The price of gold rises when some event encourages marginal buyers to buy, or discourages marginal sellers from selling. This article discusses the top 10 factors that drive gold prices.

To understand why prices rise and fall, we must first grasp what a market price is. In any market, the market price is the price which equalizes supply and demand. If the number of people willing to buy at a certain price outweighs the number of people willing to sell at a certain price, the price will adjust lower.

“Bullish” events invite buyers into the market and/or discourage sellers from selling. Conversely, “bearish” events invite sellers into the market and/or knock marginal buyers out of the market.

News headlines give the impression that certain events have a direct impact on prices – the recent rate cut caused gold prices to rise by 5%! But we should never forget that market prices are determined not by events themselves, but by how marginal buyers and sellers react to events.

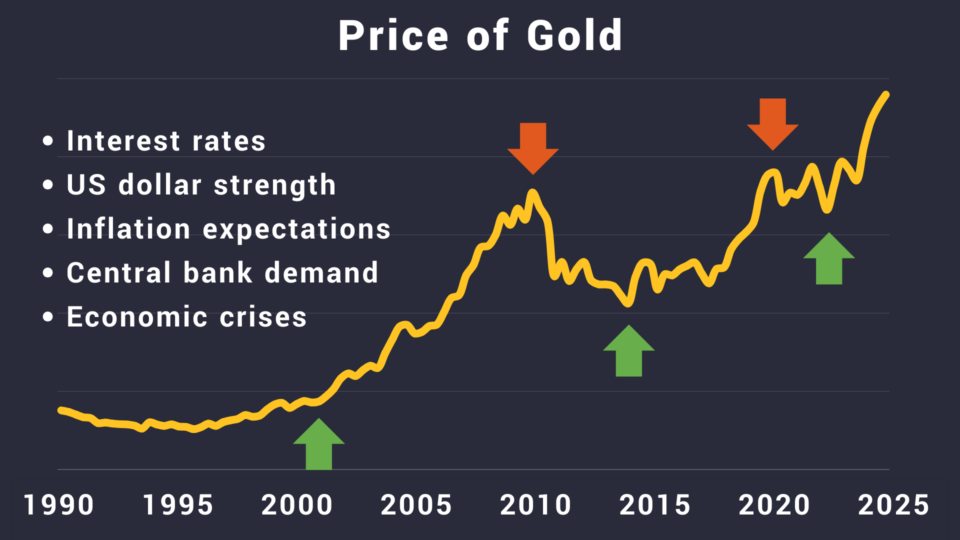

The top 10 factors that drive gold prices

This article will discuss the following 10 factors, each of which tend to encourage marginal buyers to enter the market and drive the price of gold higher:

- Falling interest rates

- Rising inflation expectations

- Falling US dollar index

- Increasing industrial demand

- Increasing jewelry demand

- Central bank gold purchases

- Geopolitical and economic crises

- Weak employment data

- Falling economic growth

- Increasing costs to mine gold

Interest rates

When interest rates fall, people tend to buy gold. This happens for two reasons:

Gold demand is inversely correlated with yields

Gold is a non-yielding asset. All other things being equal, investors prefer to earn a yield. If interest rates rise, the opportunity cost of holding gold increases, therefore decreasing demand. If interest rates fall, gold becomes more attractive, incentivizing marginal buyers and discouraging marginal sellers.

Falling interest rates mean increasing money supply.

The Fed quite literally cuts interest rates by increasing the money supply. If prevailing rates need to fall to meet their target, the Fed buys bonds from banks. To do this, the Fed creates new money and credits it to the bank that is selling the asset. This process creates demand for bonds that would have not otherwise been present, therefore lowering marginal interest rates.

Increasing money supply makes gold more attractive because gold has a strictly limited supply. The price of gold tracks the growth of the money supply over time.

Expected future interest rates actually matter more for gold investors than current interest rates. At any time, current interest rates are already priced into the market. This is why gold investors pay close attention to FOMC meetings. If the Fed indicates that it will start cutting interest rates in the future, gold traders hurry to buy gold before prices adjust to the news.

Inflation expectations

Gold serves as an excellent hedge against inflation. When the value of the dollar (or any other fiat currency) declines, investors flock to gold to preserve their wealth and purchasing power. It feels like gold is rising, but really the dollar is just falling in comparison.

