Gold has a few key characteristics that make it an essential tool for achieving superior returns, building long-term wealth, and hedging against economic downturns.

Striking it Rich

The term “strike it rich” originated in the 19th century, when prospectors rushed across America in search of gold. Those lucky enough to discover a shiny yellow vein in the side of a mountain, or a riverbed full of gold nuggets, lived the rest of their lives in luxury.

To this day, gold represents prosperity and affluence. But can gold still deliver wealth to the modern investor?

The answer is yes, but not overnight. Gold plays a vital role in a robust, diversified portfolio. It has helped millions of investors hedge against inflation, protect against economic downturns, and achieve superior returns.

However, these results are not guaranteed. To bolster your wealth with gold, you need to understand how it functions as an asset.

Gold is a Hedge

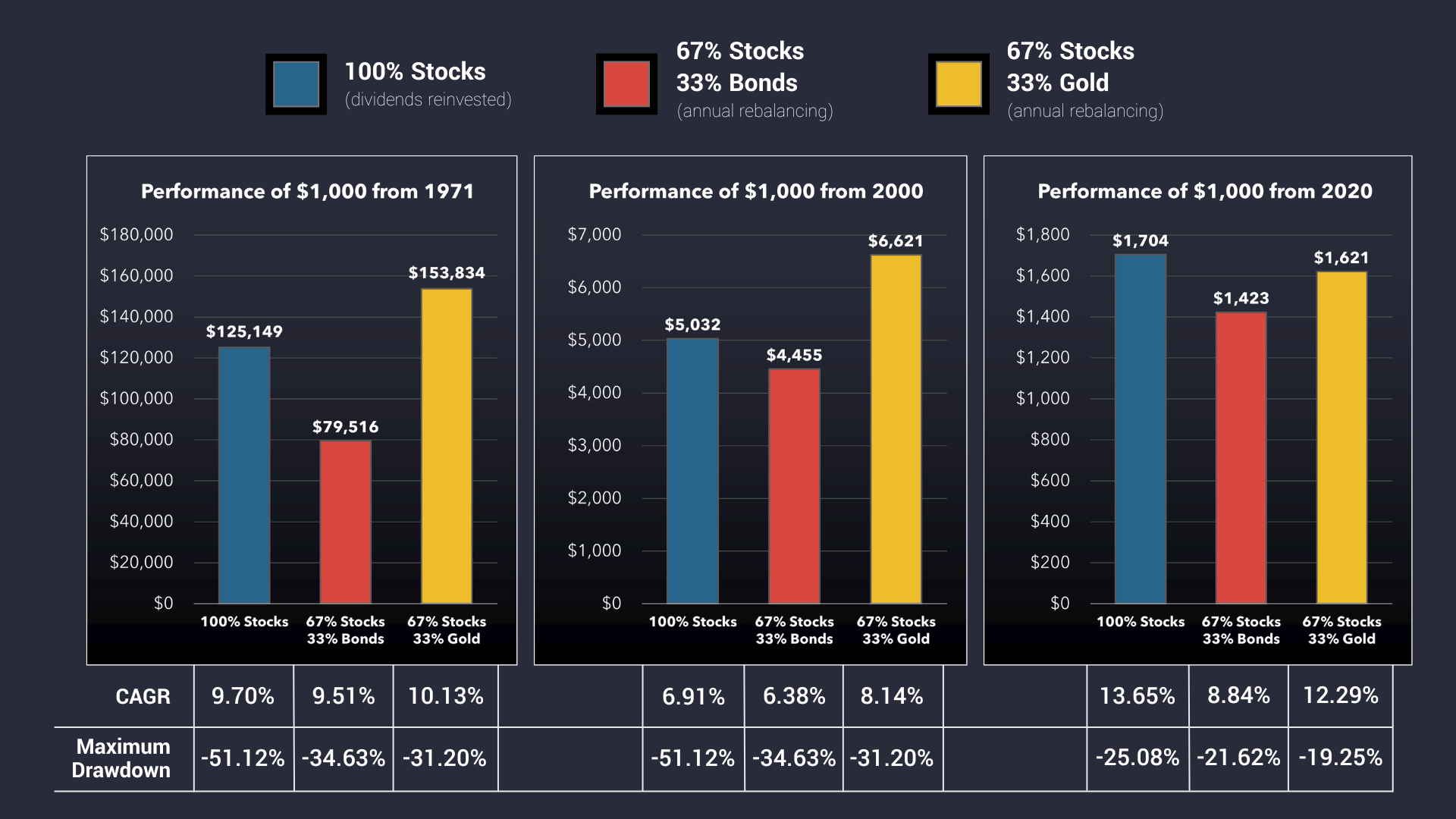

Since 1971, when President Nixon removed the U.S. dollar from the gold standard, gold has kept pace with the major stock market indices. Gold is a high-performing asset, but investors typically don’t buy it expecting to 10x their money. Investors buy gold to balance their exposure to more risky assets, such as stocks.

Gold is uncorrelated with most other asset classes. When stocks are doing well, gold tends to lag. When stocks crash or stagnate, gold tends to go up.

Non-correlation between asset classes is a vital characteristic of a healthy portfolio. It doesn’t matter how much you make in a bull market if you lose it all in the next bear market.

When integrated with stocks, bonds, real estate, and other financial assets, gold reduces maximum drawdowns in a portfolio. This held true during the dot-com bubble of 2000, the Great Financial Crisis of 2008, and the COVID crash of 2020.

An investor that hedges risk and diversifies will always outperform the investor that throws all his eggs in one basket.

