The gold supply chain has generated vast riches, strengthened the global economy, and shaped civilizations. Let’s take a look at how the supply chain functions today.

Rushing for Gold

On January 24th, 1848, a carpenter named James W. Marshall discovered gold deposits near Coloma, California. Marshall’s discovery brought more than 300,000 prospectors, dubbed “forty-niners,” to California in search of riches.

The California Gold Rush is just one example of how the precious metals supply chain has shaped our modern world. The “Gold Rush” is not a singular event, but rather a global endeavor that unites countless prospectors across millennia.

In the 19th century alone, people rushed for gold in South Africa (1880s), Australia (1850s), Canada (1890s), New Zealand (1860s), Brazil (1890s), and Chile (1880s).

The search for gold continues to this day. The methods have changed, but the spirit remains.

The Gold Supply Chain

So how does the modern gold supply chain work?

Depending on geography and application, the process changes for each piece of gold. The modern gold supply chain can be broken into eight stages: 1) Miner, 2) Refinery, 3) Mint, 4) Transport, 5) Wholesaler, 6) Brokerage, 7) Depository/Bank, 8) Retail Investor.

I. Miner

Gold miners typically retrieve gold in one of two ways: ore deposits and alluvial deposits. Miners use heavy machinery to collect ore deposits and veins deep in the ground. They collect alluvial deposits from riverbeds of loose clay, sand, or silt. Because gold is extremely dense, miners can mix the rock and gravel with water and separate the gold from other minerals.

According to the World Gold Council, gold mining employs more than 2 million people worldwide. These jobs form the lifeblood of economic activity in remote geographies such as Suriname (South America), Burkina Faso (West Africa), and Papua New Guinea (Oceania).

Barrick Gold is one of the largest mining companies in the world. Headquartered in Canada, Barrick operates gold mines in Nevada, Peru, West Africa, and Australia. If you ever visit a gold mine, you will see huge chunks of rock carved out of the earth, or deep tunnels drilled into the sides of mountains.

Miners produce semi-pure bars of gold, called doré bars, and send them to refiners.

II. Refinery

Refiners receive doré bars from miners as well as scrap metal from recyclers. Refining is the chemical process of removing impurities from mined or recycled material. They use several methods to extract pure gold content, but the two most common are the Miller process and the Wohlwill process.

During the Miller process, the refiner will melt down the impure gold and blow a stream of chlorine gas through the molten metal. Unwanted elements solidify into chlorides and separate from the gold. This process produces 99.95% pure gold.

The Wohlwill process involves sending an electric current through the mixture, dissolving contaminating metals, and leaving behind pure gold. This process produces gold with 99.999% purity.

Argor-Heraeus is a precious metals refiner headquartered in Switzerland. The company refines gold from mines as well as recycled gold products. Argor then provides refined gold to watchmakers, medical device companies, banks, and minting facilities.

III. Mint

Government mints are responsible for producing the currency that consumers use in everyday transactions. The United States Mint, Royal Mint of the United Kingdom, South African Mint, Royal Australian Mint, and Chinese Mint all fill this role for their respective nations.

