Gold bounced off the 50% correction line after last week’s plunge. The metal’s next move will either strengthen the bullish reversal or signify a continuation of the 10-month bear market.

Key Takeaways:

- Expectations for rising interest rates buoyed the U.S. dollar and halted the recent rally in precious metals prices.

- Gold has formed a reverse head and shoulders pattern, which typically indicates a bullish reversal. If the pattern holds, gold could continue the upward stair-step that began in March.

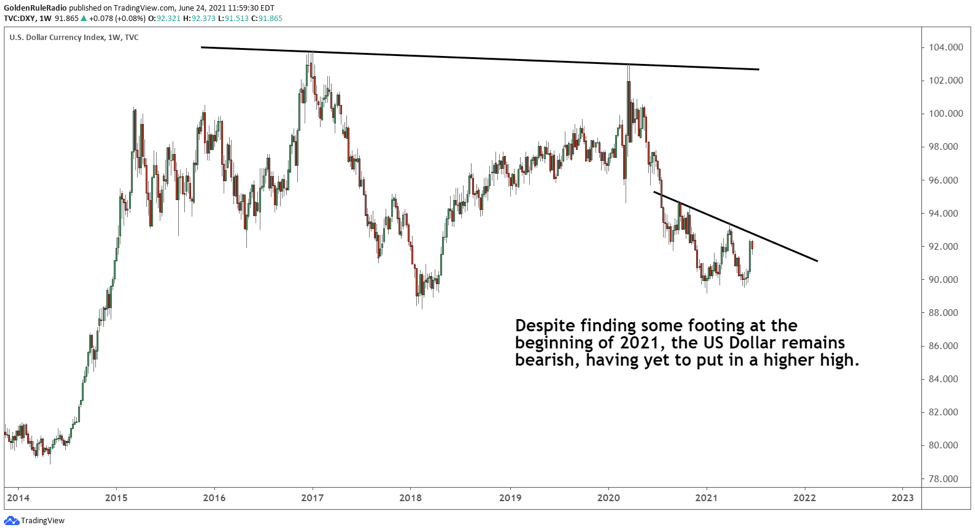

- The U.S. dollar rose 2% against other currencies last week, but the currency remains in a long-term bearish trend with little chance of a reversal.

Recovering from last week

Silver, platinum, and palladium all took heavy hits following last week’s FOMC meeting, but now appear to be stabilizing. Jerome Powell announced the Fed may need to raise interest rates in 2023 to combat rising inflation, causing immediate panic across the financial markets. Both stocks and precious metals plunged in response.

After last week’s sell-off, gold bounced off the 50% correction line. From March 2020 to August 2020, gold experienced a massive 40% spike. Since the August peak, gold has lost 50% of those gains.

Gold’s most recent drop has formed a reverse head and shoulders pattern, which typically indicates a bullish reversal. If this pattern holds, the price will bounce off its current level and stairstep toward the high $1,900’s. Ideally, gold needs to exceed its previous ceilings from late 2020 on its next leg up.

If gold were to continue down, it would need to break through the 50% retracement line and retest the .618 Fibonacci retracement line, which already saw a double bounce in March.

Gold’s short-term correlation with interest rates

As a precious metals investor, it is important to understand the relationships between metals, inflation, and interest rates. Higher inflation forces the Fed to decrease the money supply by raising interest rates. Higher interest rates make bonds more attractive because bonds pay an interest rate to investors. This can hurt gold in the short run because higher demand for bonds saps safe-haven demand for gold. Gold and bonds often compete for the same allocation in investment portfolios.

However, these effects typically only impact gold in the short run. Higher interest rates usually accompany higher inflation, which is one of gold’s primary price drivers. Gold is a commodity, which means it appreciates over time just like you expect your hamburger to increase in price. Interest rate hikes may cause short-term plunges because of competing safe-haven demand, but historically gold has had no significant long-term relationship with interest rates.

One thing is certain: gold perpetually maintains its purchasing power. It has crushed the value of all major fiat currencies over time, and consistently tracked the expansion of the global money supply. Gold is a proven hedge against currency devaluation, which means the current environment is absolutely perfect for owning ounces.

The U.S. Dollar remains long-term bearish

Speaking of currency, the U.S. Dollar Currency Index managed to pop more than 2% last week on the same news that knocked gold down. Higher interest rates in the U.S. (or expectations of rate hikes) increase the value of the U.S. dollar. The U.S. Dollar Currency Index measures the dollar’s strength not in objective terms, but against a basket of other fiat currencies. Last week’s jump means investors expect other nations to offer lower interest rates than the United States.

A rising dollar hurts gold because gold is priced in U.S. dollars. When the dollar rises in value, gold becomes more expensive for foreign investors.

Fortunately for gold investors, the U.S. dollar is in a long-term bearish trend that is unlikely to reverse. The Fed is unlikely to fight for strength, because doing so would require decreasing the money supply and therefore hurting economic growth. Short-term increases may damage gold, but the long-term trend is strongly in favor of gold’s performance over the next few years.

Secure gold savings, without the excessive fees.

Your weekly gold market commentary comes from our internal team of researchers and technical experts. Vaulted gives modern investors access to physical gold ownership at the best cost structure in the industry. With personal advising from industry experts and access to premier precious metals strategies, Vaulted is the key to life-long financial prosperity. Start protecting your portfolio today.

As always, thank you so much for reading – and happy investing!

Watch Golden Rule Radio for more of what’s in store for precious metals in 2021.