Investors sent hot technology stocks and cryptocurrencies tumbling downward this week, increasing safe-haven demand for gold.

Key Takeaways:

- Gold is holding steady around the key resistance level of $1,885, following two months of higher highs and higher lows.

- The Dollar Index dropped below 90 for the third time this year and took a weak bounce, desperately trying to stay above 2018 support levels.

- Gold is catching some safe-haven demand as the equity and cryptocurrency markets begin to price in the risk of inflation, interest rate increases, and bursting bubbles.

Stair stepping upward

Gold is up about $50 from last week, bolstered by bullish momentum, dollar devaluation, inflation expectations, and a risk asset sell-off. Other monetary metals, such as silver and platinum, are looking equally strong. The U.S. Dollar Currency Index is down about a point.

On May 17th, gold broke above its 200-day moving average after trading below the line for most of 2021. This is another bullish indicator that could signal the continuation of gold’s long-term bull market.

Is the short-term bear finally over?

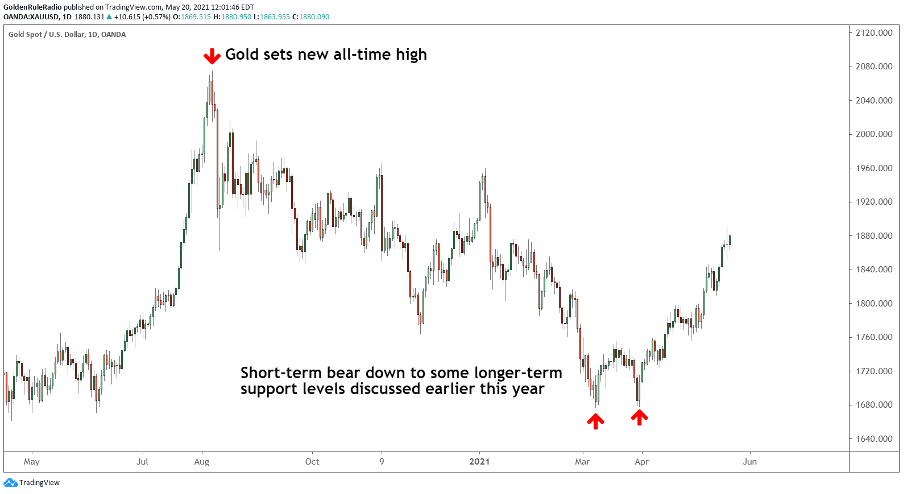

Last August, gold reached an all-time high by pushing above $2,000. The peak sparked a correction that brought gold down more than 18% over a period of seven months, providing wonderful entry points in gold’s long-term bull market. After a rough start to 2021, gold put in a double bottom at $1,680 and began rising above previous resistance levels. Gold needs to continue stair-stepping toward previous peaks before we can confidently claim an end to the bear.

Gold reached $1,885 this week, which corresponds to the .618 Fibonacci retracement line calculated on gold’s short-term bear market. We expect to see some resistance here after weeks of price increases. If gold does meet heavy resistance at the .618 Fib level and drop back down, we are looking at $1,760 as an entry point. Based on the bullish price action over the last month, we would be surprised to see any short-term corrections past $1,760.

$1,885 also corresponds to an important hurdle we saw earlier in 2021. Gold broke through the first hurdle on May 7th, which was around $1,815. If gold breaks confidently above $1,885, we would like to see it turn around and bounce off that level before moving higher, just like it did at $1,815 on May 12th.

The next high point?

After pushing above $1,885, we will look closely at the range between $1,943 and $1,975. Between September 2020 and January 2021, gold put in at least four tops inside this range. Prices just below $2,000 will be extremely important for deciding gold’s movement in the rest of 2021.

