Gold took a hit this week, alongside the stock market, after Jerome Powell announced the Fed’s plan to mitigate hotter-than-expected inflation.

Key Takeaways:

- After Wednesday’s highly anticipated Federal Open Market Committee meeting, Jerome Powell announced a plan to raise interest rates in 2023 to curb rising inflation expectations.

- The U.S. Dollar rallied on the news, while gold and the stock market indexes reacted with steep drops.

- Expectations of rising interest rates can hurt gold in the short term, but history tells us gold ultimately thrives in the inflationary environment that requires rate hikes.

A steep price drop pauses gold’s rally

Gold peaked at $1,914 this month after two months of very strong gains. The tides turned against gold following Wednesday’s FOMC meeting, during which the Fed moved up the estimated timing of their first interest rate hike. Inflation trades took a hit. This steep reaction is surprising, considering the Fed still plans to keep interest rates near zero for another 2 years.

In his announcement, Powell very cautiously introduced the idea of increasing interest rates. Any interest rate hikes in the near future could hurt economic recovery and trigger a severe sell-off in equities. With equity valuations at record highs, this sell-off could be quite painful. Still, just the subtle mention of rising interest rates 2 years from now was enough to impact markets.

The yellow metal has dropped nearly $100 in the last two days. It is now sitting in the congestion zone just below $1,800.

Other implications of future interest rate hikes

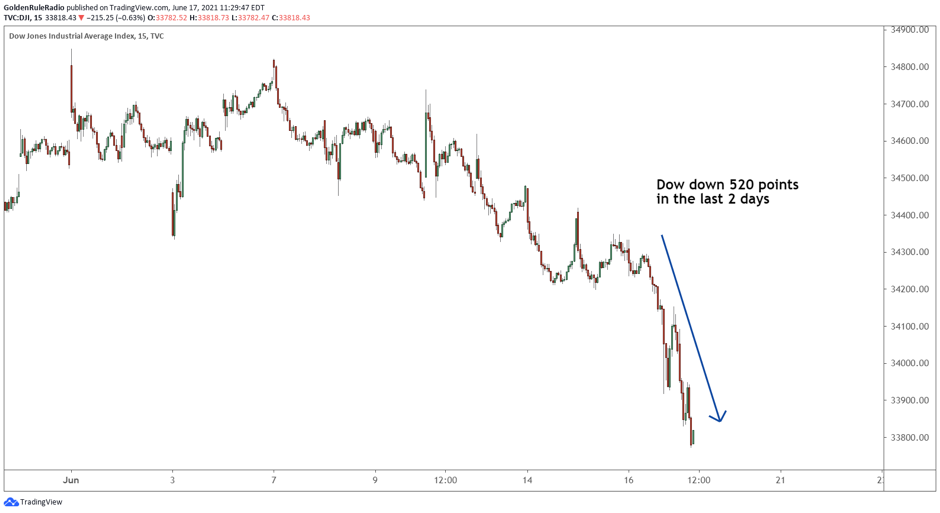

Gold wasn’t the only market to get whacked; the Dow Jones Industrial Average also dropped 520 points on the news. The stock market enjoys cheap money. Low-interest rates make borrowing money less expensive for businesses, which stimulates economic growth.

Many companies had to borrow massive amounts of cash to stay afloat during the COVID-19 pandemic. In fact, U.S. companies are currently burdened with a record $11 trillion in corporate debt. If interest rates rise, those companies will be forced to cough up massive interest payments on their debt, damaging profitability.

Household debt has also skyrocketed to record levels. Interest rate hikes impact individuals in the same way they impact businesses. Higher interest payments on household debt reduce discretionary income, which reduces consumer spending. Over time, higher interest rates crimp economic growth and slow inflation.

This week’s winner

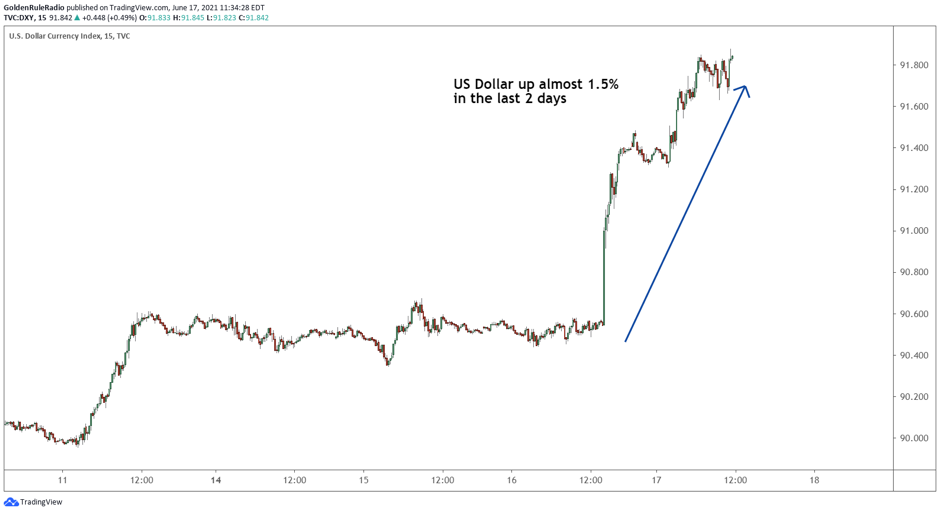

The biggest beneficiary of this week’s FOMC announcement was the U.S. Dollar. After dropping over 4% since early April, the U.S. Dollar Index has rebounded to just under 92. The index broke above its 200-day moving average for the second time in the last 3 months, although the 200-day moving average remains in a downward slope.

Unless we see a series of very compelling bullish indicators, we expect the Dollar’s long-term decline to continue. Seeing a continued Dollar rally in such an inflationary environment would be surprising. The Dollar tends to be negatively correlated with gold.

Precious metals vs. fixed income vehicles

Gold benefits from low interest rates just like stocks, but for a completely different reason. Gold often competes with bonds because both are safe haven assets. Bonds pay an interest rate; gold does not. When interest rates are high, bonds become more attractive to investors. When interest rates are low, the opportunity cost of gold increases by comparison. This phenomenon is just one of the many drivers of the gold price.

Are high interest rates always bad for gold?

Not necessarily. The economic conditions that cause higher interest rates are usually positive for gold – namely inflation expectations. When inflation starts running hot, the Fed increases the price of money by raising rates. Historically, inflation’s upward pressure on the price of gold has far outweighed any headwind from subsequent interest rate hikes.

Long-term historical data reveals no significant correlation between interest rates and gold. In the 1970’s, gold experienced its strongest bull market in history while rates rose rapidly. This suggests that other factors, such as supply and demand dynamics, are much more important in determining the gold price. Over the long term, our current economic environment is perfect for gold owners.

Secure gold savings, without the excessive fees.

Your weekly gold market commentary comes from our internal team of researchers and technical experts. Vaulted gives modern investors access to physical gold ownership at the best cost structure in the industry. Start protecting your portfolio today with the world’s most trusted currency. Vaulted is your key to lasting savings.

As always, thank you so much for reading – and happy investing!

Watch Golden Rule Radio for more of what’s in store for precious metals in 2021.