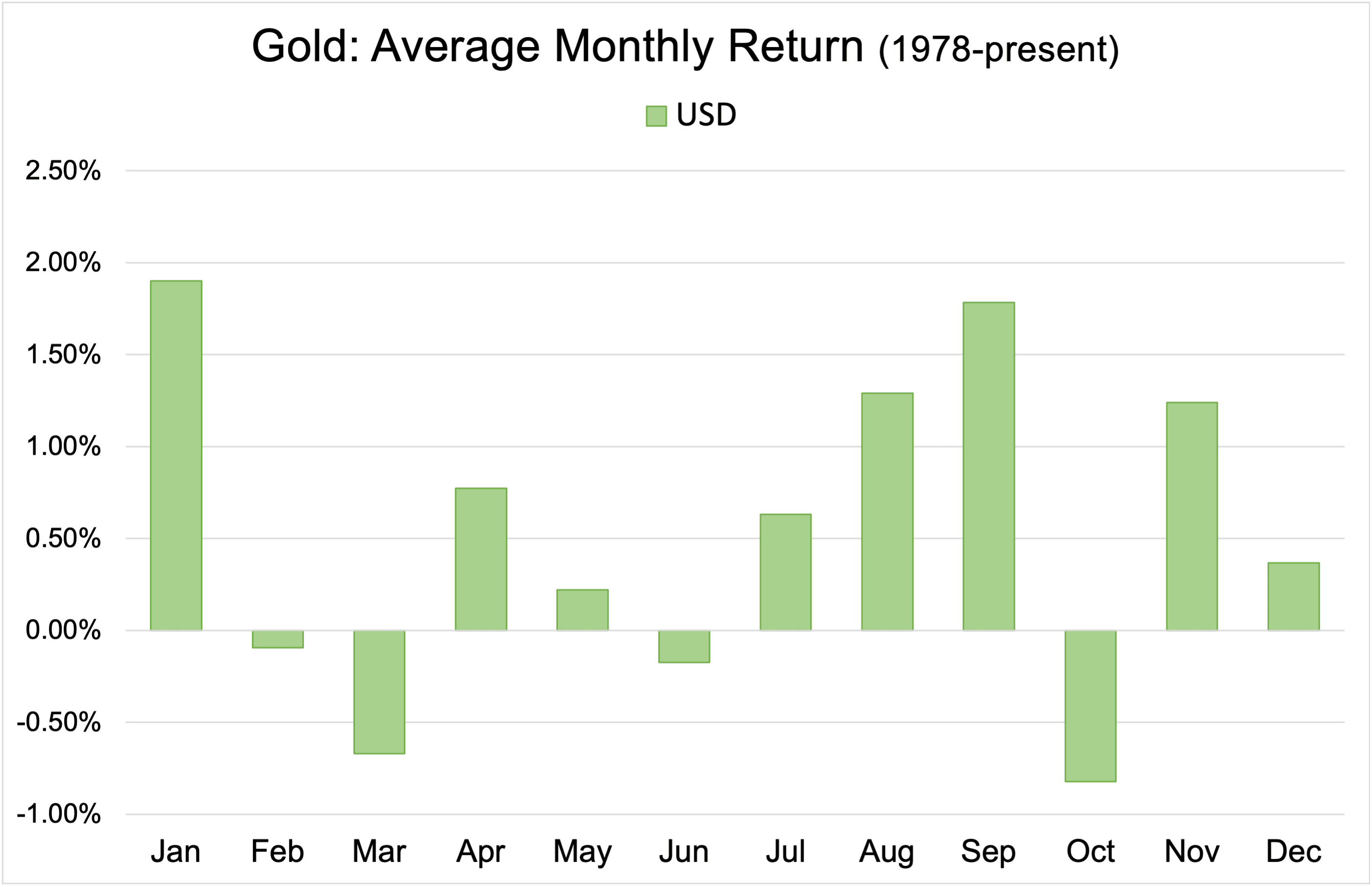

The chart below shows gold’s average monthly performance in US dollars from 1978 to present.

August, September, and January have historically been gold’s strongest months. January is the strongest, with an average monthly return of 1.90%.

March, June, and October tend to be gold’s weakest months.