The dollar shows more weakness

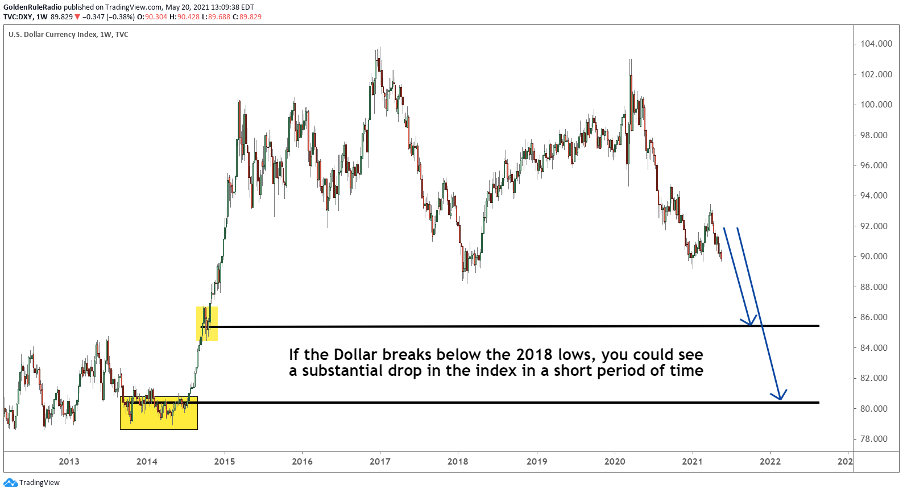

The U.S. Dollar Currency Index made its third break below 90 this year, putting more pressure on this strong support level. So far, the dollar has stayed above its 2018 lows.

A lower dollar index is positive for the gold price because gold is priced in U.S. dollars across most major precious metals markets. When the U.S. dollar weakens compared to other currencies, foreign investors tend to purchase more gold. When the U.S. dollar strengthens, gold gets more expensive in terms of foreign currencies, decreasing demand.

Fortunately for gold investors, the U.S. dollar is facing immense pressure from ballooning budget deficits and record money printing. It will be increasingly difficult for the currency to maintain its purchasing power over the next few years.

If we break below the floor set in 2018, we will likely see a free fall down to 2014-2015 levels.

The Fed acknowledges inflation risks…

During the Fed meeting in late April, policymakers hinted that they could begin slowing down Treasury and mortgage-bond purchases. Asset purchases currently total $120 billion a month. The massive spending campaign is designed to keep bond yields low alongside the Fed’s commitment to keeping interest rates near zero. These policies promote economic growth by reducing borrowing costs for consumers and businesses.

These policies also make money extremely cheap. When money is cheap, it loses purchasing power, which leads to a phenomenon we have been hearing about a lot lately: inflation. The economy and the stock market both benefit from moderate inflation. Economists estimate that 2% annual inflation is the ideal number to promote economic growth while preventing rapid currency devaluation. However, if inflation surpasses this 2% goal, it can become very dangerous very fast. Consumer prices skyrocket, and people can’t afford to buy food, fuel, and other necessities.

Many investors and economists are worried the Fed is over-correcting with ultra-accommodative monetary policy, which could spur uncontrollable inflation. Core prices rose 0.9% in April, the fastest one-month gain since 1981. Year-over-year CPI rose to 4.2%, blowing away expectations.

Federal Reserve Chairman Jerome Powell has repeatedly said that inflation is temporary, but the recent Fed meeting minutes indicate that the FOMC is starting to acknowledge the risk inflation poses to the economy.

The key to diversification

The Fed’s accommodative monetary policy and the White House’s stimulus measures have injected trillions into the damaged COVID-19 economy. A lot of this extra money has found its way into risky assets such as technology stocks and cryptocurrencies. These speculative asset classes have delivered mind-boggling returns over the past year, but last week proved they are prone to quick and brutal selloffs.

Gold serves as a hedge against the weakness we are seeing in other areas of the market. It has been one of the most stable and dependable assets throughout human history as a store of wealth, a safe harbor during economic downturns, and a hedge against inflation. Gold is an essential component of any portfolio.

Take your next step toward financial freedom

Login to Vaulted today.

Acquire physical gold at the best cost structure in the industry. Turn your dollar bills into gold bars with the tap of a finger, and start leveraging unmatched privacy, protection, and preservation. The Vaulted alternative banking platform is strengthened by the past and prepared for the future – now you can be too.

Watch Golden Rule Radio for more of what’s in store for precious metals in 2021.