We’ll explore the silver price history from 1925 to today and zoom in on recent decades (30-year and 10-year price trends).

Silver has seen it all: legal tender status, demonetization, wild speculative manias, decades of price suppression, and new life as both an inflation hedge and a critical industrial metal.

From the days when everyone carried silver coins in their pocket to its vital role in solar panels and electric vehicles today, silver’s price tells a story of economic upheavals and technological change.

Understanding the last century of silver price history helps investors understand the role precious metals will play in the coming decades.

To track silver’s performance in real time, check the current silver price here.

100-Year Silver Price History

Silver Prices by Decade

| Decade High | Decade Low | Closing Price | Average Price | % Change | |

| 1925-34 | 0.69 | 0.28 | 0.48 | 0.48 | -30.4% |

| 1935-44 | 0.64 | 0.35 | 0.45 | 0.43 | -6.2% |

| 1945-54 | 0.89 | 0.52 | 0.85 | 0.77 | 88.9% |

| 1955-64 | 1.31 | 0.89 | 1.31 | 1.01 | 54.5% |

| 1965-74 | 6.70 | 1.29 | 4.37 | 2.14 | 232.8% |

| 1975-84 | 48.00 | 3.82 | 6.36 | 9.75 | 45.5% |

| 1985-94 | 10.20 | 3.46 | 4.87 | 5.09 | -23.4% |

| 1995-2004 | 8.44 | 4.05 | 6.79 | 5.33 | 39.4% |

| 2005-14 | 49.83 | 6.26 | 15.69 | 18.88 | 131.1% |

| 2015-24 | 34.86 | 11.64 | 28.89 | 20.61 | 84.1% |

As of January 2026, silver had peaked at $121/oz. Check the current silver price here.