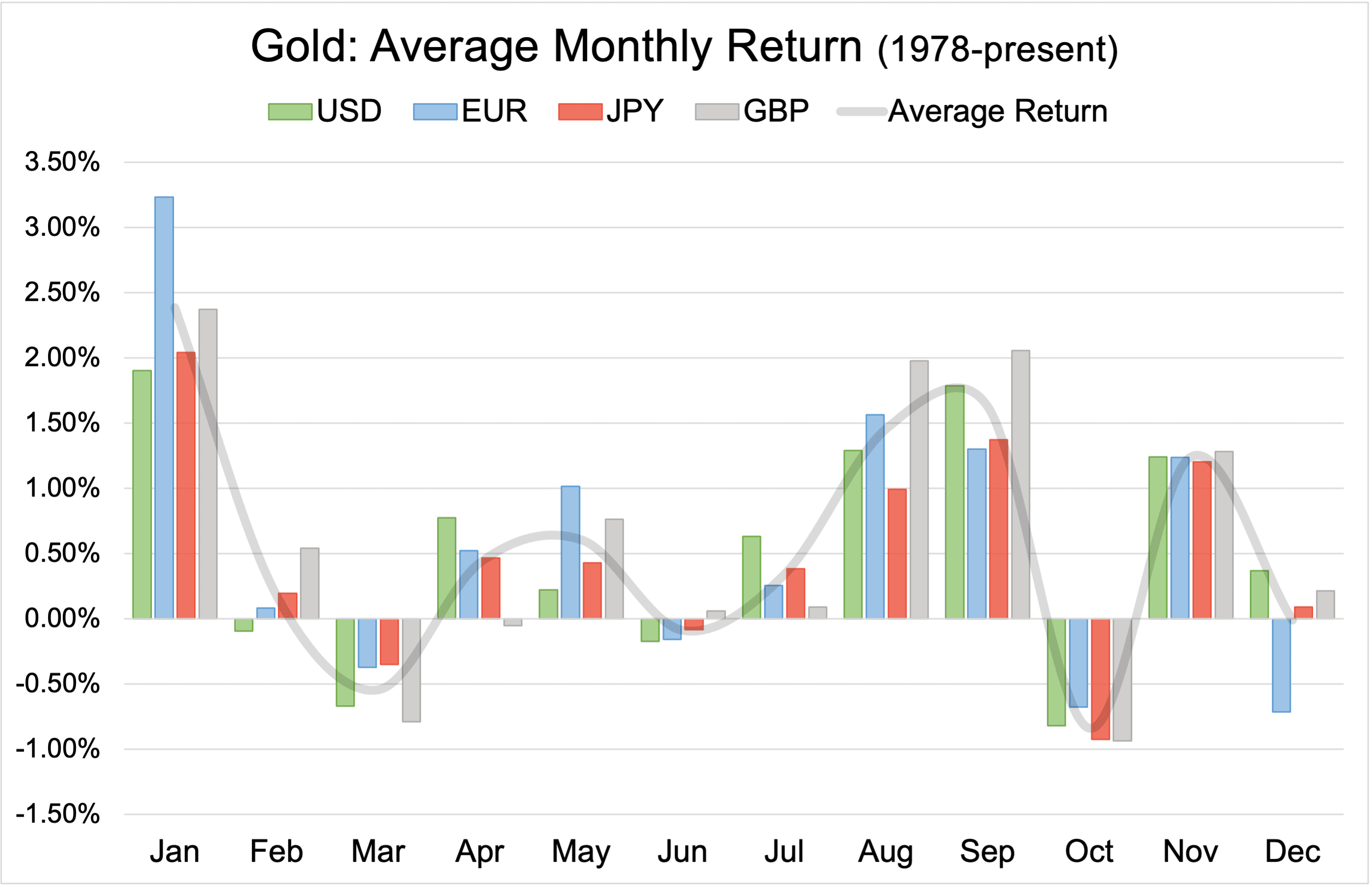

This pattern persists across other currencies. Below we see gold’s average monthly performance in four currencies: the US dollar, Euro, Japanese yen, and British pound. January still has the highest average return of 2.39%.

