Gold and the US dollar were once inseparable partners. Now they are sworn rivals. Let's dig into the breakup that shaped the modern economic system.

For most of U.S. history, gold and the dollar were literally the same thing. One U.S. dollar simply meant 1/20th of an ounce of gold. You didn’t need to “trust” the government to maintain the value of your currency; your money was physically backed by real, tangible value sitting in a vault.

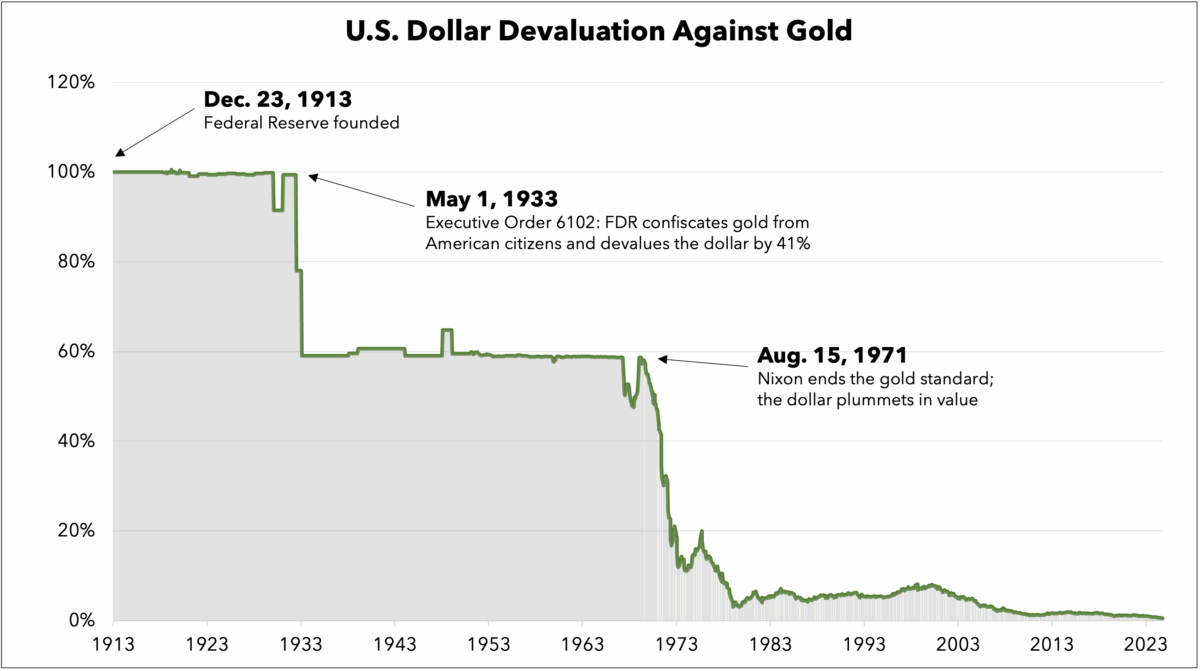

Then came 1913. The Federal Reserve was born, giving Washington the power to expand or contract the money supply at will. The gold standard still existed in name, but cracks started to form. The Fed could now create money with the stroke of a pen — and did, especially when crises hit.

By 1933, those cracks turned into a full-blown rupture. In the depths of the Great Depression, President Franklin D. Roosevelt made it illegal for Americans to own gold. Citizens were forced to turn in their coins and bullion to the government, which promptly revalued gold from $20.67 to $35 per ounce — a 41% devaluation of the dollar overnight. The dollar was still technically backed by US gold reserves, but citizens could no longer redeem their greenbacks.

Fast-forward to 1971. President Nixon delivered the final blow, “closing the gold window” and ending the dollar’s convertibility to gold entirely. That was the official breakup. (That raises the question…what backs the US dollar today?)

To the surprise of many, gold didn’t collapse. It thrived. Freed from its dollar peg, gold’s price exploded from $35 an ounce to over $4,140 today. Meanwhile, the dollar has quietly lost more than 85% of its purchasing power.

Half a century later, the former partners are bitter rivals.

In 1971, money split in two:

- The dollar became the world’s medium of exchange.

- Gold remained the ultimate store of value.

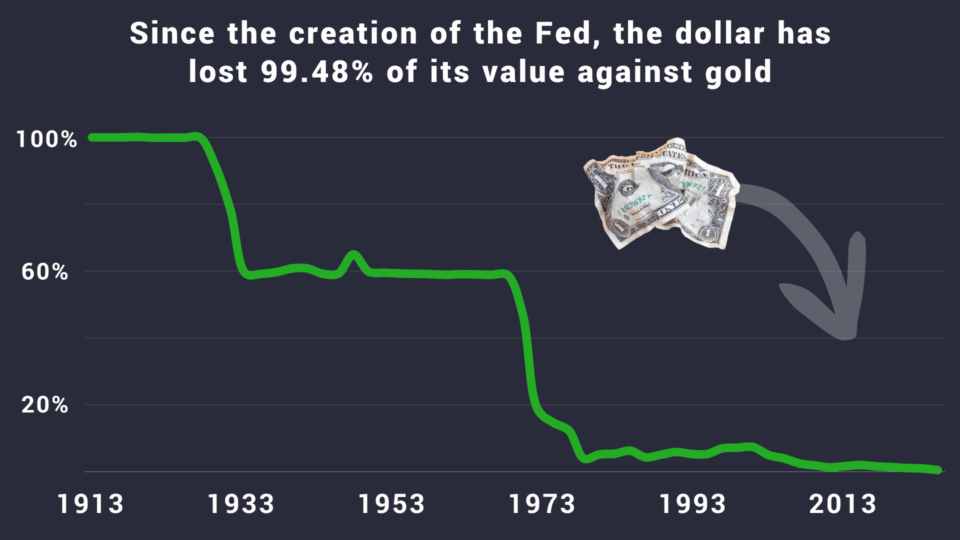

When we look at dollar devaluation against gold since 1913, it is clear who is winning the breakup.

Compared to gold, the US dollar currently has 0.52% of its original 1913 value. In other words, it has lost 99.48% of its purchasing power.

This equates to a whopping 19,912% increase in the gold price since the creation of the Federal Reserve.