Gold is providing a key pocket of value in a market where everything else is getting more and more expensive.

Key Takeaways:

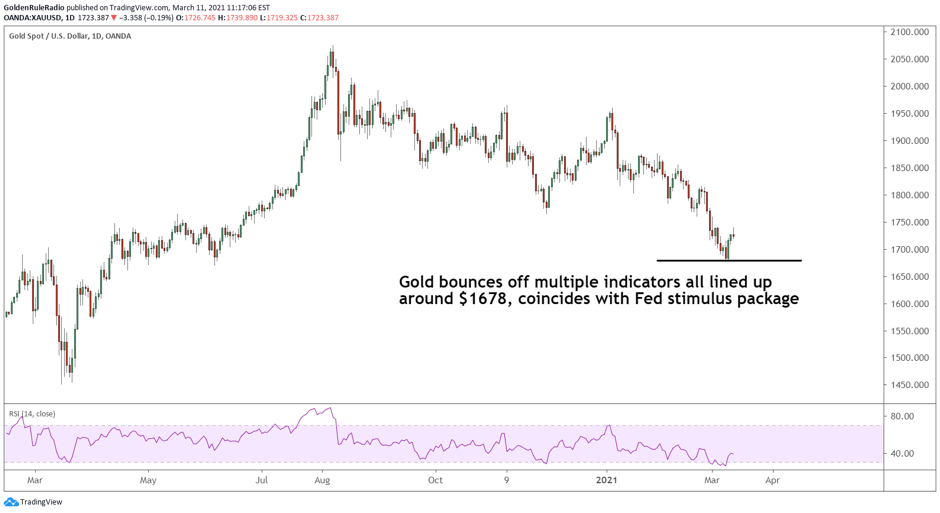

- Gold price bounced off the key support level just below $1,700. The fundamentals indicate that this could be the bottom of gold’s short-term bearish trend.

- Precious metals popped up alongside a rising Dollar, while equities markets are also hitting all-time highs (again). Americans are getting more free money from the Fed while all assets are rallying at the same time – how long can this continue?

- The gold market is starting to experience tight supply and rising demand, which can drastically increase the premiums on certain gold products. Vaulted provides investors a stable, efficient, and fully allocated gold investment option that is resistant to these supply chain bottlenecks.

Did gold finally turn around?

Gold has been bleeding hard since hitting all-time highs last summer. The long-term economic fundamentals are very strong for gold, yet the metal has been struggling to find a floor amid soaring equities markets, insanely high stock valuations, and unprecedented increases in the money supply and national debt (we also just surpassed the $28 trillion mark, by the way).

However, last week gold hit the key support level just below $1,700 and bounced upward. Silver and platinum are rising alongside gold, providing a much-needed relief for precious metals portfolios that have been taking a beating. From a long-term perspective, this kind of volatility is expected following the great COVID runup last year, but it is not easy to maintain confidence in gold when every other asset seems to be skyrocketing.

We are optimistic that gold can hold above the Fibonacci range that provided a solid floor last week. However, keep in mind that the $1,690 price level is the most shallow correction line based on long-term Fibonacci levels. If the price continues to drop, we are still in bullish territory.

If the price holds above $1,690, be prepared to see a lot of sideways movement in the coming weeks. Until we see further stimulus from the Fed, a rollover in the equities markets, or a significant drop in the U.S. Dollar, gold is unlikely to experience another big pop. We do expect to see large moves upward eventually, but not until some of those fundamentals turn in favor of gold. Fortunately for gold bugs, we are likely to see most or all of those changes in 2021, so it is only a matter of time before the yellow metal resumes its long-term bull market that began in 2015.

Up, up, and up

Precious metals are not the only assets that rallied this week. In fact, just about everything did. The Dollar Index is rising alongside monetary metals, and the Dow just hit another all-time high. Unfortunately, everything cannot always go up. The question is, which asset class will reverse its trend first?

The Dollar has been tracking pretty closely to its expected pricing ranges, and will likely continue its path down after this brief upward bounce. We could see the Dollar push up to 94 before reversing again, although inflationary pressures will likely push the Dollar back into its bearish decline well into the low 80’s.

The collision of price pressures: Fibonacci levels and Covid-19 stimulus

Biden signed the $1.9 trillion Covid-19 relief bill into law today, providing direct payments and jobless aid to Americans and adding another huge chunk of credit to the ballooning money supply. The more fiat money there is in the system, the less each Dollar is worth. Gold is a hedge against currency devaluation, meaning gold ultimately benefits from big fiscal stimulus measures. The $1.9 trillion bill coincided exactly with hitting the Fibonacci support level of $1,690, which was the primary focus of last week’s commentary.