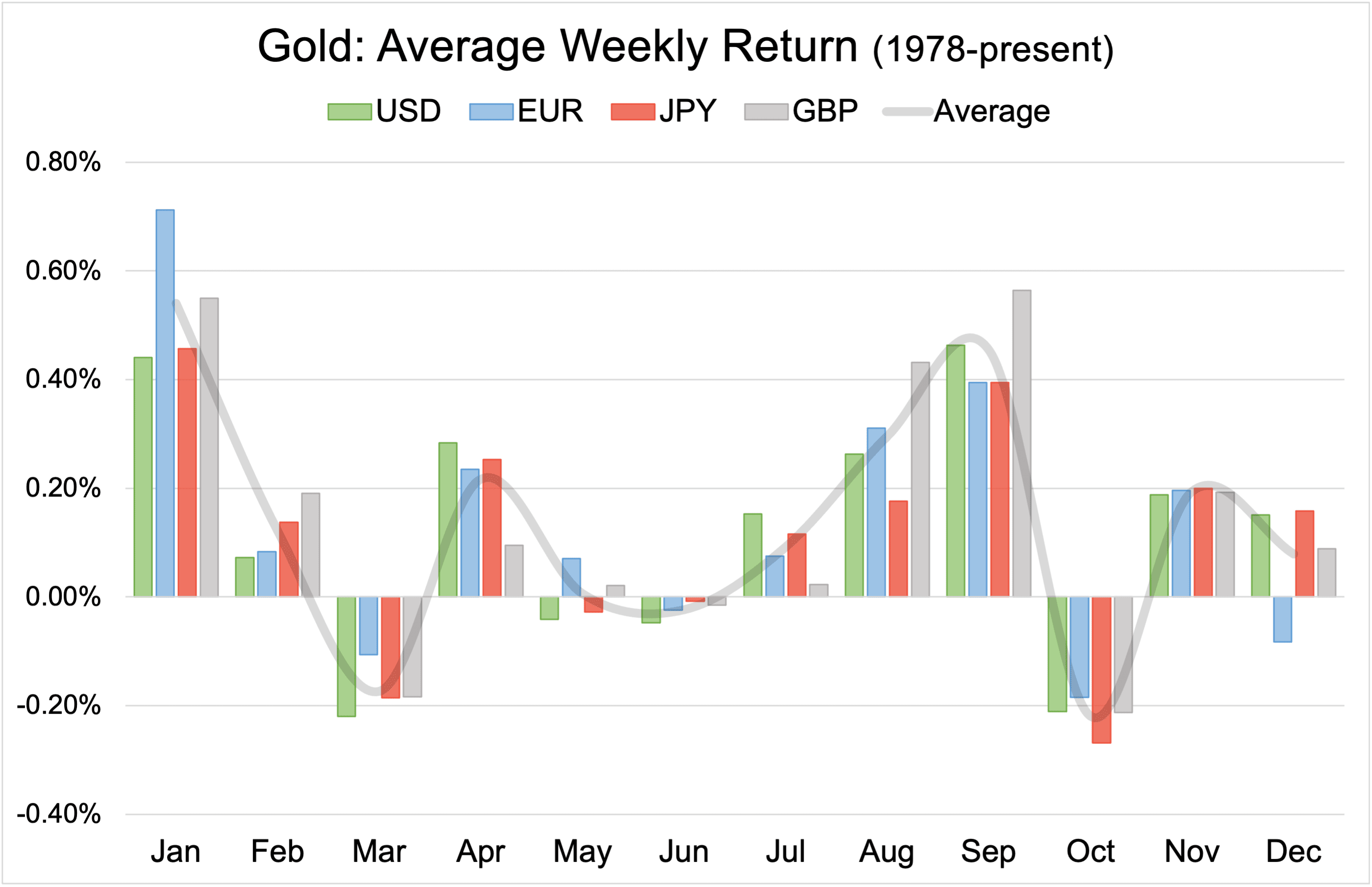

If we look at weekly performance, we see a similar pattern. The chart below shows average weekly performance during any given month.

A very similar trend persists if we map out gold’s median monthly returns, which reduces the influence of extreme outliers.

In this article, we delve into the factors driving these patterns. Our goal is to offer enhanced insights into gold’s seasonal patterns and identify opportunities to enter/exit the market.