Gold Protects Purchasing Power

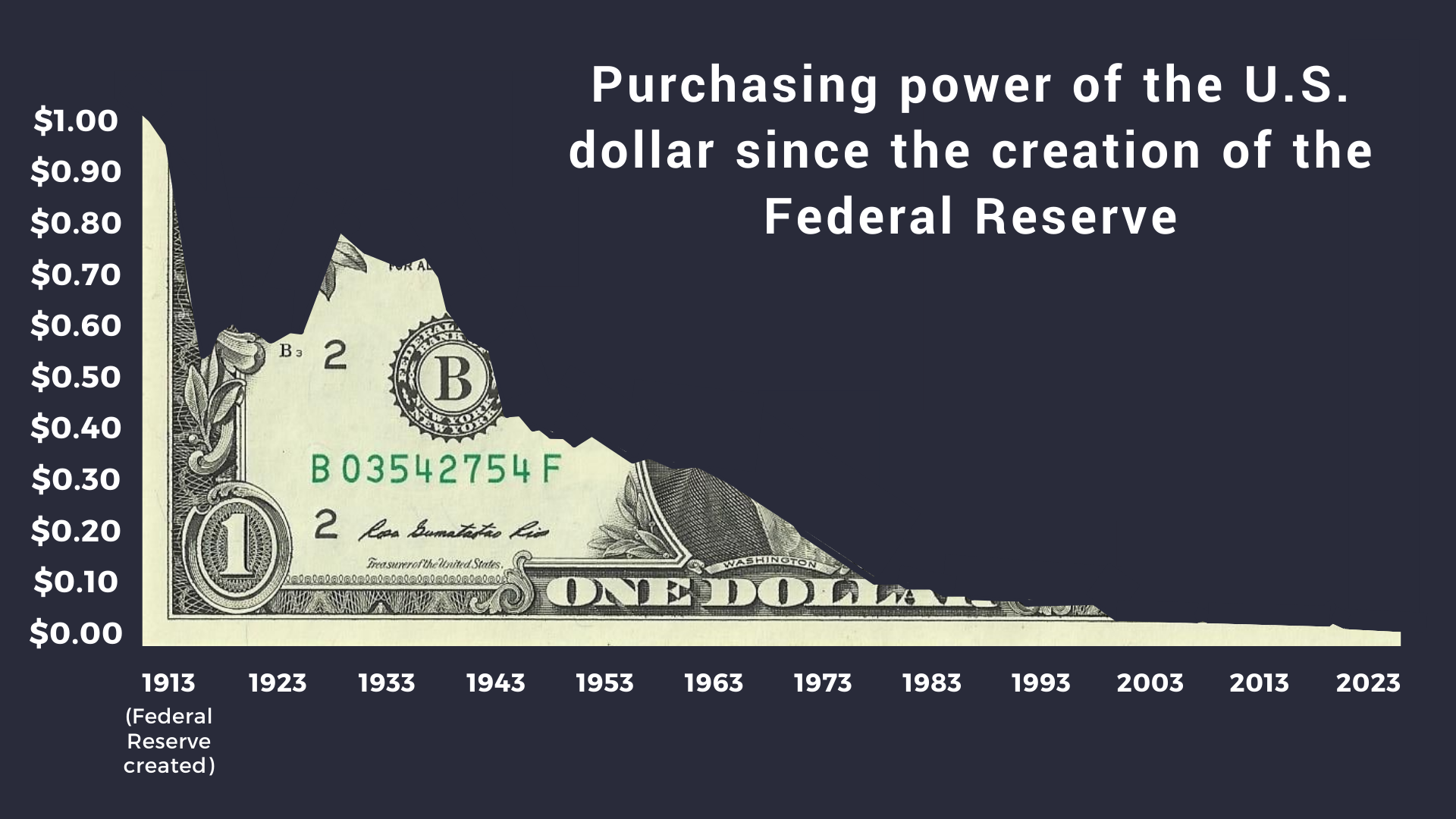

Since the creation of the Federal Reserve in 1913, the U.S. dollar has lost 98% of its purchasing power. The gold price, on the other hand, has multiplied a hundredfold. This may seem like a lot, but really gold has just maintained its purchasing power. Today, one ounce of gold purchases approximately the same goods and services it did 100 years ago.

But it doesn’t stop there: price data from Roman times suggests that gold has maintained its purchasing power for thousands of years. During the reign of Emperor Augustus (27 B.C. to 14 A.D.), a Roman centurion earned the equivalent of about 40 ounces of gold every year. The closest modern comparison to a Roman centurion might be a U.S. Army captain, who earns an annual salary equivalent to, you guessed it, 40 ounces of gold.

Governments cannot resist the urge to print money. For this reason, keeping your wealth denominated in fiat currency is a dangerous game. As the costs of goods and services rise over time, your purchasing power deteriorates.

Gold’s ability to hold its purchasing power across time will not necessarily make you rich, but it will absolutely prevent inflation from destroying your wealth!

Gold is a Savings Vehicle

In the late 19th/early 20th centuries, nearly all developed nations pegged their currencies to gold. Most European nations detached their currencies during WWI. The United States was the last country to abandon the gold standard in 1971.

When the governments severed the gold standard, their currencies lost all intrinsic value. We now live in a fiat currency world, with no restrictions on government debt, money printing, and inflation.

Today, gold’s role as a savings vehicle is more important than ever.

Did you know that modern central banks hold a considerable amount of their assets in gold? These are the smartest economists in the world. Maybe we should pay attention to how they are allocating their nations’ reserves.

Can you get rich investing in gold?

It depends on what you mean by “rich.” There are ways to get rich investing in any asset, including gold. However, multiplying your money in the short term requires a high degree of risk, perfect market timing, and complex trade strategies that are often impractical for individual investors.

Getting rich is a long-term game. It requires savings, risk mitigation, and prudent investing strategies. In those areas, gold thrives.

Secure gold savings, without the excessive fees

Your weekly gold market commentary comes from our internal team of researchers and technical experts. Vaulted gives modern investors access to physical gold ownership at the best cost structure in the industry. With personal advising from industry experts and access to premier precious metals strategies, Vaulted is the key to life-long financial prosperity. Start protecting your portfolio today.

As always, thank you so much for reading – and happy investing!