Retail sales are up, consumer sentiment is plummeting, and gold is thriving on the uncertainty of a wonky, cash-rich environment.

Key Takeaways:

- Retail sales beat expectations moving into the holiday season, indicating that consumers have the money to temporarily absorb skyrocketing prices.

- Consumer sentiment hit its lowest level in a decade, even dropping below the level we saw in March of 2020 during the onset of the pandemic.

- As corporations jack up prices, more and more workers demand higher wages. This inflationary cycle is imbedding itself in the global economy.

Gold approaches its next test

Gold is staying strong, consolidating around $1,860/oz after last week’s surge. The yellow metal even made it on the front page of the Wall Street Journal in an article titled “Inflation Anxiety Drives Gold Near Highest Level in Months.”

Its next test is $1,918, a resistance level that ended gold’s rally in May of this year. Gold is up 10.5% from its 2021 low last March, and up 5.2% in the last 2 weeks.

The $1,918 resistance level actually dates back to gold’s previous all-time high in 2011. We still have some climbing to do, but overcoming this level would likely invite a windfall new investor money.

Consumers flaunt their wealth

Inflation entered the mainstream dialogue over the last couple weeks, as consumer prices notched their fastest increase in over three decades. Many economists expected skyrocketing prices to take a hit on retail sales, but so far consumers seem to be accepting higher prices without much grumbling (ok, maybe a little grumbling).

Retail sales rose 1.7% in October from the previous month, beating expectations. Corporations will continue to crank up prices as long as consumers pay them. In fact, corporate profit margins have been improving in recent months despite skyrocketing costs of labor, raw materials, and other inputs.

Households have accrued over $2 trillion in excess savings since the start of the pandemic, and they are using it. The question is, will the money run out? When and if it does, the economy could be stuck in an upward spiral of inflation without consumer demand to back it up. This would create a stagflationary episode similar to what the United States experienced in the 1970’s.

The Great Resignation

The boost in retail sales comes alongside some very interesting patterns in the labor market, now dubbed the “Great Resignation.” According to the Bureau of Labor Statistics, a record 4.4 million Americans quit their jobs in September.

Many are pursuing higher compensation and better work conditions; others are living on government sponsored unemployment benefits; some are even living on their newfound cryptocurrency wealth.

Mixed messages

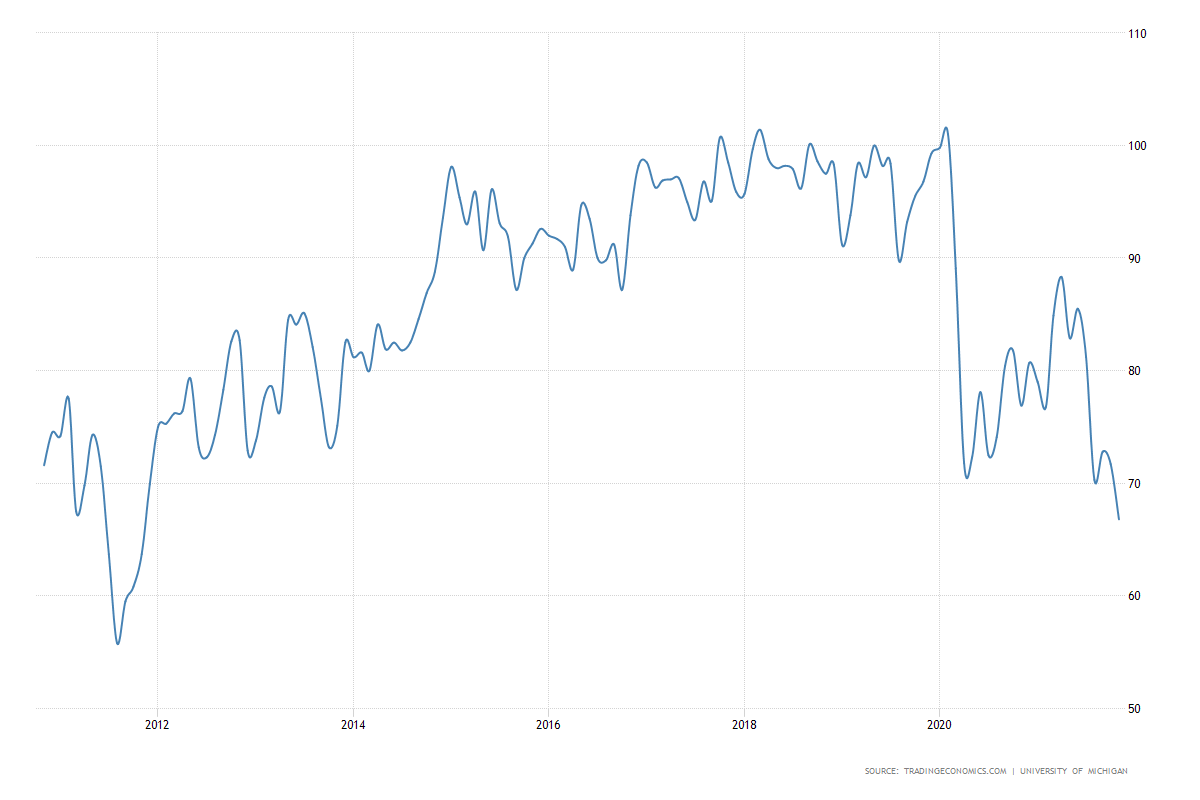

However, all is not rosy in the realm of consumer confidence. The Consumer Sentiment Index (a key benchmark generated by the University of Michigan) fell to 66.8, the lowest level in more than a decade. Economists forecasted a reading of 72.4.

Declines in consumer sentiment often correlate with rallies in the price of gold, because gold serves as a hedge against market uncertainty. The recent drop highlights the fact that Americans are very concerned about the stagflation risk, perhaps more than their buying habits indicate.

Consumer Sentiment Since 2010

source: tradingeconomics.com

Secure gold savings, without the excessive fees

Your weekly gold market commentary comes from our internal team of researchers and technical experts. Vaulted gives modern investors access to physical gold ownership at the best cost structure in the industry. With personal advising from industry experts and access to premier precious metals strategies, Vaulted is the key to life-long financial prosperity. Start protecting your portfolio today.

As always, thank you so much for reading – and happy investing!

Additional Resources:

Bloomberg: Powell’s Five Inflation Benchmarks Are Starting to Flash Amber

Reuters: Growth, jobs and inflation clash in Biden Fed choice

Reuters: UK inflation leaps to 10-year high, bolstering rate hike bets

AP News: Key reason for supply shortages: Americans keep spending

Financial Times: Investors lulled into ‘dreamland’ by central banks, warns Bill Gross