It should be noted that countless factors influence the price of gold. Past seasonal trends may or may not continue in the future.

The “January Effect”

Gold’s strong performance at the beginning of the year is known as the “January Effect.” It stems from tax-loss selling in December, where investors sell assets to offset capital gains or lock in profits. When the new year begins, investors re-enter the market and buy assets with their year-end bonuses.

The January Effect appears in the stock market as well (especially small-cap stocks).

The Gold Rush of Indian Wedding Season

Gold holds immense cultural significance in both India and China, the two largest gold consuming nations.

November marks the beginning of the Indian wedding season, and with it a huge influx of gold buying.

An Indian wedding is more than just one special day. The week-long extravaganza includes a huge gathering of friends and family, religious ceremonies, singing, dancing, and feasting.

Gold jewelry is an integral part of Indian bridal attire. Hindus believe that Lakshmi (the goddess of wealth and good fortune) brings blessings to the groom’s family via the bride. It is customary for the bride to wear elaborate gold necklaces, bangles, earrings, and other ornaments on her wedding day as symbols of prosperity and purity.

The period between November and February as this is seen as the most auspicious time to get married. According to Nikkei Asia, there were 3.2 million weddings in India in 2022.

Gold Glitters in the Winter Holiday Shopping Season

Retailers know well that Black Friday through Boxing Day is the prime shopping season in Western nations. Thanks to the explosion of e-commerce, the holiday shopping season typically starts in November.

Gold necklaces, earrings, and bracelets are in high demand during the prime shopping season. Gold coins can also be a perfect gift for children and grandchildren as a tangible asset that retains value (like savings bonds, but much cooler).

Gold and platinum engagement rings are also in high demand during the holidays. According to Wedding Wire, the most popular days to get engaged are Valentine’s Day, New Year’s Day, Christmas Day, and Christmas Eve. The Wedding Report shows that 15% of all proposals happen in the last two months of the year.

During this time, silver tableware can also see an uptick in demand.

The Chinese Lunar New Year Ushers in Gold Demand

Gold plays an integral role in Chinese Lunar New Year festivities. Loved ones often exchange gifts of gold jewelry to convey their best wishes for a prosperous year ahead.

They also give out red envelopes, known as Hong Bao (“红包” in Mandarin), as a symbol of good luck and prosperity. The envelopes usually contain paper currency or gold coins in a “lucky number” amount — the number 8 in particular.

The true origin of Hong Bao started with gold.

As the legend goes, Sui was the demon who terrorized children while they slept on New Year’s Eve. To keep Sui away, the children would try to stay up all night.

One day, a child was given 8 gold coins to play with to keep him away and keep Sui away. The child fell asleep with the gold coins under his pillow. When Sui appeared, the coins shone with a bright light that scared the demon away.

Chinese gold demand tends to pick up in December and January in preparation for the New Year, which usually falls in late January/early February. Besides being a symbol of renewal, hope, and prosperity, gold represents the supremacy of the Chinese emperors throughout history.

Gold’s Summer Doldrums

Gold demand from Eastern nations cools off in the summer months. As a result, precious metals tend to trade lower in the summer, providing strategic entry points.

Prudent investors use summer months to add more ounces before the gold rush in the fall. Buy at a lower price, and watch your metals grow in value in the autumn.

Why Buy Gold Any Time of Year?

Investing in hard assets like precious metals gives your portfolio distinct advantages.

Diversification

Precious metals often move counter to stocks, providing a financial cushion when other assets decline. Gold and silver also offer excellent liquidity.

Inflation protection

Unlike fiat currency, gold and silver are finite. They cannot be printed by the government, which is why they have maintained their status as money for thousands of years.

Personal satisfaction

There’s something viscerally satisfying about owning a tangible asset. It’s not just numbers on a screen. It’s real, and it’s yours.

Get Started with Vaulted

Buying and securing gold and silver has never been easier. You can set up a free Vaulted account in 30 seconds.

Once you link your bank account and transfer funds, you can buy physical gold and silver in any quantity, on demand.

Vaulted instantly processes your transactions during market hours, and you always pay the lowest premiums in the industry.

Click here to learn more about buying gold and silver with Vaulted.