Expected future inflation rates matter more than current inflation rates, because current inflation rates are already priced into the market. If investors believe inflation will rise in the future, gold demand tends to rise as well.

The most common ways to measure inflation include:

- Consumer Price Index (CPI): Measures the average change in prices over time that consumers pay for a basket of goods and services.

- Producer Price Index (PPI): Tracks the average change in selling prices received by domestic producers for their output. It provides insight into inflation at the wholesale level. Both the CPI and PPI are calculated and published monthly by the Bureau of Labor Statistics.

- Personal Consumption Expenditures (PCE) Price Index: Reflects changes in the prices of goods and services consumed by households. The Federal Reserve uses this measure for its 2% inflation target. The Bureau of Economic Analysis (BEA) publishes the PCE every month.

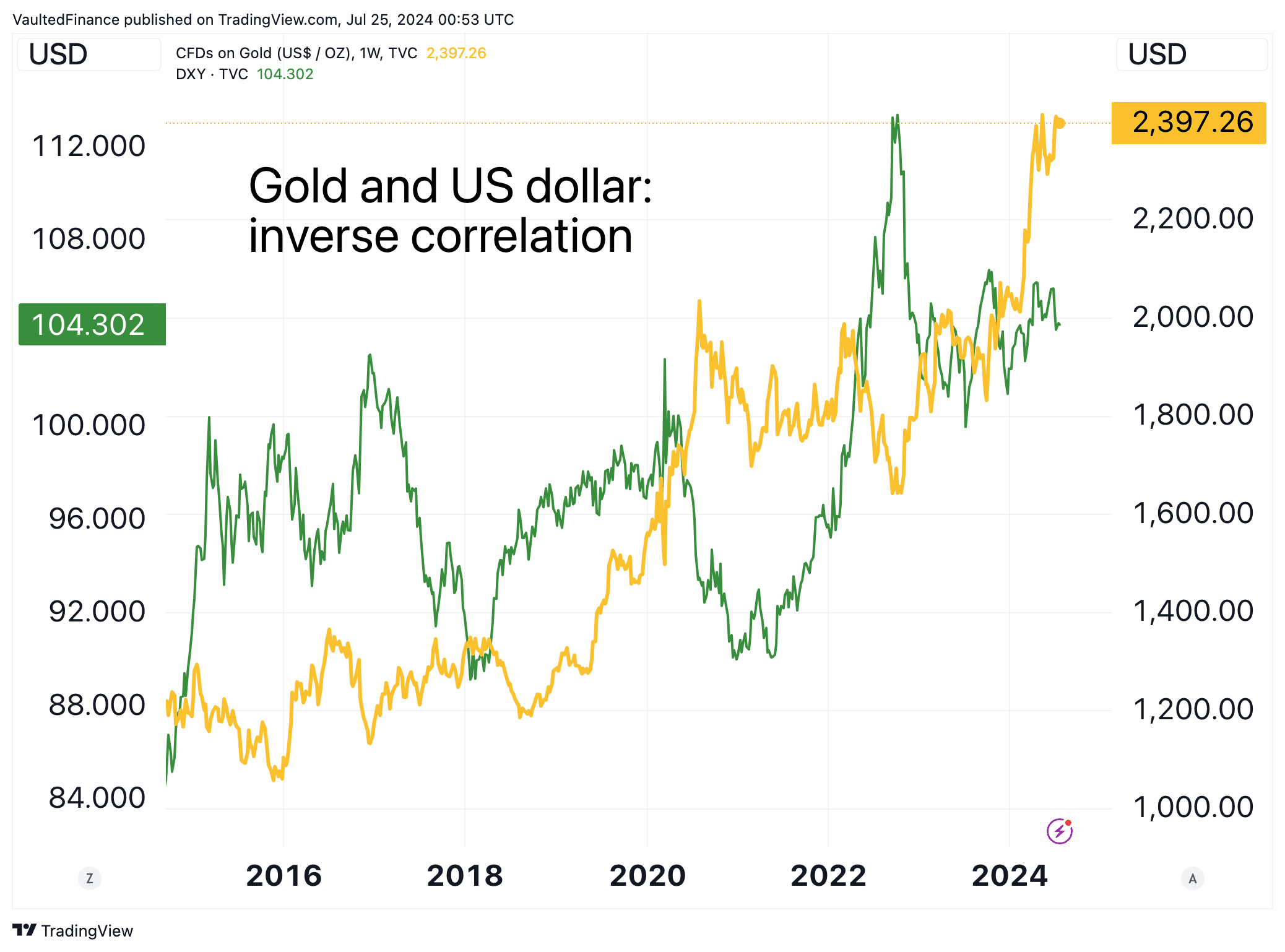

US dollar index

The US dollar index measures the strength of the US dollar against other currencies. The value of gold is inversely correlated to the US dollar index.