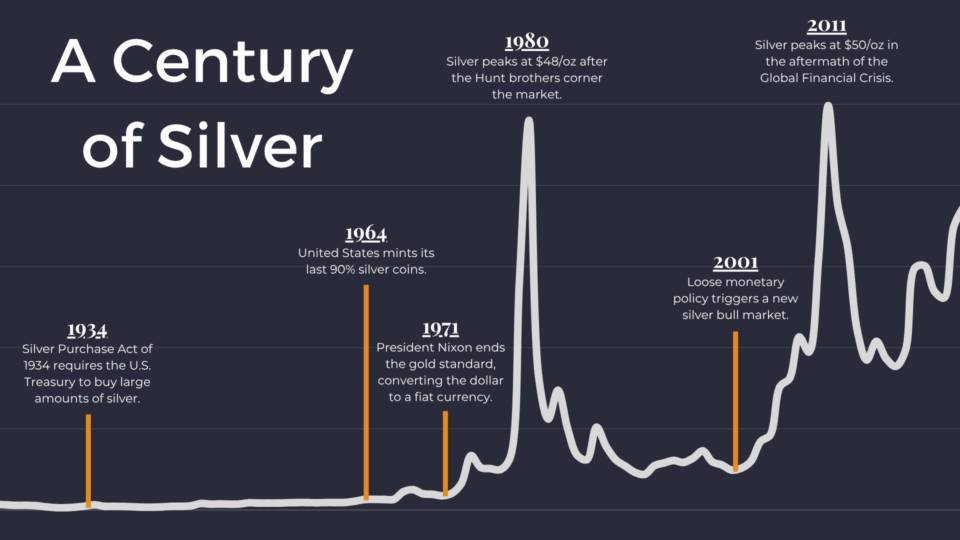

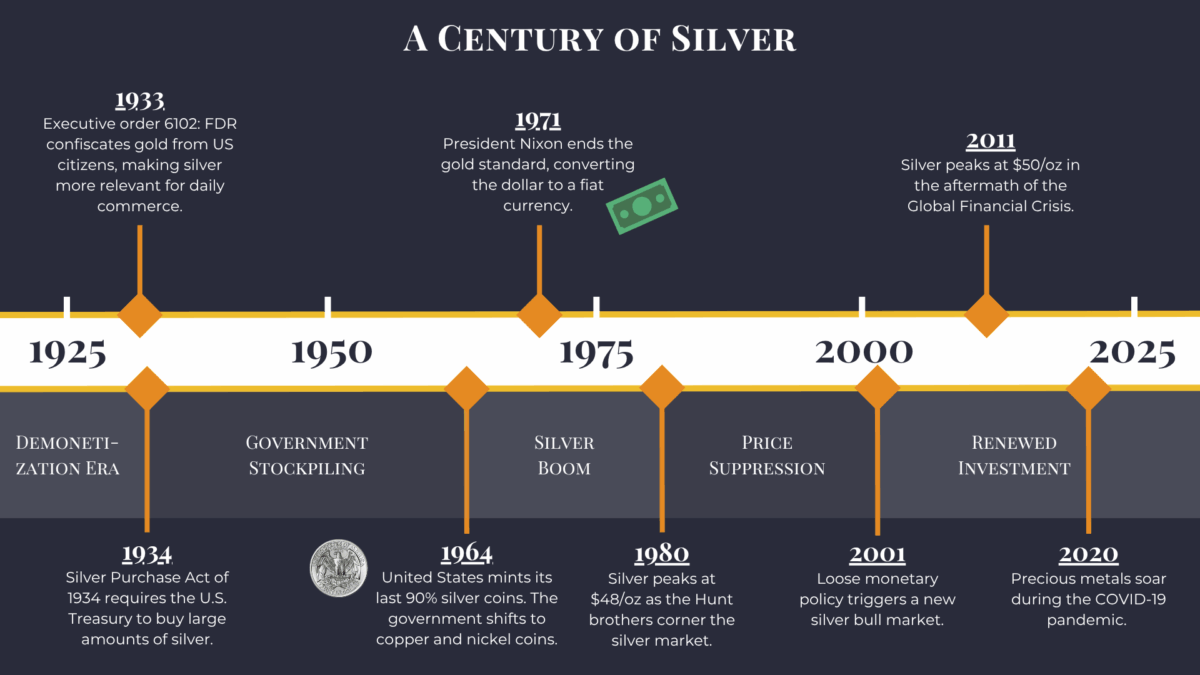

A Century of Silver: 1925 to Present

Over the past century, silver’s price history can be divided into five eras:

- Demonetization Era (pre-1934)

- Government Stockpiling Era (1934-1964)

- Silver Boom (1964-1980)

- Price Suppression (1980-2001)

- Renewed Investment (2001 to present)

Demonetization Era (pre-1934)

The Coinage Act of 1792 established silver as legal tender (alongside gold). Silver coins circulated widely for everyday transactions, including silver half dimes, dimes, quarters, half dollars, and dollars.

Throughout the 1800s, the U.S. operated under a bimetallic standard, using both gold and silver to back the U.S. dollar.

At the time, anyone could bring silver bullion to the U.S. Mint and have it struck into legal tender silver coins at little or no cost. With the Coinage Act of 1873, the U.S. ended the free coinage of silver. Existing silver coins remained in circulation, but this law stopped the creation of new silver dollars at the public’s request. This effectively shifted the U.S. toward a pure gold standard.

Rising supply and falling demand pushed silver prices down steadily in the following decades. Farmers, debtors, and silver miners suffered from this price drop, which is why the demonetization of silver is called the “Crime of 1873.” The Free Silver movement pushed to reintroduce silver coinage to expand the money supply and raise silver prices.

The silver price reached a low of $0.28/oz during the Great Depression.

In 1933, President Franklin D. Roosevelt outlawed private gold ownership and required U.S. citizens to turn in their gold coins and bullion to the Federal Reserve.

This increased the importance of silver in the U.S. monetary system. Gold was removed from circulation while silver coins remained legal tender.

Government Stockpiling Era (1934-1964)

In 1934, Congress passed the Silver Purchase Act of 1934, requiring the U.S. Treasury to buy large amounts of silver until its value reached one-third of the nation’s gold reserves.

The act aimed to raise silver prices, support struggling silver miners during the Great Depression, and expand the money supply by issuing silver certificates backed by the newly purchased silver.

Silver coins continued to circulate widely in the U.S. until the 1960s.

In 1964, the United States minted its last 90% silver coins. Rising silver prices made it too costly to continue using silver in everyday coinage. This marked the end of nearly 170 years of silver coin circulation in the U.S., as the government shifted to clad (copper-nickel) coins.

This is why pre-1965 dimes, quarters, and half dollars are worth significantly more than their face value.

Silver Boom (1964-1980)

Industrial demand for silver remained strong throughout the late 1960s.

In August 1971, President Richard Nixon officially ended the U.S. gold standard. Gold was no longer artificially fixed at $35/oz and was allowed to trade freely.

Investment demand for gold and silver surged as people sought protection against inflation and a weakening dollar. In 1974, silver hit $6.70/oz.

In the mid-1970s, Texas oil billionaires Nelson Bunker Hunt and William Herbert Hunt, fearing a collapse of the dollar, began purchasing massive quantities of physical silver and futures contracts. By 1979, they controlled over 100 million ounces of silver (around half of the world’s deliverable supply).

Silver prices spiked to $48.00/oz in January 1980 in a full-blown speculative bubble – up nearly 3,000% in a single decade.

Price Suppression (1980-2001)

The COMEX intervened in the Hunt brothers’ silver purchases by imposing “Silver Rule 7,” which limited the amount of silver contracts investors could hold and sharply increased margin requirements.

The Hunt brothers and other leveraged investors could not meet these new requirements, forcing them to liquidate their positions, flooding the market with silver. Panic selling followed. Silver prices collapsed from $48 to $11/oz within a few months.