This coincidence is bringing back a faint echo of a theory that seemed to jump out the window in 2020: the efficient market hypothesis (EMH). It appears that investors factored the stimulus news into the gold price, pushing gold down to a key support level right as the relief package was signed into law. Investors expect more stimulus and more quantitative easing, which should keep providing upward pressure on the monetary metals. If EMH has anything to say about it, gold should benefit heavily to the inflationary forces creeping up on the world economy.

Below are three charts that show the short-term Fibonacci retracement levels dating back March 2020, mid-term Fib levels dating back the June 2019, and long-term Fib levels dating back to late 2015 (the beginning of gold’s third great bull market). Notice how three key Fib support levels from different time horizons coincide right below $1,700 – exactly where gold bounced this week. When Fib levels coincide, they form stronger support/resistance levels, typically with higher trading volume.

Gold could continue to stairstep down, although there is a strong reason to believe (from a technical charting perspective) we will look back several months from now and say $1,678 was the bottom. Gold will not officially confirm the next leg of the bull market until it spends some time in the $1,900-$2,000 range.

Mining company stocks vs. the price of gold

Investors can gain precious metals exposure in several ways: physical metal, gold-backed ETF’s, futures and options, stocks of gold mining companies, etc. All of these investment vehicles tend to rise and fall alongside the price of gold. Sometimes the price relationship between these asset classes can bring light to certain market forces that impact gold.

For example, last week we saw a divergence in the performance of the mining company stocks and the underlying commodities, which is a notable phenomenon. Miners ended up almost 5% for the week, even though gold was still selling off. This kind of divergence may be a signal that we are getting to a place where gold bullion has tested its depths and is now positioned to move higher. Miners tend to react to favorable supply and demand forces sooner than physical metals. Historically, these types of divergences have been very advantageous times to purchase gold at a discounted price.

The gold investment supply chain

Investing in gold is very different than investing in stocks and bonds. It comes with massive benefits, but requires a level of expertise that many investors are not interested in obtaining. Gold products such as coins and bars travel down a long supply chain before reaching the retail investor, which is why physical gold is often so expensive. Gold might travel from the miner, to a refinery, to a mint, to a wholesaler, to a brokerage, and to a depository before finally reaching the retail investor on the other side. Everyone has to take their cut.

This long and complex supply chain can cause shortages of available physical product when investment demand rises. Government mints, the manufacturers of gold coins and bars, are not consumer-facing businesses, so they are not incentivized to ramp up production when everyone wants to buy gold. When demand rises, bottlenecks start to form at the manufacturing level, and the premiums/spreads on gold products increase dramatically.

March 2020 was a perfect example of one of these scenarios. Gold demand skyrocketed, supply chain bottlenecks formed, and many precious metals dealers jacked up their prices or ran out of product altogether. If you were to go to a local coin shop to buy an ounce of gold during one of these times, you would be shocked by how limited the supply is and how high the price is compared to the fair value of your product.

Smaller products such as one-ounce coins or half ounce coins are most heavily impacted by supply chain bottlenecks because they are the most accessible to the greatest number of investors. When everyone suddenly wants gold, everyone goes out and buys the smaller products, causing premiums and spreads to increase. Larger products, such as gold kilo bars, are not as affected because retail investor demand is less volatile for more expensive products (fewer people have $60,000 lying around to spend on a gold kilo bar).

This is exactly why Vaulted provides such a fantastic value proposition. Vaulted deals exclusively in allocated kilo bars, so we skip the supply bottleneck and offer physical gold investments for a fraction of the price. Every investment is 100% allocated to 99.99% pure gold bars, so investors can own any amount of physical metal they want without paying exorbitant premiums.

How should I react?

In a world where everything is overpriced, we must look for pockets of value. The market is overlooking the discounted value of gold, which makes this the perfect time to increase your metals position. Deficit spending, inflationary trends, and discounted gold prices are creating the perfect environment for owning physical precious metals. Vaulted can provide security, portfolio protection, and superior returns in a world where everything is expensive.

Login to your Vaulted account today.

Watch Golden Rule Radio to understand more of the price movements of gold, silver, platinum, palladium, US Dollar index, & DOW.