Why?

Most major commodity exchanges, such as the New York Mercantile Exchange (NYMEX) and the London Bullion Market Association (LBMA), price and trade gold in US dollars. This standardizes pricing and makes it easier for all participants to understand and compare bids.

When the dollar weakens against other fiat currencies, gold becomes cheaper for foreign investors using that currency. All other things being equal, this incentivizes buyers to enter the market, pushing the price higher. Conversely, a strong dollar makes gold more expensive and decreases foreign demand.

Obviously, the effect is reversed for US investors. US investors want to buy gold from foreign investors when the dollar is overvalued and sell when it is undervalued.

Still, gold tends to have an inverse relationship with the US dollar index. This is because a significant portion of gold demand comes from outside the United States, with major contributions from countries like India and China due to their cultural ties to gold. Most central banks hold large amounts of gold as part of their foreign exchange reserves. China, Russia, and India have been significant buyers of gold in recent years to diversify their reserves away from the US dollar.

For most of US history, the dollar and gold were the same thing. The “dollar” was simply a name for a specific weight of gold (1/20 of an ounce). However, this relationship was fully severed in 1971, and now the dollar and gold compete with each other.

Industrial demand

Gold has three key properties that make it an indispensable as an industrial metal:

- Electrical conductivity (efficiently carries an electric current)

- Resistance to corrosion (does not degrade when exposed to moisture, air, or corrosive substances)

- Biocompatibility (can interact with the body without causing harmful effects, such as inflammation)

Because of these characteristics, gold plays a key role in the production of smartphones, computers, medical devices, and dental applications. For example, gold is used in the wiring of microprocessors and memory chips, as well as in the coating of connectors and contact points on circuit boards.

As technological advancements continue and demand for electronics grows, the demand for gold in these industries will rise. This increased industrial demand can drive up the price of gold, especially if supply is constrained.

Industrial applications account for about 7-9% of global gold demand in any given year (approximately 335 metric tons).

Jewelry demand

Jewelry demand accounts for about 50% of global gold demand in any given year. This equates to 2,100 to 2,300 metric tons of gold per year.

In times of economic growth and rising disposable income, consumers are more likely to purchase luxury items like gold jewelry. Gold plays a significant cultural role during the Indian wedding season and Chinese New Year as a symbol of wealth, purity, and good fortune. High demand for gold during these events helps support gold prices.

Central bank demand

Central banks hold substantial amounts of physical gold as part of their reserves. Collectively, central banks own approximately 37,000 metric tons, which accounts for about one-fifth of all gold ever mined.

The United States owns the most amount of gold (8,150 metric tons), followed by Germany, Italy, France, Russia, and China. Click here to view central bank gold reserves by country (reported by the World Gold Council).

On average, central banks hold about 20% of their reserves in gold. Gold allocations vary widely:

- Turkey: 100% (570 metric tons)

- Germany: 72% (3,352 metric tons)

- Greece: 59% (115 metric tons)

- Ecuador: 33% (26 metric tons)

- Switzerland: 9% (1,040 metric tons)

- Czech Republic: 2% (40 metric tons)

The remaining central bank reserves are usually held in government bonds and foreign currencies, such as the US dollar, euro, and Japanese yen. The dollar has traditionally been the dominant reserve currency, but concerns over political stability, inflation, and federal debt have prompted countries to seek alternatives. As a result, central bank gold purchases have increased significantly in recent years.

In any given year, central banks account for 12-18% of total gold demand. Central banks are long-term holders, which means their purchases tend to have a stabilizing effect on the market, reducing volatility.

Geopolitical and economic crises

Gold is a “safe haven” asset. Wars, political upheaval, economic sanctions, and financial crises typically increase gold demand as investors turn to gold to safeguard their wealth.