This dramatic crash ended the silver boom and led to a long-term bear market. Silver fell to a bottom of $3.46/oz in February 1991.

During this period, governments and large institutions sold off silver reserves. Compared to the 1970s, the 1980s and 90s had relatively stable monetary policy and lower inflation, reducing investor demand for silver as a hedge.

Here is a closer look at the last 30 years of silver prices:

30-Year Silver Price History

Silver Price Trends: Last 30 Years (1995–2025)

Late 1990s: Steady Prices

The late 1990s featured strong global economic growth, low inflation, and soaring technology stocks. Silver held steady between $4 and $6/oz.

Investment demand continued to fall, but industrial demand supported silver prices. Silver outperformed gold in is period due to demand from photography and electronics.

2000s: A New Bull Market

When the dot-com bubble burst in 2000 and triggered a recession, gold and silver re-entered the spotlight.

The Federal Reserve sliced the Federal Funds rate from 6.5% in 2000 to just 1% in 2003. Interest rates across the economy fell, reducing yields on traditional investments. As a result of loose monetary policy, the U.S. dollar weakened significantly against other currencies.

Silver rose from $4.05/oz in November 2001 to $21.31/oz in March 2008.

When the Global Financial Crisis hit, silver plunged by 50% along with most other assets.

2009-2011: Post-GFC Bubble

In response to the recession, the Federal Reserve and other central banks started printing money and slashing interest rates to stabilize the economy. This fueled fears of inflation and currency debasement, driving investors back into precious metals.

Silver prices bounced back fast. In April 2011, silver peaked at $49.83/oz.

In total, silver increased by 1,130% during the 2000 to 2011 bull market.

2011-2015: Consolidation

As the economy recovered, the Federal Reserve gradually tightened monetary policy, strengthening the dollar. Demand for precious metals dwindled. Silver prices fell for six years, stabilizing around $16/oz.

This brings us to the last decade.

10-Year Silver Price History

Silver Price Trends: Last 10 Years (2016–2025)

2016: Silver rallied sharply to $20.78/oz as Brexit drove safe-haven demand. In the second half of the year, priced dropped back down to $16.25/oz.

2017: Strong stock markets and a rising dollar offset modest investment demand. Silver saw some support from industrial demand in solar and electronics.

2018: Silver declined by 8.4% as the Federal Reserve continued to hike rates and the dollar strengthened. Silver ended the year at $15.50/oz.

2019: Silver rebounded by 16.4% as the Fed shifted to rate cuts amid global growth concerns, pushing silver to $18.00/oz.

2020: Silver plunged at the onset of the COVID-19 pandemic, along with most other assets. Central banks responded with unprecedented stimulus measures and silver quickly recovered, ending the year at $27.20/oz (up 52.4%).

2021: Silver remained elevated early in the year with the “silver squeeze” retail investor craze, but prices then dropped to $22.88/oz by the end of the year as the economy recovered and bond yields rose.

2022: Rising interest rates and a strong dollar weighed on silver, but demand from solar and industrial sectors provided some support. Prices ended the year 3.1% higher.

2023: Silver saw upward pressure from record solar demand and renewed safe-haven interest as inflation remained sticky. It ended the year at $23.64.

2024: Silver was driven by a weakening dollar and rising geopolitical tensions. Industrial demand for green energy and electronics supported prices amid global supply concerns. Silver ended the year at $29.52/oz.

2025: Gold achieved an all-time high of $4,318/oz, ending the year with a 64.6% gain. But silver was the real story, closing the year at $71.6/oz with a 147% gain. Silver prices exploded when a years-long physical supply deficit met surging industrial demand (for solar, electronics, and AI), constrained mining output, tight inventory, and pure momentum.

What Drives Silver Prices?

Silver’s price is determined by marginal buyers and sellers on the open market. When the silver price rises or falls, it is always the result of shifting supply and demand.

For more information, check out the World Gold Council’s World Silver Survey. They provide an annual report on supply and demand statistics and price data. CME Group also provides great resources on both gold and silver.

There are several important factors that encourage people to buy and sell silver, including:

- Industrial demand

- Gold prices

- Interest rates

- Inflation expectations

- Monetary policy

- Regulatory changes

- Market sentiment

- Speculative positioning

- Silver scrap supply

- Cost to mine silver

To better understand these factors, check out this article: 10 Key Factors That Determine the Price of Silver

Historical Outlook on Silver Prices

Silver has proven its value as both a strategic asset and an essential industrial metal over not just the last 100, but the last 5,000, years. It has served as money, a store of value, and a symbol of wealth across nearly every human civilization.

In today’s high-tech world, silver’s unique properties make it more important than ever. Investment demand has surged alongside industrial demand, with silver consistently outperforming in periods of currency debasement and financial stress.

In an era of rising geopolitical tensions, silver offers investors a rare combination: the security of a precious metal with the growth potential of a critical industrial commodity.

To track silver’s performance in real time, check the current silver price here.