Do elections affect gold? Or does the price of gold predict who will win an election? This week, we dive deeper into how the upcoming elections might impact precious metals portfolios.

Before we do that, let’s take a look at where precious metals stand as of October 9, 2024.

- The price of gold is down about 3% from its $2,685 peak.

- The price of silver is down about 7.5% from its $32.95 peak. It is still holding above $30.

- Platinum is down about 6.7% from its high of $1,016.

- Palladium is down around 7.2% from its high of $1,120.

Gold has been the most steady of all the precious metals on the heels of a significant move up. Silver has been a bit more volatile.

Price of Gold and Elections

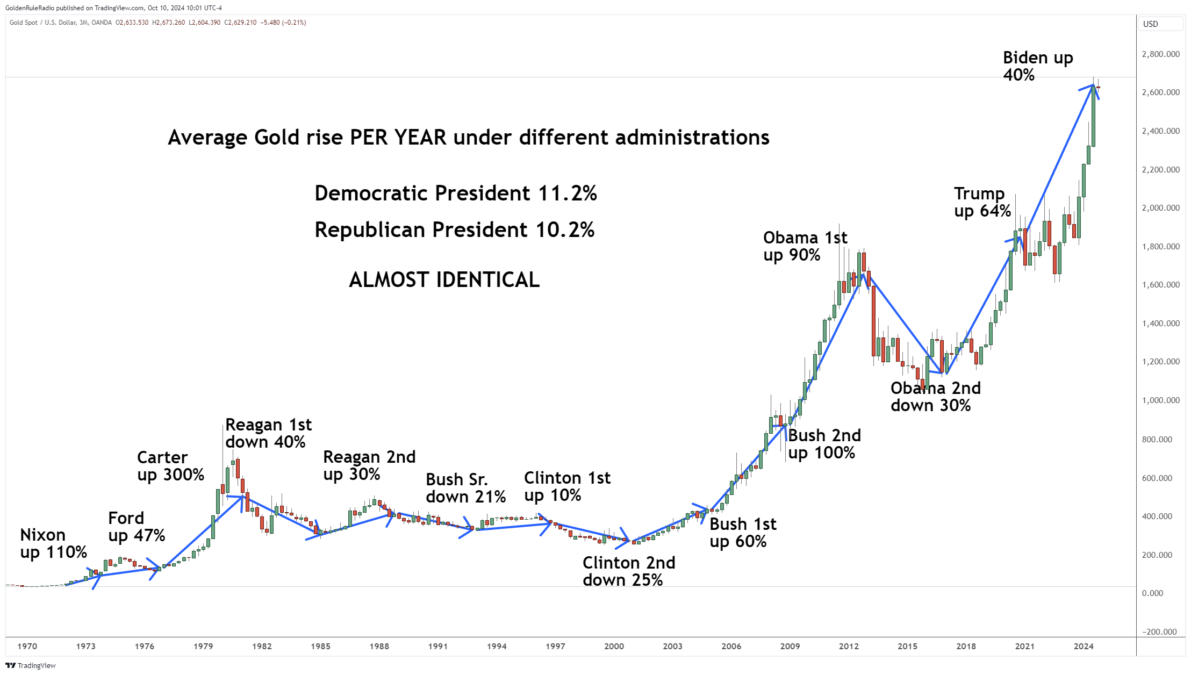

We looked at the last 13 elections — from 1972 to present. In reviewing the data, we looked at the initial response post-election as well as the next year’s charts to see how the price of gold would move.

When a Democrat wins, the price of gold tends to rise about 0.5% from the Wednesday right after the election through the end of the week. This spike is then followed by an initial decline by about 1.1% for the following two to eight weeks post election.

We see the opposite when looking at the other party. If a Republican wins, the price of gold will drop about 0.5% for that same initial period. And that initial drop will reverse and increase by about 1.1% over the next short-term period.

Demand for Gold and Elections

While prices often take center stage, the real benefit comes from understanding underlying demand. In the first and second year after a Democratic presidential win, the physical demand for gold is twice as high as after a Republican victory.

The heightened demand for gold following a Democratic win is driven by investor expectations of economic policy. Historically, Democratic administrations are more likely to introduce higher government spending, regulation, and tax increases, which can raise concerns about inflation, economic growth, and fiscal deficits.

Gold Predicts Election Winner?

Historically, when a Republican candidate won, gold prices experienced a strong upward trend in the six months prior to the election. In contrast, when a Democratic candidate won, gold prices were either stagnant or declined during the same period.

Is gold currently predicting a Republican win? Only time will tell.

US Debt Monster Looms

Regardless of who takes office in January, the US government will still have a $36 trillion debt burden that falls squarely on the shoulders of taxpayers. Interest payments on this debt have eclipsed total defense spending. Debt is the unmovable object which neither administration has the tools to deal with. The dollar’s purchasing power will continue to erode along with the trust of the American people — no matter who wins.

Protect Your Wealth With Gold

Gold is a powerful safe haven and insurance policy against economic and political uncertainty.

Now is the time to set up regular investments in gold and silver through Vaulted. In just a few taps, you can log into your account, connect it with your bank account, and set up a VaultPlan to put your investments on autopilot. Learn more about VaultPlan now.