Governments and central banks respond to economic crises with “easy money policies” such as quantitative easing, lowering interest rates, and increased spending, which tend to weaken their currencies and boost gold.

Gold is one of the only assets that is not under direct control of the government or banking system. The value of most other assets, including stocks, currencies, and bonds, are contingent on the solvency and stability of banks, companies, and governments.

Gold, on the other hand, has no counterparty risk. It is rational for people to turn to gold when financial institutions are under pressure.

Employment data

Non-Farm Payroll Announcements

The Non-Farm Payroll (NFP) report, released monthly by the US Department of Labor, measures the number of people employed in the US, excluding those who work in farming, non-profits, and the federal government.

Analysts use the NFP to gauge the health of the labor market. Strong employment figures can lead to expectations of higher interest rates, which may negatively impact gold prices. Weak employment data can boost gold prices by increasing the likelihood of lower interest rates and economic stimulus measures.

Economic growth

Quarterly Gross Domestic Product Estimates

Gross Domestic Product (GDP) estimates provide a snapshot of economic growth. Strong GDP growth in the US can lead to higher interest rates and a stronger dollar, which may negatively affect gold prices. Conversely, weak GDP growth can increase demand for gold as a safe-haven asset, especially if it leads to expectations of economic stimulus and lower interest rates.

The cost to mine gold

The cost to mine one ounce of gold plays a crucial role in determining the market price.

The All-in Sustaining Cost (AISC) is a metric that measures the total cost of producing gold, including extraction, refining, administration, and sustaining capital expenditures. Click here to view AISC data from the World Gold Council.

When the AISC rises, it sets a higher baseline for the price at which gold can be profitably produced and sold. If the gold price falls below the AISC of marginal producers, they may shut down mining operations, leading to reduced supply (and therefore higher prices). Increased costs of energy, labor, or regulatory compliance all raise mining costs.

The difference between the market price of gold and the AISC represents the profit margin for mining companies. Wider margins generally lead to increased production as companies capitalize on higher profits, while narrower margins can lead to reduced output.

Understanding gold prices

Let’s say gold rose over some previous time period. What exactly does this mean?

It means some combination of the following:

- An event occurred that made investors realize the dollar was overvalued. The dollar dropped, incentivizing marginal buyers to bid the price of gold higher.

- An event occurred that made investors realize that interest rates were too high. Maybe the Fed indicated it would drop rates sooner than previously expected. Perhaps the market got some optimistic news about the debtors’ creditworthiness or lenders’ ability to extend credit (both of which would cause interest rates to fall). Yields dropped, incentivizing marginal buyers to bid the price of gold higher.

- An event occurred that made investors believe a fiscal, monetary, or geopolitical crisis is on the horizon.

- An event occurred that made central banks want to buy more gold. Perhaps the US launched a trade war against several other nations, encouraging those nations to diversify away from the US dollar.

- An event occurred that made investors believe economic growth will increase industrial demand for gold.

No one knows precisely how a certain event will impact prices. Many events are even contradictory – economic growth may point to higher gold prices (because of increased industrial and jewelry demand) and lower gold prices (because of higher interest rates). This makes predicting gold prices extremely difficult.

Some events are obviously much more important than others. Few events that will drastically impact total jewelry demand. Interest rates, on the other hand, can be quite volatile. Therefore, gold investors tend to put much more weight on news about interest rates than news about jewelry demand.

When is the best time to own gold?