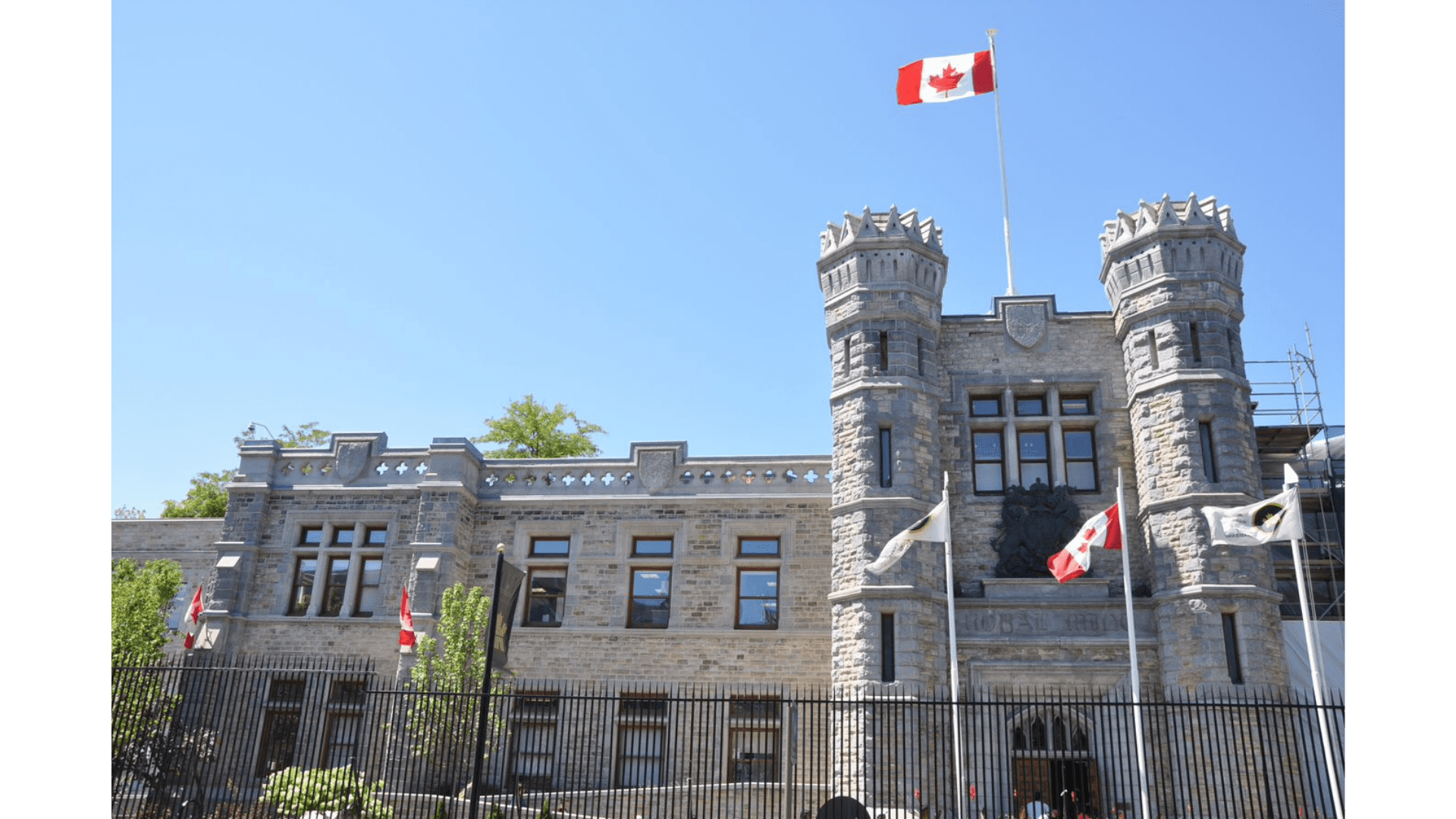

These national Mints also produce precious metals products such as collectible coins and bullion bars. The Royal Canadian Mint, for example, issues the 1-ounce Gold Canadian Maple Leaf on an annual basis.

Government mints may purchase raw gold from miners, recyclers, or refiners. After forming gold coins and bars, they send the products to precious metal wholesalers.

IV. Transport

Few people understand how valuable gold really is. You could purchase a brand new corvette with a single gold bar the size of your phone, and then fit millions of dollars worth of gold in the passenger seat of that same corvette. Because of gold’s immense value, moving gold between miners, refiners, mints, and wholesalers requires very strict security protocols.

Precious metals traverse the globe via plane, train, and armored truck. Brinks is a global leader in precious metals transport. The company offers logistics, insurance, and auditing systems for other parties along the supply chain.

V. Wholesaler

Wholesalers bridge an important gap between the mining/refining side of the equation and investors. They are responsible for acquiring large quantities of metal from government mints and selling them to brokerage firms.

Wholesalers typically hold large, diverse inventories and hedge against price exposure. Some may do business with retail investors, but wholesalers usually lie a step or two away from the final consumer.

VI. Brokerage

Precious metals brokerage firms do business directly with retail investors. Instead of holding a large inventory, they create relationships with wholesalers and acquire specific products when clients request them. Brokerage companies can also help investors open a gold IRA, ratio trade between metals, etc.

McAlvany ICA is the oldest precious metals brokerage company in the United States. The company was founded in 1972, right after Richard Nixon removed the U.S. dollar from the gold standard. The brokers at McAlvany ICA advise clients on investment strategies, purchase certain coins and bars from wholesalers, and deliver those products to the investor.

VII. Depository/Bank

Depositories and banks store precious metals for investors. Individual and institutional investors may choose to store their assets in a depository or safe deposit box rather than their house for increased security.

This step in the supply chain is especially important if an investor wants to hold precious metals in their retirement account. The IRS requires that the investor stores their gold at an IRS-approved facility. When opening a gold IRA, the investor’s brokerage company will send clients’ products directly to the depository.

The Delaware Depository is one of the largest in the United States. The facility serves a wide range of customers, including IRA custodians, investment banks, brokerage firms, manufacturers, and individual investors.

VIII. Retail Investor

Retail investors are the last step in a long process of mining, refining, buying, selling, transporting, and storing.

Millions of Americans own gold jewelry and coins. If you include the gold found inside phones, computers, and other electronics, the percentage jumps to nearly 100%.

Slicing the Supply Chain

When you purchase gold, each one of these companies takes a cut of your investment. Gold’s complex supply chain means the asset class comes with a very high premium.

As you can imagine, the goal of the cost-conscious investor should be to slice out as much of the supply chain as possible. That is exactly what Vaulted has done. Vaulted allows investors to acquire physical, deliverable gold directly from the Royal Canadian Mint.

The Royal Canadian Mint gets its gold directly from the mine, refines the bars on sight, and stores them in an exceptionally secure vault for Vaulted clients. Vaulted sliced out 70% of the supply chain, creating the most affordable cost structure in the industry.

If you want to learn more about the Vaulted program, set up an account here. You will be assigned a personal precious metals advisor to help guide you on investment strategies, entry/exit points, and more.

Thanks so much for reading. We look forward to connecting with you!