Gold bounced off a key support level last week, and continues to hold its gains after the Fed’s announcement to maintain easy money policies.

Key Takeaways:

- Gold is maintaining moderate gains after the Fed’s highly anticipated FOMC meeting yesterday, in which Jerome Powell confirmed the central bank’s commitment to easy money policies designed to support economic recovery.

- Investors are reacting negatively to this news, selling off both tech stocks and government bonds, which increases bond yields. This indicates that investors are worried about the threat of rising interest rates and increased inflation.

- If you are looking for value investment, precious metals are the place to be. Discounted prices mean higher future earnings, especially when so many economic fundamentals favor the long-term performance of commodities.

Stair stepping up?

Gold pushing a little higher this week, giving some time for gold investors to breathe after three months of declines. In fact, all the precious metals are rallying; silver, platinum, and palladium all saw a small jump off last week’s lows. We appear to have started a countertrend after gold hit the key support level near $1,690.

Gold is now approaching the resistance level of $1,765, which is the floor established back on November 30th (see chart below). We are interested to see if gold decides to push above that level or turn back around and continue its downward trend.

We have already seen gold put in a higher high and a higher low following the bounce off $1,678, indicating a solid stair-stepping pattern up toward its next resistance. Pushing through $1,765 would be a good sign.

All eyes on the Fed

The Federal Open Market Committee (FOMC) had a very important meeting yesterday. Fed Chairman Jerome Powell announced that the central bank will continue large-scale purchases of Treasury securities to help lower interest rates and support economic recovery. This is known as quantitative easing.

The financial markets reacted. The Fed’s easy money policies stimulated unprecedented stock market growth over the last year, but many investors are worried that we will pay a price for all the money that has been injected into the economy.

Inflation rates have been inching up in reaction to Congress’ latest round of stimulus (no surprise), which forced the Fed to increase its projections for inflation over the next year. This caused investors to sell government bonds, which increases yields, thus making borrowing costs more expensive for businesses and individuals.

Investors are also dumping tech stocks such as Apple, Amazon, Google, and Tesla and moving to companies perceived to be less risky. Overpriced tech stocks get less and less valuable as interest rates rise. The broad stock market indexes are showing some weakness today as investors weigh the potential impact of inflation and rising rates on the financial markets, which have been in overdrive for the past year.

The announcement also caused a small drop in the Dollar, which confirms our hypothesis that the Dollar will face heavy downward pressure over the next year. The lower the value of the Dollar, the easier it is for the government to pay off debts, so the government is unlikely to try and reverse this downward pressure.

Does this mean gold is starting its next leg up?

If only we knew. The recent price movement and economic backdrop both look extremely positive for gold, but that doesn’t mean the price will soar right away. There are still some price levels below $1,678 that gold could hit while still remaining in a long-term bullish trend.

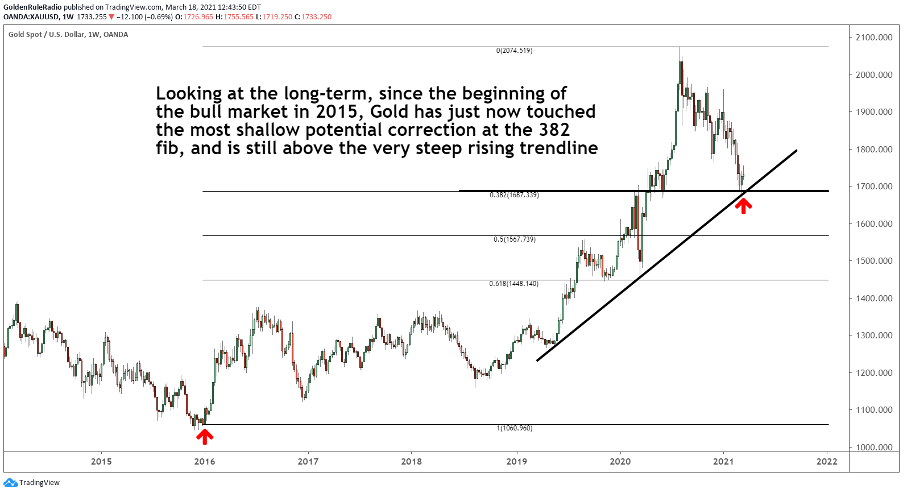

The charts below highlight other correction points we could possibly see in the coming months. The .382 fib is the most shallow potential long-term correction level. $1,568 is the 50% correction line. $1,445 is the long-term .618 fib and the bull market floor. It is unlikely we will see gold drop to that level, but it is certainly possible.

How should I react?

If you are reading this article, you are likely looking for opportunities to start investing in gold. If so, you are staring those opportunities right in the face. In a world where nearly every asset is hitting all-time highs, precious metals are providing rare pockets of value.

It is dangerous to wait for perfect buying opportunities in a bull market because we could have already seen the bottom. In that case, we will likely see the price move up very quickly from here. This is why we recommend Dollar Cost Averaging into gold, to take advantage of these low prices while still preparing for the possibility of more price drops.

We cannot confirm if we hit the bottom until the price rises by $300 or $400. By then, investors will have missed the opportunity to purchase gold at such a discounted price. The point is: these are the entry points you are looking for.

Gold is an essential component of any healthy portfolio, and Vaulted is the best way to acquire it. We can walk you through how to build your precious metals exposure with full liquidity, personalized advising, and the most affordable cost structure in the industry.

Thanks for reading, and happy investing!

Login to your Vaulted account today.

Watch Golden Rule Radio to understand more of the price movements of gold, silver, platinum, palladium, US Dollar index, & DOW.