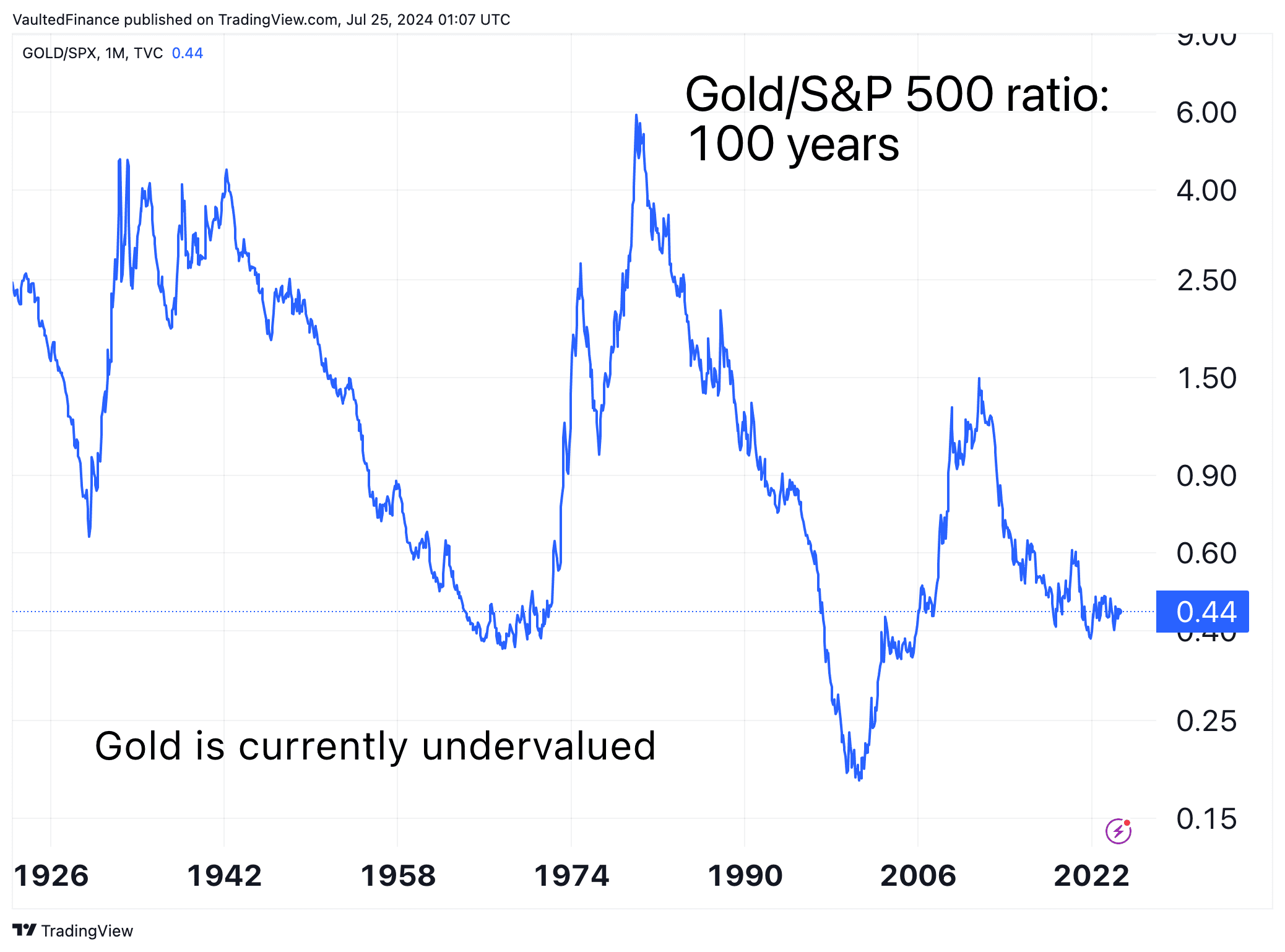

The best time to buy gold is when it is undervalued against other assets.

To know whether gold is under/overvalued, we must track the gold price against other markets. Comparing the gold price to the money supply, stock valuations, and prices of other commodities provides a long-term perspective that is often overlooked in day-to-day news.

- Gold/money supply: this ratio compares the total amount of money in circulation to the price of gold.

- Gold/stocks: this ratio compares the price of gold to a stock market index, such as the S&P 500. It provides insights into the relative valuation between gold and equities.

- Gold/silver: this ratio measures the relative value of gold to silver by dividing the price of gold by the price of silver. It indicates how many ounces of silver it takes to buy one ounce of gold.

When these ratios are low compared to historical averages, gold is undervalued. Historic undervaluation presents a strong buying opportunity. Over time, these ratios tend to revert to historical levels.

Vaulted: buy gold with the tap of a finger

Vaulted is the simplest way to own physical gold. It takes 30 seconds to set up your free Vaulted account, where you can buy real gold and silver in any quantity.

You have direct ownership of segregated, serial-numbered bars. Plus, you can take delivery of your metals at any time.